The majority of people start trading to become affluent and gain financial independence. No one trades to lose money. Yet it often seems like people who lose their investments outnumber those who hit it big. No trader (even the most professional one) can win 100% of the deals, yet we can look into the main causes of money loss so that you could try to avoid them in the future.

1. Not knowing what you’re buying

Famous investor Peter Lynch made the idea of buying “what you know” popular. The logic here is dealing with the stocks that you understand. While this doesn’t mean that you should buy Tesla stock because you like Tesla Roadster, it could be a perfect starting point for additional research.

Remember to always do your homework on the stock. Spend some time on historical analysis, find out all the pro’s and con’s of investing in this stock. Many traders buy stocks in sectors that they don’t understand, simply following recommendations of market analysts. That’s a reckless strategy which leads to impulsive purchases and sells, since these investors can’t grasp the long-term perspectives of the stock.

2. Not following earnings reports

Warren Buffett was once asked how investors can make smarter decisions, he held up stacks of reports and said, “read 500 pages like this every day. That’s how knowledge builds up, like compound interest.”

Many investors ignore company’s most recent quarterly reports and conference calls. As a result, they fail to learn why a company beat or missed expectations during the quarter, and become oblivious to the upcoming challenges and headwinds that may influence their portfolio.

3. Overlooking forecasts and valuations

There are traders who rely on the technical analysis and merely follow the trend, thus ignoring the fundamental analysis and missing on the underlying business’ factors, growth and valuations. In such cases traders violate the core rules of the long-term investing, only fundamental analysis can give you an insight into why the company is growing and to determine if a stock is cheap based on fundamental valuation.

4. Selling winners and holding losers

Investors naturally want to sell winners and hold onto losers. That’s because they’re constantly afraid that their gains will be erased, and always hopeful that they can recover their losses.

History shows us how disastrous selling winners can be. If you had invested $10,000 in Amazon’s (NASDAQ:AMZN) IPO in 1997, you would have received 555 shares. After three splits in 1998 and 1999, your share count would have risen to 6,660. That stake would be worth $5.8 million today. Imagine how you would feel if you had sold that stake the first time it doubled, tripled, or even quadrupled.

As for losers we can look at BlackBerry (NASDAQ:BBRY), which lost 95% of its market value over the past decade. Investors who believed that the former smartphone market leader would make a comeback (in phones, tablets, or software) were repeatedly disappointed.

5. Failing to diversify

One of the easiest ways to lose money in the stock market is to not diversify. Investing in one single stock might be great if that stock goes up, but you’ll be in big trouble when it comes plunging down.

Meantime buying a lot of stocks from a single sector doesn’t count as diversification, since bad news about one company often drags down its industry peers. Thus it would make more sense to spread your stocks out over a number of industry sectors.

6. Craving to get rich quickly

Financial sphere is crowded with account managers and strategy developers, they all promise to share a magic trick to help you top the charts of investing gurus. Some of them can really help you improve your investing approach but none of them can promise you wealth until you work hard on it yourself.

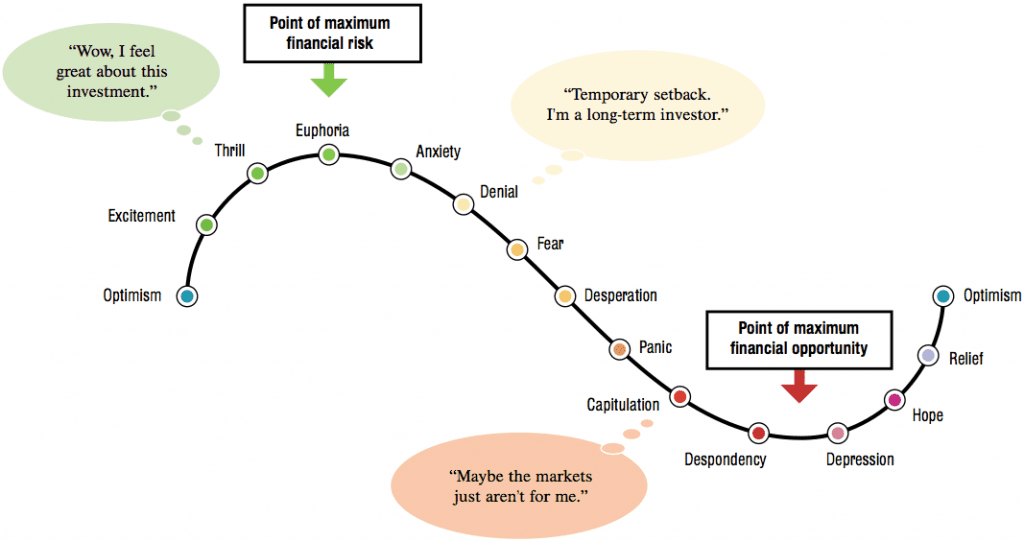

A vast majority of traders need to realize that they need to conquer themselves, learn, practice, do their homework and improve self-awareness. This chart of emotions will help you realize how important it is to tame your emotions when money is at stake.

The key takeaways

Here is what you might want to do when trading stocks: look deeper into corporate news and reports, understand the company you trade, diversify your trading portfolio, let the winners grow and cut losses. Thus you will get a chance to improve your trading effectiveness.