Candlesticks and candlestick trading is my favorite part of technical analysis. The candles literally jump off the charts to tell you a story, if you know how to listen. While it is easy to spot candle formation that may be signals most usually aren’t reliable, and when you do spot a reliable signal it’s often hard to know what to do next. In this post I will describe a powerfully bullish signal, how to recognize it and what to do once you’ve seen it. Three White Soldiers.

Three White Soldiers is a powerful bullish signal indicative of rally and continuation. It consists of three long white candles, one after another, that march to new highs. Individually each candle represents a period of buying, as a group they represent an extended period of sustained buying and a shift of market sentiment. Any three white candles in a row may be considered to be a sign of buying and higher prices to come it takes a few more characteristics to be considered Three White Soldiers.

The candles must all be long and white

An average sized candle is not enough, the candle must be at least as long as any other candle over the past 100 candles or so and preferably longer. Each candle in the formation must as long as the last, preferably longer, in indication of increased buying as the formation appears. If the candles get shorter it may mean the rally is already losing momentum.

The formation should break above resistance or take the asset to a new high

Three White Soldiers that appears in the middle of a trading range is bullish but upside may be impaired by resistance at the top of the range. A break out or break to new highs shows a change in market conditions and is a coincident indication of higher prices.

Volume should be on the rise

If three white candles forms with volume rising the move has more strength. If volume isn’t rising the move is weak and without broad support, leaving it vulnerable to correction. Luckily, cryptocurrencies like Litecoin give good volume data, unlike other types of forex. In the case of forex tick data may be substituted; increasing tick volume implies increased market activity and higher volume.

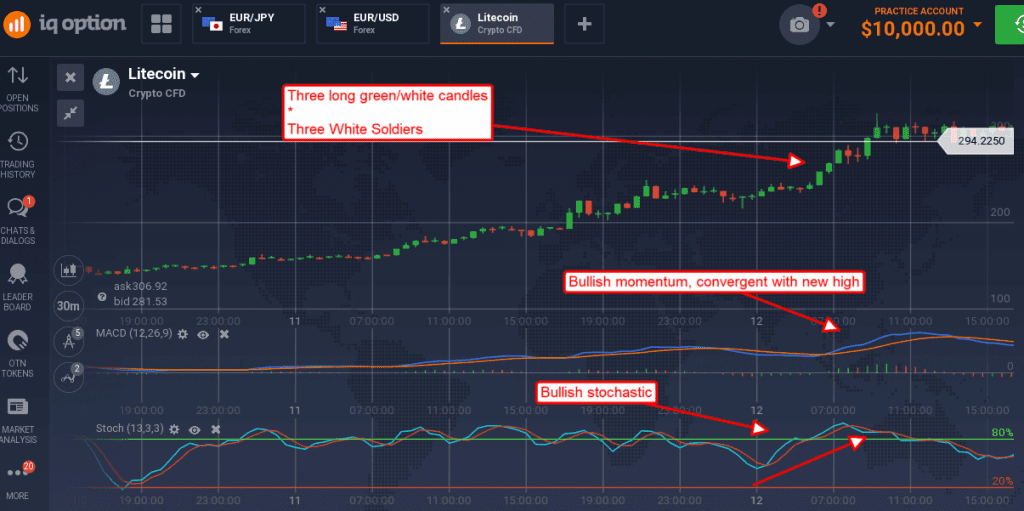

Secondary indicators should be convergent

If indicators such as MACD, stochastic, RSI or other momentum based tool are bullish and convergent with the Three White Soldiers it shows underlying strength in the market and a high likelihood the highs of the formation will be tested multiple times and/or exceeded.

Look at the chart below. This is a chart of 30 minute Litecoin candlesticks. It shows the appearance of Three White Soldiers on December 12th. These candles are all long, much longer than any other candles over the past day or so. The move up breaks LTC to a new high following consolidation within an uptrend. The candles get longer as the pattern forms, the third candle is the longest, and the indicators are rising along with it. This is a strong signal of higher prices, but what do you do next?

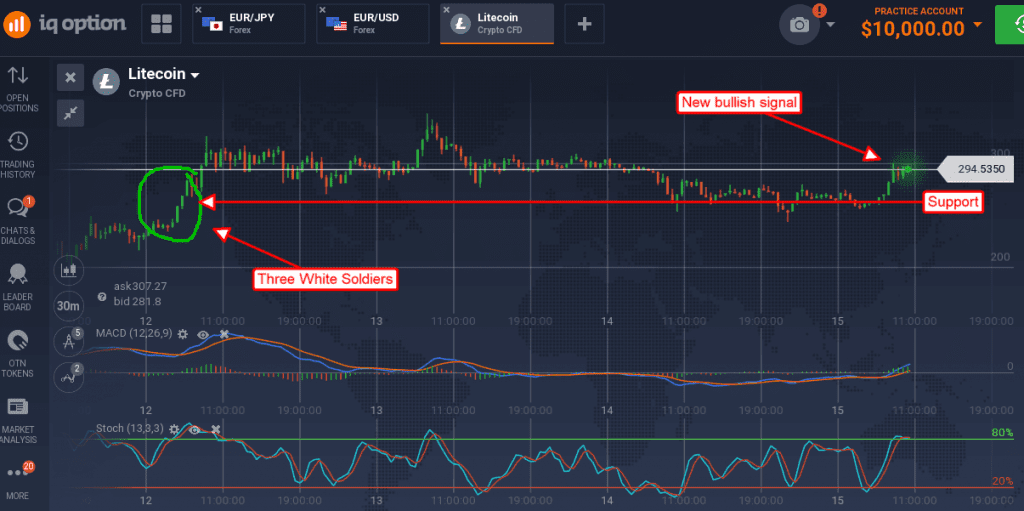

Because prices have already moved to an extreme and extended high it is usually not a good idea to buy in right after this pattern forms. It is better to wait for prices to consolidated and/or pull back to support levels and then look for the next bullish signal. If you look at the chart below it shows LTC did in fact enter into a consolidation pattern as profit takers took advantage of new high prices. Now that prices have found, tested and confirmed support near the $275 level new longs can be entered with relative safety.

Projections for the next move will be equal to the height of the original Three White Soldiers or about $125 which makes $400 the first target on recovery, and then $525 when $400 is broken.