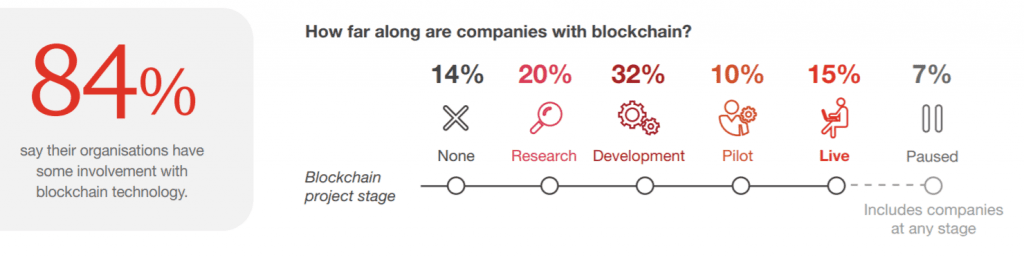

If 2017 was the year of blockchain trials, today we see how more and more companies around the world are implementing this emerging technology for various use cases. Professional services firm PwC has carried out a research study to find out whether the distributed ledger technology (DLT), an umbrella term that also includes blockchain, has many supporters among company executives. The London-based firm surveyed about 600 executives from 15 regions. According to the final results of the study, 84% of the executives said that their companies had at least some blockchain-related projects or trials.

When asked how they would describe their organizations’ current involvement with the technology, the executives responded as follows:

- 14% said that their organizations had no involvement with blockchain;

- 20% revealed that their companies were researching the technology;

- 32% said that the blockchain adoption was at the development stage;

- 10% stated that their companies were testing the technology through pilots;

- 15% unveiled that their firms had been already using blockchain;

- Finally, 7% of the respondents said that their companies put the blockchain-related projects and trials on pause.

Even though only 15% of the executives said that their organizations were already implementing blockchain at its full capacity, there is an overwhelming majority that has at least some involvement with DLT.

In the near future, these trends will consolidate, and we will see even more companies implementing blockchain solutions. It’s because the technology is really transformative and has several significant advantages. It can reduce intermediaries, cut costs, increase speed, and what’s more important, ensure a high degree of transparency.

Gartner, a US-based research and advisory firm, predicted that blockchain would contribute an annual business value of over $3 trillion by 2030, which suggests that more than 10% of the global economic infrastructure will be more or less based on DLTs.

Blockchain Implementation by industry and region

Even though the technology shows unmatched benefits for many industries and use cases, the financial services industry accounts for almost half of the blockchain-related use cases. According to the PwC study, financial services get 46% of the total use cases. Industrial products and manufacturing along with energy and utilities go next with 12% of use cases each. The health industry is close with 11%, the government sector has 8%, and retail and consumer industry and entertainment and media are last with 4% and 1% respectively.

If we compare these trends with the initial coin offerings (ICOs) data provided by CoinSchedule, we can see some similarities as we’ll find finance, trading & investing, and payments industries in the top. All three sectors in the CoinSchedule list can be merged in what PwC would call financial services.

Thus, the financial sector will lead the blockchain adoption at all levels. Giant banks around the world don’t want to stay aloof from another tech revolution and are trialing the technology. For example, JPMorgan and Barclays are some of the banks that have filed applications for blockchain-related patents with the US Patent and Trademark Office (USPTO).

I have already explained in an earlier IQ Option blog post how the distributed ledger technology is implemented by Wall Street banks, including JPMorgan, the largest US bank by total assets, Goldman Sachs, Morgan Stanley, Bank of America, and Citigroup. It’s worth mentioning that Bank of America has filed the most blockchain-related patent applications than any other organization in the US. Elsewhere, Goldman Sachs plans to develop a custody service for Bitcoin and cryptocurrency-based funds. The fact that Wall Street banks are showing interest in blockchain helps the technology gain confidence.

And it’s not only about the US. In Australia, the Australian Securities Exchange (ASX) has already decided to fully replace its Clearing House Electronic Subregister System (CHESS) with a blockchain-based platform.

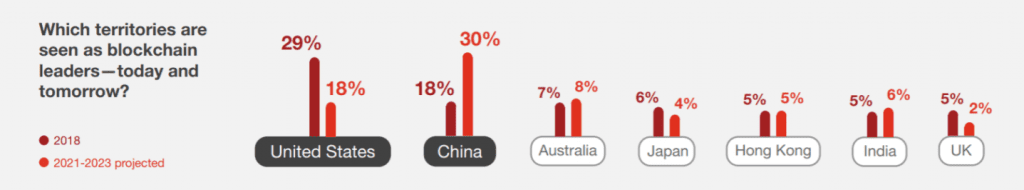

Now getting back to our PwC survey, when the executives were asked which of the territories around the world are the most advanced in developing blockchain projects as of today, 29% pointed to the US, and 18% mentioned China. Australia was named in 7% of the responses, while Japan in 6%. Hong Kong, the UK, Denmark, and India got 5% each. However, in the future, the trends might change, as 30% of the executives expect China to dominate the market, while the US was named in 18% of the responses.

Blockchain adoption challenges

As the PwC found out, the executives, 44% of which are C-suite and vice-presidents, could define several barriers that stagnate the blockchain implementation. Thus, the biggest challenges are the regulatory uncertainty (48% of the respondents), lack of trust among customers (45%), ability to bring network together (44%), difficulty to integrate or merge separate blockchain systems (41%), inability to scale (29%), intellectually property issues (30%), and audit and compliance issues (20%).

Even though there are lots of difficulties in developing blockchain solutions, the benefits make it worth trying. As the PwC study put it, companies won’t generate the greatest return on investment in DLT if they’re developing the technology only for themselves. The advantages are best observed when more entities are coming together to build a shared system.

Blockchain has made a lot of progress during the last two years, but the most interesting part is about to come. Even today, many executives don’t really understand the real potential of the technology, and many users are afraid of big changes. However, the DLT is expanding at a fast pace and blockchain will probably become one of the most important technologies.