CarMax Inc. (KMX) Stock is the United States’ used car retailer and provider of related services, such as financing and sell of warranties. The mix of different services and an accent on used vehicles helped CarMax outperform the industry in the past year.

Despite above the average revenue growth on the verge of earnings report publication, that is scheduled for 6 April 2017 (before the opening bell), CarMax can find itself in an embarrassing situation. Rated “Sell” by Zacks, the company is no longer an attractive asset for many long-term investors. Nonetheless, its stock can be an interesting option for classic options trading.

At the moment CarMax’s stock is getting mixed recommendations from leading market analysts, ranging from “Sell” to “Buy”.

Current situation

Even if the company doesn’t show two-digit growth in the upcoming years and doesn’t provide conservative investors with steady incomes, IQ Option traders can still profit from major economic news about the company with the help of classic options. Potential investors have to decide whether the price of the underlying asset is going to go up or down.

On the bright side

CarMax has left Zacks-categorized Retail/Wholesale-Auto Parts industry far behind, showing 2.9% share price growth (against industry’s 6.4% decline) last year. Store expansion strategy and capital deployment are among the possible reasons for positive stock price dynamics.

The company has already managed to increase its used cars sales by 6.6% in fiscal 2017 and is expecting to boost the figure even more in the upcoming fiscal quarter.

CarMax is well-known for its aggressive expansion policy under which it opened 14 new stores in fiscal 2016 and 11 new stores during the first three quarters of fiscal 2017, complemented by plans to open four more stores in 4Q17.

Regular buybacks, carried out by the company, increase shareholder value. In the previous fiscal year CarMax repurchased 16.3 million shares for $971.2 million. In fiscal 2017 the company has already spent $456,5 on buybacks, yet the year is far from over.

In case you believe these facts are enough for CarMax stock prices to lift off in 2017 and reverse a month-long negative trend, a “Call” classic option can be a good choice.

On the not-so-bright side

Other sales and revenues of the company leave much to be desired. In fiscal 2016 the figure showed a 4.2% decrease ($522 million in monetary terms). In fiscal 2017 the decrease is estimated to cross the 5.3% mark.

Corporate income from financial activities has been falling down during the first nine months of fiscal 2017, equaling minus 4.5%.

Another concern is cash outflows from operations. Not only it siphoned $148.9 million of company’s money in fiscal 2016 but also increased to $343.1 million in the first three quarters of fiscal 2017.

For certain investors negative factors outweigh the positive ones in case of CarMax. If you are one of them, “Put” option is the instrument you should consider buying.

The third way

CarMax is a hard nut to crack. Company’s performance, and therefore future stock prices, depend on numerous, sometimes unrelated, factors.

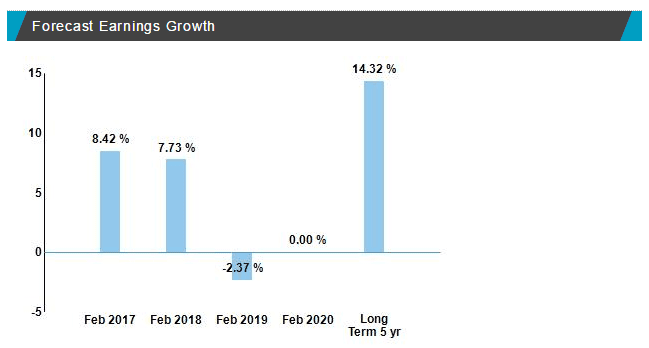

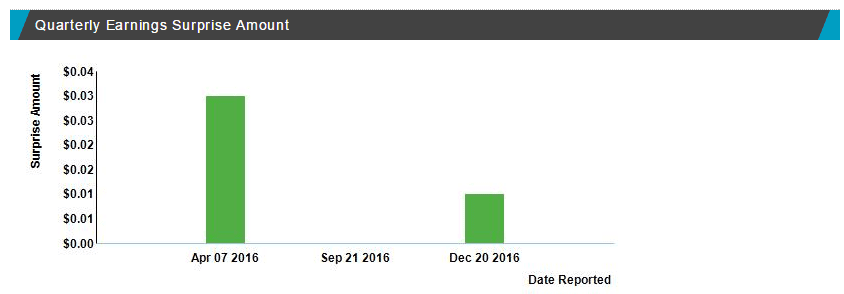

Despite showing controversial financial results and inviting doubt into investors, CarMax has a trick up its sleeve, and the trick is the earnings report for the fiscal quarter ending February 2017. According to the estimates, CarMax shares have a chance of going up, mostly because to its ability to outperform the industry and consensus EPS forecast of $0.79 (compared to $0.74 in the last year).

At the moment it can be said that there are more reasons for the price to move up than vice versa, but the contrary cannot be excluded completely. The stock has already depreciated in the previous month and can be expected to bounce back once the earnings report is published.

Undecided investors may want to take a closer look at the strangle strategy. Such events as earnings report can trigger spikes of volatility. By using the strangle one can avoid a difficult choice between call and put options and go with a bidirectional deal, hoping that potential profit from one of them will exceed the purchasing price of both.