CFD trading or Contract for Difference trading, allows traders to speculate on the price movement of financial assets without owning the underlying asset. Instead of buying a stock, index or commodity, traders enter into a contract that mirrors the asset’s price changes. This way, profit or loss depends on the difference between the entry and exit price.

CFDs cover a wide range of instruments, including stocks, forex, commodities, indices and crypto. They are popular for short-term strategies and margin trading due to their flexibility and leverage.

The concept is simple: if a trader believes the price will rise, they open a “buy” position. If they expect the price to fall, they open a “sell” position. The goal is to close the trade at a more favorable price than where it started, capturing the difference.

How CFD Trading Works? Basic Mechanics

At its core, CFD trading is based on price speculation. You don’t own the asset; you simply speculate on whether its price will go up or down. A CFD is a contract between a trader and a broker to exchange the difference in the price of an asset from the time the position is opened to when it is closed.

When a trade is placed:

- A trader selects an asset (e.g. stock, forex pair, commodity)

- They choose to go long (buy) or short (sell)

- If the asset’s price moves in the predicted direction, the trader makes a profit

- If the price moves against the prediction, a loss is incurred

CFDs are typically traded with leverage, allowing traders to open larger positions than their initial capital would permit. However, while leverage increases potential gains, it also increases risk.

Key Features of CFD Trading

Understanding what makes CFD trading different helps traders build better strategies and manage risk more effectively.

Leverage

One of the defining features of CFDs is the use of leverage. Leverage allows traders to open larger positions than their account balance would normally allow. For example, a 10:1 leverage ratio means a trader can control a $10,000 position with just $1,000 of their own capital. This amplifies both potential profits and potential losses. Because of this, it’s essential to apply proper risk management when using leverage, especially in volatile markets.

Going Long or Short

CFDs allow traders to profit in both rising and falling markets. A trader who believes the price of an asset will increase can go long (open a buy position). If the price rises, they profit from the difference. Conversely, if they expect the price to decline, they can go short (open a sell position). This flexibility makes CFDs suitable for both bullish and bearish strategies, giving traders opportunities regardless of market direction.

No Ownership of the Underlying Asset

When trading CFDs, the trader does not own the asset being traded. There are no physical shares, commodities or currencies involved. Instead, the trader enters into a contract that reflects the asset’s price movement. This allows for easier access to diverse markets without the need for custody, delivery or ownership documentation. It also simplifies transactions and reduces trading overheads.

Access to Global Markets

CFDs offer exposure to a wide range of global markets from a single trading platform. Traders can speculate on:

- Major and minor currency pairs in forex

- Global stock indices like the S&P 500, FTSE 100 and DAX

- Commodities such as gold, oil and natural gas

- Popular stocks across global exchanges

- Volatile cryptocurrencies like Bitcoin and Ethereum

- ETFs that track industries or market segments

Fast Execution and Tight Spreads

Most CFD platforms offer instant execution and tight bid/ask spreads, especially in liquid markets. This is important for traders who rely on short-term moves and precise entries. Fast execution helps avoid slippage, while narrow spreads reduce trading costs. Together, they contribute to more efficient and responsive trading, especially when markets are moving quickly.

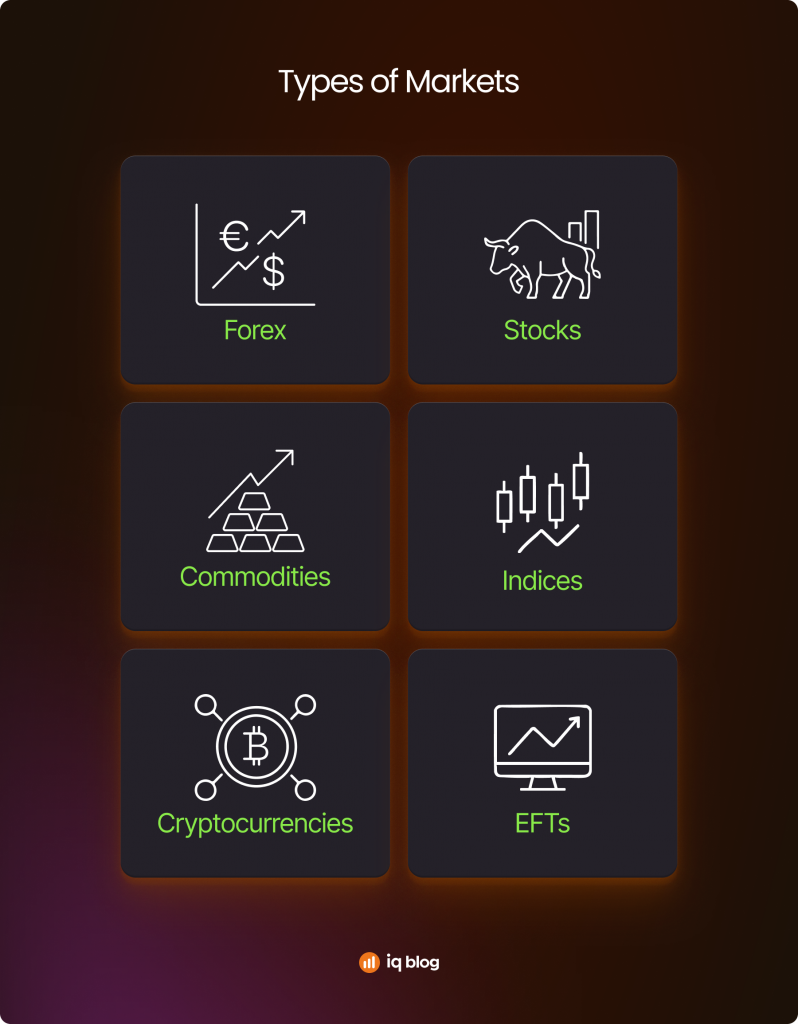

Types of Markets You Can Trade with CFDs

One of the biggest advantages of CFD trading is access to multiple financial markets from a single platform. This flexibility allows traders to diversify and adapt their strategies to different asset classes.

Forex (Currency Pairs)

CFDs offer access to major, minor and exotic currency pairs without owning actual currency. The forex market is highly liquid, trades 24 hours a day and often comes with tight spreads. Traders speculate on the value of one currency against another, such as EUR/USD or GBP/JPY.

Why traders use CFDs for forex:

- High liquidity

- Fast execution

- Access to leverage

Stocks

CFDs allow traders to speculate on the share price of companies like Apple, Tesla or Amazon without buying the shares outright. This enables short selling, portfolio diversification and lower capital entry points.

Why traders use CFDs for stocks:

- No need for ownership or dividends

- Easier short selling

- Access to international markets

Commodities

CFDs cover both hard (gold, oil, metals) and soft (coffee, wheat) commodities. These markets often react to geopolitical or seasonal events, offering unique opportunities.

Why traders use CFDs for commodities:

- Trade gold or oil without owning physical assets

- Hedge inflation or currency risks

- Diversify portfolio outside of equities

Indices

Stock market indices represent the performance of a group of companies. CFDs let you trade indices like the S&P 500, NASDAQ, DAX or FTSE 100 based on their price movements.

Why traders use CFDs for indices:

- Exposure to broad markets

- Efficient market sentiment trading

- Lower volatility compared to single stocks

Cryptocurrencies

CFDs provide access to volatile crypto markets like Bitcoin, Ethereum and Ripple, without the need for wallets or exchanges. Crypto CFDs trade like other instruments with leverage and flexible positions.

Why traders use CFDs for crypto:

- Avoid managing crypto wallets

- Trade rising or falling prices

- Benefit from high volatility

ETFs

CFDs on ETFs allow traders to speculate on groups of assets that track sectors, indices or themes. This includes tech ETFs, energy ETFs and more.

Why traders use CFDs for ETFs:

- Broader market exposure in one trade

- Lower capital requirement

- Combine multiple strategies in one instrument

How Profits and Losses Are Calculated in CFD Trading

Understanding how to calculate profit and loss (P&L) in CFD trading is critical. Every position’s outcome depends on the difference between the entry and exit prices, multiplied by the position size and adjusted for any fees or leverage.

The Basic Formula

Profit or Loss = (Closing Price – Opening Price) × Position Size

- If you went long (buy) and the price went up, the difference is profit.

- If the price fell, the result is a loss.

- For a short (sell) position, this logic is reversed.

Example for Long Position

You buy 100 CFDs on a stock at $50. The price rises to $55.

Profit = (55 – 50) × 100 = $500

Example for Short Position

You sell 50 CFDs on an index at 4000. The price drops to 3950.

Profit = (4000 – 3950) × 50 = $250

Be aware of additional trading costs like spreads, overnight fees and commissions, which can reduce net profit.

Risks of CFD Trading and How to Manage Them

While CFDs offer flexibility and access to various markets, they carry significant risks. Without proper management, losses can exceed expectations, especially when using leverage.

Leverage Amplifies Losses

Leverage works both ways. Just as it boosts profits, it can also magnify losses. A small market move in the wrong direction can lead to losing more than the initial investment.

Market Volatility

Highly volatile markets, like crypto or commodities, can shift quickly. Unexpected news, economic events or low liquidity can cause large price swings, triggering stop-outs or losses.

Overnight and Rollover Fees

Holding CFD positions overnight often incurs a financing fee. These can accumulate over time and reduce overall returns, especially for longer-term trades.

Platform Risk

CFDs are traded through online platforms. Downtime, latency or poor execution speed can impact trade outcomes, especially during high-volume events.

How to Manage CFD Risks

- Use Stop Loss and Take Profit Orders – Automatically close positions at pre-set levels.

- Limit Leverage – Don’t use the maximum allowed. Apply leverage conservatively.

- Diversify – Avoid placing all capital in one asset or trade.

- Monitor Open Positions Actively – CFD trading requires close attention and discipline.

- Understand Trading Conditions – Know your broker’s margin rules, spreads and fee structure.

Advantages of CFD Trading

CFD trading attracts many retail and professional traders because of its flexibility, accessibility and efficiency. It opens doors to global markets without complex ownership structures.

- Access to Global Assets from One Platform – CFDs give traders exposure to thousands of instruments across stocks, indices, forex, commodities, crypto and ETFs. This makes portfolio diversification easier and faster.

- Ability to Profit in Both Directions – Traders can go long or short, depending on market expectations. In falling markets, short positions allow you to capture downward moves, which is not always possible in traditional investing.

- Low Capital Requirement – Thanks to leverage, traders can open large positions with limited capital. This makes it more accessible for individuals who want to enter the markets without committing full investment amounts.

- No Ownership Hassles – You don’t need to take delivery of physical commodities or manage corporate shares. This reduces the operational burden and makes execution faster.

- Fast Execution and Real-Time Data – CFD platforms are built for speed. Trades are executed within seconds and most platforms offer live pricing, real-time charts and instant order confirmation.

CFD Trading Fees and Costs

CFDs offer access and flexibility, but trading them involves several types of fees. Understanding these costs helps traders set realistic expectations and manage capital more effectively.

Spread

The spread is the difference between the price at which you can buy (ask) and sell (bid) a CFD. This cost is automatically factored into your trade when you open a position. For example, if EUR/USD has a bid price of 1.1050 and an ask price of 1.1052, the spread is 2 pips. To make a profit, your trade must move beyond that spread in your favor. Spreads can be fixed or variable and tend to widen during high volatility or low liquidity periods. Liquid markets like forex typically offer tighter spreads than individual stocks or exotic instruments.

Overnight Financing Fee

Holding a CFD position overnight usually results in a financing fee, also called a swap or rollover. This fee is based on the total leveraged value of the position and applies daily. Long positions often incur a cost, while short positions may sometimes earn a rebate, depending on interest rate differentials. For example, if you hold a $10,000 position overnight with a daily swap rate of 0.01%, you’ll be charged $1. Traders planning to hold positions beyond a day should factor in these ongoing costs.

Commission

CFD brokers may charge a commission per trade, especially for stock CFDs. This fee is typically a fixed percentage of the trade size. For example, a 0.1% commission on a $5,000 stock CFD would be $5. Some brokers offer commission-free trading but compensate with wider spreads. High-volume traders often choose brokers with low commission rates and tight spreads to keep costs manageable.

Inactivity Fees

If your trading account remains unused for a set period, usually three to twelve months, your broker may charge an inactivity fee. These charges are meant to maintain account administration and data storage costs. The fees vary but are generally deducted monthly after the inactivity threshold is reached. This fee is avoidable by executing a small trade or logging into your account periodically.

Currency Conversion Fee

When trading assets priced in a different currency from your base account currency, a currency conversion fee may apply. For example, if your account is funded in euros and you trade a U.S. stock CFD, profits or losses must be converted into euros. Brokers typically charge a percentage-based fee (e.g., 0.5% to 1%) on the amount converted. This cost can impact overall profitability if not accounted for in advance.

How to Start Trading CFDs

Getting started with CFD trading involves a few key steps. It’s important to take the time to understand the platform, practice trading and manage risk from the beginning.

- Choose a Regulated Broker – Start by selecting a regulated and reputable broker. Regulation ensures your funds are held securely and that the broker follows financial standards. Look for brokers regulated by authorities like CySEC, FCA or ASIC.

- Open and Verify an Account – Once you’ve chosen a broker, complete the account registration process. You’ll be asked to provide identification documents to comply with KYC (Know Your Customer) rules. Verification is usually fast, taking less than 48 hours.

- Fund Your Account – After verification, deposit funds using supported payment methods. These may include cards, bank transfers or digital wallets. Choose a currency and method with minimal processing fees.

- Choose a Trading Platform – Brokers offer web-based platforms, desktop terminals and mobile apps. Select the one that suits your style. Look for features like customizable charts, one-click trading and built-in risk tools.

- Use a Demo Account First – Before trading with real money, practice on a demo account. This allows you to test strategies, understand platform features and build confidence without risk.

- Analyze and Place Your First Trade – Once you’re ready, choose an asset to trade, decide whether to go long or short and place your first trade. Always define your stop loss and take profit levels to manage risk.

- Monitor and Review – Track your open positions and analyze performance regularly. Make use of the broker’s tools for analytics, reporting and trade history review.

Popular CFD Trading Strategies

CFD traders use different approaches depending on their goals, timeframes and risk appetite. Each strategy requires planning, discipline and clear entry and exit rules.

Day Trading

Day trading involves opening and closing positions within the same trading day. The goal is to profit from small price moves. Traders rely heavily on technical analysis and short-term indicators. Since positions are not held overnight, there are no financing fees.

Swing Trading

Swing traders hold positions for several days or weeks to capture medium-term price moves. They use a mix of technical indicators and fundamental analysis. This strategy suits those who don’t want to monitor charts all day but can handle overnight exposure.

Scalping

Scalping focuses on executing many trades per day to capture small price movements. Positions may last seconds to minutes. Traders use tight spreads, high-speed platforms and strict discipline. It’s best suited for experienced traders.

Trend Following

This strategy aims to ride market trends by identifying assets moving consistently in one direction. Traders use indicators like moving averages or ADX to confirm trend strength and direction. It requires patience and works well in strong trending markets.

News-Based Trading

Some traders use economic releases or breaking news to catch fast price movements. This strategy demands quick decision-making and a good understanding of how news affects asset prices. Risk can be high due to volatility and slippage.

Tools and Platforms for CFD Trading

Effective CFD trading requires more than just market access. Traders need robust tools and platforms to analyze charts, manage risk and execute trades with precision.

Charting and Technical Analysis Tools

Modern CFD platforms offer advanced charting features. These include customizable timeframes, drawing tools and hundreds of technical indicators. Traders use these tools to identify patterns, support and resistance zones and trade signals. Common platforms like MetaTrader, cTrader and TradingView are widely used for charting.

Economic Calendars

Economic calendars display upcoming data releases, central bank decisions and geopolitical events. Traders use them to prepare for volatility and avoid entering trades right before major announcements.

Risk Management Features

Built-in tools like stop loss, take profit and trailing stop orders are essential. They allow traders to define risk parameters before entering trades. Some platforms also show margin usage and exposure in real time.

Mobile and Desktop Platforms

Many brokers, like IQ Option offer platform access through both desktop terminals and mobile apps. Mobile platforms help traders stay connected and manage positions while on the go.

CFD Trading Platforms

IQ Option delivers a simple yet powerful platform tailored for CFD trading. It offers interactive charts, one-click trading, built-in indicators and fast order execution. The platform includes a built-in profit and loss calculator, customizable layouts and integrated risk controls. Traders can open positions across assets including forex, stocks, crypto and commodities, all from a single interface.

Regulations and Legal Considerations

CFD trading is regulated differently depending on the region. Traders should understand the legal framework in their country before opening an account.

- Licensing and Oversight – Reputable brokers must operate under the supervision of financial authorities. In the European Union, CFD brokers fall under ESMA regulations. In the UK, they are regulated by the Financial Conduct Authority (FCA). These bodies ensure brokers follow fair practices, maintain adequate capital and protect client funds.

- Leverage Restrictions – Regulators often set maximum leverage limits to reduce retail trader risk. For example, in the EU, forex CFDs are capped at 30:1, while other assets have even lower limits. Unregulated brokers may offer higher leverage, but at greater risk.

- Risk Warnings and Investor Protection – Licensed brokers must display standardized risk warnings and offer negative balance protection. This ensures traders cannot lose more than their deposits. Brokers are also required to segregate client funds from operational funds.

- IQ Option’s Regulatory Status – IQ Option operates under strict regulatory standards, holding licenses in multiple jurisdictions. Traders benefit from negative balance protection, secure fund handling and transparent policies. The platform also complies with anti-money laundering (AML) and know-your-customer (KYC) procedures.

Tips for Beginners

CFD trading requires preparation, discipline and continuous learning. Beginners should focus on building skills gradually and protecting their capital.

- Start with a Demo Account – Before trading real money, practice with a demo account. This helps you understand the platform, test strategies and build confidence without financial risk.

- Learn Basic Market Analysis – Familiarize yourself with technical and fundamental analysis. Study how indicators work, how trends form and how news affects prices. Understanding the basics can help you avoid impulsive trades.

- Use Risk Management Tools – Always set a stop-loss and define your position size. Risking a small percentage of your balance per trade helps preserve capital during losing streaks.

- Keep a Trading Journal – Record your trades, including your reasoning, outcomes and lessons. This helps you identify patterns in your behavior and refine your approach over time.

- Focus on a Few Markets – Avoid trying to trade everything. Start with 1–2 asset classes, like forex or indices and get familiar with their behavior and volatility patterns.

- Stay Informed – Monitor economic calendars, news updates and platform notifications. Being aware of events that cause volatility can help you avoid unnecessary risks.

Common Mistakes to Avoid

Avoiding common errors can greatly improve the chances of success in CFD trading. Many beginners lose money due to habits that can be corrected early on.

- Trading Without a Plan – Jumping into trades without a defined strategy often leads to poor decisions. Every trade should have a clear entry, exit and risk level.

- Overleveraging – Using too much leverage increases risk and reduces the margin for error. Even small market movements can lead to significant losses if exposure is too high.

- Ignoring Risk Management – Skipping stop-losses or risking too much per trade can quickly deplete your account. Traders should never risk more than they can afford to lose.

- Emotional Trading – Fear and greed often drive poor decision-making. Avoid revenge trading, overtrading and deviating from your plan due to temporary emotions.

- Neglecting to Review Trades – Without reviewing past trades, it’s hard to improve. Keeping a trading log and analyzing outcomes helps identify patterns and weak points.

Conclusion and Final Thoughts

CFD trading gives traders the flexibility to speculate on a wide range of global markets without owning the underlying assets. It offers leveraged opportunities, fast execution and access to instruments across forex, stocks, indices and commodities, all from a single account.

While the potential for returns is high, the risks are equally significant. Beginners should approach CFD trading with preparation, starting small, using demo accounts and applying strong risk management from day one.

IQ Option provides a user-friendly platform equipped with advanced tools, real-time data and risk controls designed to support both beginners and experienced traders. With the right strategy, ongoing education and disciplined execution, CFD trading can be a valuable tool in a modern trader’s portfolio.