When it comes to trading, there are many different approaches and strategies, and choosing the one that works well for you can be challenging. Some go the investing route — holding a stock for years and paying close attention to the company they invested in. It is a classical strategy, but it will require a lot of effort to figure out the businesses worth investing in on a long-term perspective. Though the payout could be positive, it will take time to see the returns, moreover, this approach is generally associated with higher investments. Not all novice traders are willing to invest that much straight away, which is understandable.

Those who can not wait years may turn to position trading. This strategy is also focused on long-term, but the deals are usually closed within weeks or months. Traders would search for those stocks where a significant change in price can be predicted for the next couple of weeks and get out of the deal once the price movement stops and settles down.

Day trading, on the other hand, is one of the popular approaches among those who prefer very active and short-term trading. Unlike position trading, day trading is about buying and selling the asset within the same day. Day traders usually close all deals in the evening in order to avoid overnight fees. This approach may save you the overnight costs, however it is one of the riskiest. The price should change quite a bit in order for the trader to receive any payouts. And there is a big chance of losing the investment, too. That is why day traders usually make 20-30 deals per day, with small gains adding up. With that said, learning how to day trade may be a good place to start when just getting acquainted with trading. Day trading is rapid and can be stressful, but it requires action from the trader. Knowing how the market works, the ability to implement indicators and other analysis tools, making fast decisions is a natural part of being a day trader. So once you get into it, you will be forced to gain a lot of knowledge very quickly.

Who is a day trader?

As was mentioned, day trading is a fast-paced activity and it requires certain skills and personality traits to become a day trader. No doubt, anyone can open and close deals within the same day, however, it is not all it takes to be a day trader.

One of the skills that is worth mentioning first, would be self-discipline. Self-discipline comes first, then comes all the rest — knowledge, experience, grit. Day traders always have a trading plan and an exit strategy. It is easy to get carried away in trading, but that is exactly what a day trader should be prepared for and avoid. Fighting the natural compulsiveness and sticking to the plan is not easy and that is why day trading should be approached as a full-time activity. Working on self-discipline is arguably half of the success in day trading. Many traders who do not tackle this task first, end up losing their money because they let emotions take over and start acting irrationally — investing too much, making impulsive deals, getting out too late.

It can be hard to know when to stop and take a breath, that is exactly why making a trading plan is crucial. Think of it as a guide you make for your future self — set the boundaries and stick to them. A day trader should always spend time on thinking their activity through. What is the asset you are about to trade? What are the expectations? How much can you afford to lose if the market goes against you? Such questions are important and sticking to the initial plan is even more important. Of course, the plan can change and you should always try to improve, but it is better to do it in your spare time, when you are not influenced by your emotions.

Another important part of being a day trader is keeping a trading journal. It is not a strategy of action, like a trading plan, it is simply a record of all your activity done within the day. Write down everything — from the time of entering and closing the deal, instruments used and outcome to the market condition and your emotional state. It is important to reflect on the work done, just like with any other task you do. It will help you notice the improvements and track the repetitions. Analyse this data carefully and be honest with yourself when doing so.

A portrait of a day trader would be incomplete without mentioning the passion for learning. It might not be wise getting into trading and expect doing great without doing any learning or research. Practice is also important, these two go hand in hand. That is why starting with a practice balance may be beneficial. Try to learn as much as you can, but take it slow and do not expect to become a professional overnight. Instead, try paying attention to what other traders do. Learn from their success and their mistakes and, if possible, talk to other traders. There are plenty of forums, websites, chat rooms and messenger channels dedicated to that. You will find that there are many traders who, just like you, are searching to improve and understand how to day trade — and you will definitely find common ground. Do not compare yourself to other traders, though, instead focus on learning.

How to day trade?

When getting into day trading, it is important to take it seriously and make it a part of the daily routine. It is more of a full-time thing, rather than a hobby, because it requires your full attention to the market. It may seem intense, but let us break it down and try to handle it step by step.

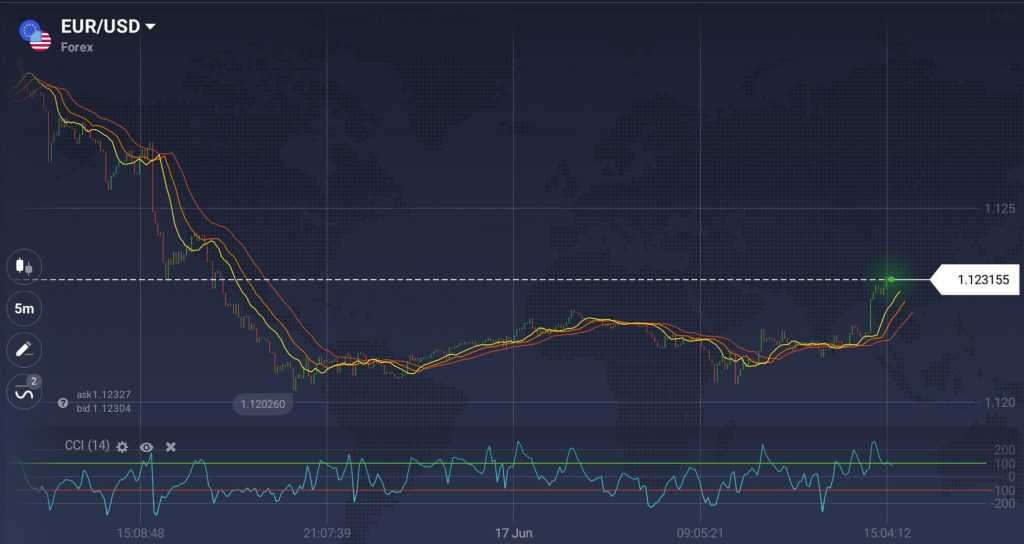

First things first: decide on the asset or assets you want to trade and let your decision to be educated. Day traders usually go for the highly volatile securities. High volatility means that the price fluctuates a lot, allowing for higher returns. But it also involves higher risk, as it becomes harder to predict the movement. Still, such assets are the most common ones in day trading. Another important factor is liquidity — the ability to buy and sell the asset without affecting the price levels. When deciding which market to trade, you have many options. One of the most popular is stocks and indices. Another is Forex, which allows you to trade currency pairs. You do not have to choose just one, but picking fewer securities will help you concentrate on them better.

Once you have established what you are trading this day, decide on the strategy you will be implementing. This is where you can get creative and explore all the different options you have. At this stage, again, it could be useful to try all of them out on the practice balance first. Sometimes you have to try it on practice and see if it works for you, before using your real money.

Let us have a look at the most popular day trading strategies.

1. The Breakout Strategy. This strategy involves using support and resistance lines. These lines are the potential levels of a trend pause. The Breakout strategy is based on a notion that when the asset price breaks through the support or resistance line, it is a signal of a strong trend that will continue its movement. Therefore, traders buy if the price breaks through the resistance line and sell in case the price goes beyond the support level.

2. The Reversal Strategy. The usage of support and resistance lines can also help to spot a strong reversal of the trend. Short-term reversal can be extremely valuable for day traders. When the price bounces off of the resistance line and drops, they would sell. If the price bounces off of the support line and starts rising, it could be a signal to buy.

3. The Scalping technique is an approach of making numerous short-term (1-5 minute) deals with a small investment amount. Small payouts may add up to larger amounts, however high spread can be an obstacle to this strategy, so it is important to choose the security that you will be trading wisely.

Day traders often take advantage of the multiplier, as it helps to trade with a larger investment and gain more profit based on that. However, higher multipliers can also introduce bigger risk to an already risky trading approach. Trying to balance the risks is an important part of learning how to day trade.

Risk management in day trading

There are several things a trader can do to manage and control the risks. Day trading is one of the riskiest approaches due to the short timeframes, so it is especially wise to take the extra step to avoid the risk as much as possible.

Risk management begins with downsizing the investment amount. Make sure that you are always trading with the money you can afford to lose. This applies both to the individual amount of each trade and to the overall amount of investment you make within the trading day. A day trader has to be ready for any outcome and not get greedy. A volatile market is hard to manage and it can get very stressful very soon. Stick to the amount you initially decided on and you will avoid the desperate trading streak.

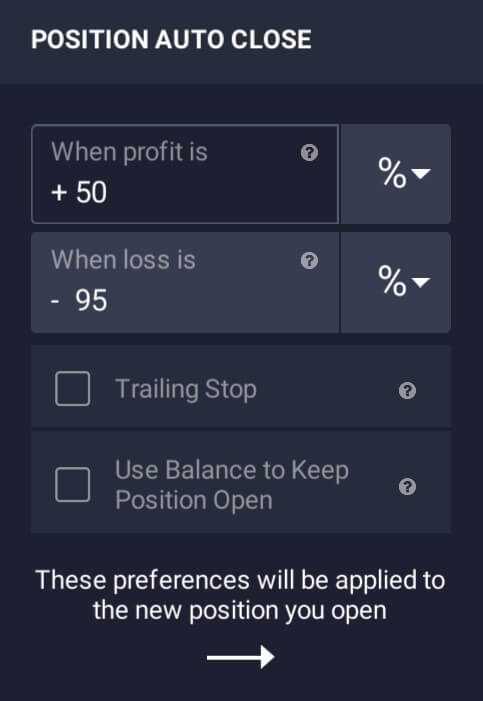

Using the stop loss and take profit levels provided by the platform is crucial when trading short timeframes. Set a tight stop loss when opening deals, but remember that even a small fluctuation of the market can trigger it. Figuring out the optimal positioning of a stop-loss is a task you need to figure out on practice and it also largely depends on the strategy you are implementing. A take profit level will help you get out of the deal on time and will prevent you from giving into the greed.

One last thing before you start

Day trading is an exciting but risky approach that should be pursued with caution. Besides all the factors that you need to take into account, there is also the technical side. As day trading is very fast-paced, you need to make sure that you have the convenient setting to perform it. First of all, make sure that you trade in a comfortable but still working environment. It will help you to set your mind and concentrate. Try to treat trading like a business, having a comfortable chair, table and devoting a separate notebook for the trading journal. Keep your notes neat and organized. It will remove a part of stress if you write everything down instead of memorizing. Make sure that you are in a quiet place and that nothing bothers you, then you will be able to fully devote your attention to what matters.

Another important thing is Internet connection. When making short-term deals, seconds and minutes can play a big role, so make sure that your Internet connection is not affecting the display of the trade room on your computer. Using an actual computer instead of a phone can also be to your advantage — trading on a mobile phone can be convenient, but not always comfortable, especially in the early stages when you are trying to learn how to day trade. It is a matter of preference, but make sure you have the capacity to fully concentrate.

When starting to day trade, take it slow and prepare as much as you can. Do not expect yourself to learn everything there is about trading and know all the answers straight away. Start with composing your trading plan and then begin practicing. Try to stay as realistic and rational as you can, it will help you make well weighed decisions and progress faster.