17 cryptocurrency trading platforms, currently residing in Shanghai, are expected to stop all operations in the foreseeable future, following the most recent legislation adopted by the national government. All ICO-related activities have been previously outlawed by the National Internet Finance Association (NIFA). BTCChina, Binance, Bitbill and ICORaise are among the affected exchanges.

The ICO boom hit China in the beginning of 2017, when the exchange rate of major cryptocurrencies started to demonstrate explosive growth. During this year alone China has already witnessed 65 completed ICOs, all together worth $395 billion. Before 2017, only five initial coin offerings have reached their final stage in China.

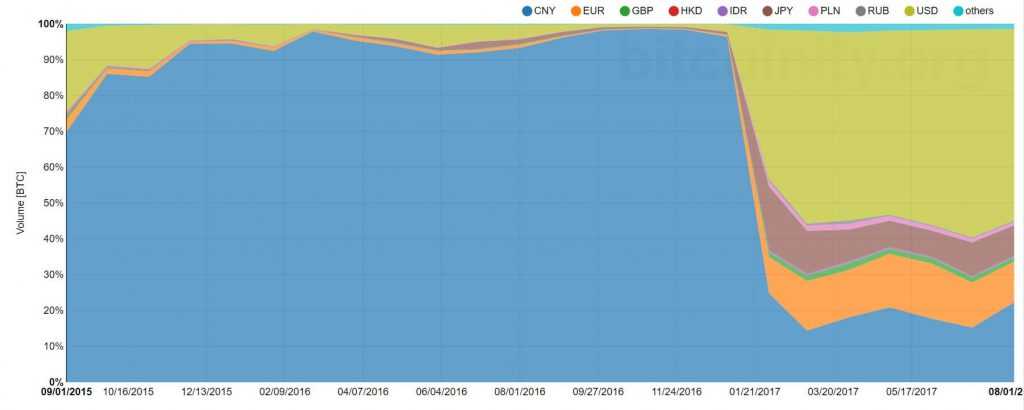

Some experts do believe that Hong Kong, formally a part of China that nonetheless enjoys wide autonomy, can replace Shanghai as the number one cryptocurrency hub of the Far East and will play an important role in the future development of the crypto infrastructure. But this opinion is not universal. Charlie Shrem, BTC enthusiast and a leading expert at Jaxx, says that the times when China was able to seriously affect the exchange rates of Bitcoin, are over. In his Twitter, he wrote:

This China FUD is playing on all your fear, uncertainty and doubt. China has no real effect on the future of Bitcoin. Bitcoin is about censorship free and an alternative non-government controlled financial system. China’s relevancy is diminishing by the day. They overplayed their hand and there is a reason they are being ambiguous.

Still an important location for cryptocurrency-related activities, China, however, can no longer claim leadership in this segment due to tightening regulation and lack of governmental support.