There are always companies that get a lot of attention from investors and traders. They seem to appear in just about every news piece and even infiltrate daily conversations with friends and colleagues. Here are 4 companies that have recently been generating a lot of buzz. Let us look closer to figure out why they are drawing so much attention and try to understand what to expect from them next.

Twitter, Inc.

Background Information

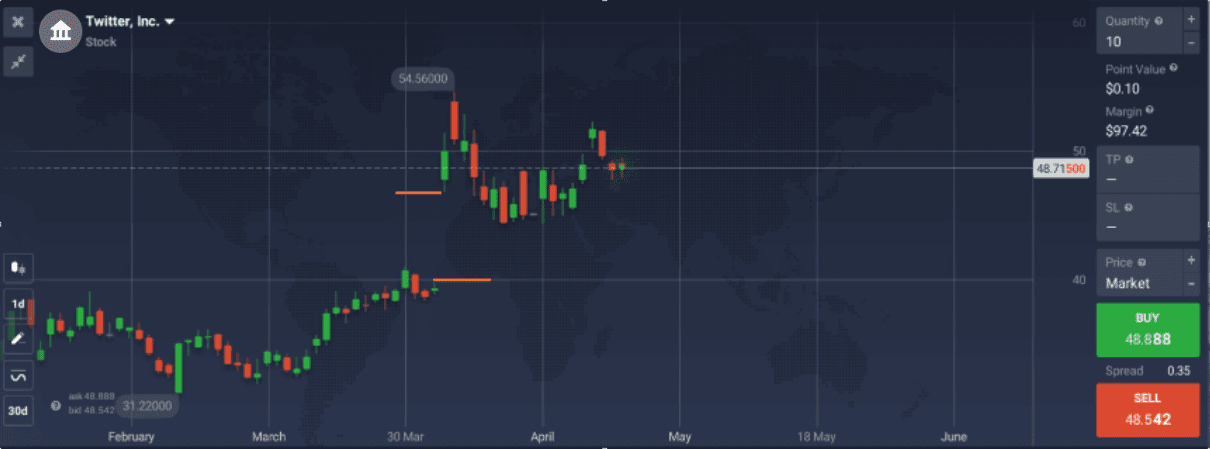

Many traders have been closely following Elon Musk’s attempts to buy this social networking service. First the CEO of SpaceX and Tesla declared having purchased 9.2% shares of Twitter in early April 2022. This was followed by his offer to buy the entire business on April 14 for $54.20 a share (around $44 billion total). The board of directors of Twitter took some time to consider the offer and accepted it on April 25. However, the acquisition process is not over yet: it might take a few more months to get the deal approved by shareholders and regulators. Meanwhile, if either party for some reason backs out of the deal, it will have to pay out a termination fee of $1 billion.

What is next?

When the deal finally closes, Twitter will become a private company. There will be less transparency on financial performance: it will not be required to share its operational results with the public.

When it comes to user experience, there might be significant changes. Elon Musk has characterized himself as a free speech advocate, ready to protect everyone’s right to express themselves freely. Some people might be happy to hear that there may be less moderation and restrictions on Twitter under his management. But there are others, who feel concerned about the potential changes.

Regular users

There have been reports of fluctuations in the number of followers for some high-profile accounts on Twitter after the acquisition announcement. Some suddenly lost thousands of followers, others experienced an influx of new readers. It appears that some users decided to leave the platform after Elon Musk bought Twitter. Others, however, took it as a sign to join in.

Political organizations

The European Parliament and the EU Member States have recently reached a provisional agreement on the Digital Services Act (DSA). Its goal is to create a safer online environment and protect European citizens from illegal content on the Internet. This Act might compel companies and platforms to reinforce stricter content moderation, making sure that illegal materials do not reach users. These guidelines will firstly affect large digital platforms like Twitter. They may have to come up with new methods of content moderation to comply with the European regulations. If not, they might risk fines of up to 6% of their global annual revenues – around $300 million for Twitter, based on its revenue of $5 billion for 2021.

Thierry Breton, a European Commissioner for the internal market, personally mentioned Elon Musk in his tweet mentioning the DSA, cautioning him to follow the rules.

The Market

The changes in ownership have not significantly affected Twitter’s stock. There was a price increase in early April, which was then followed by a slight decrease. There are many factors that might affect this stock in the future. So if you are interested in trading this asset, carefully consider all the factors before making a deal.

Tesla, Inc.

Background Information

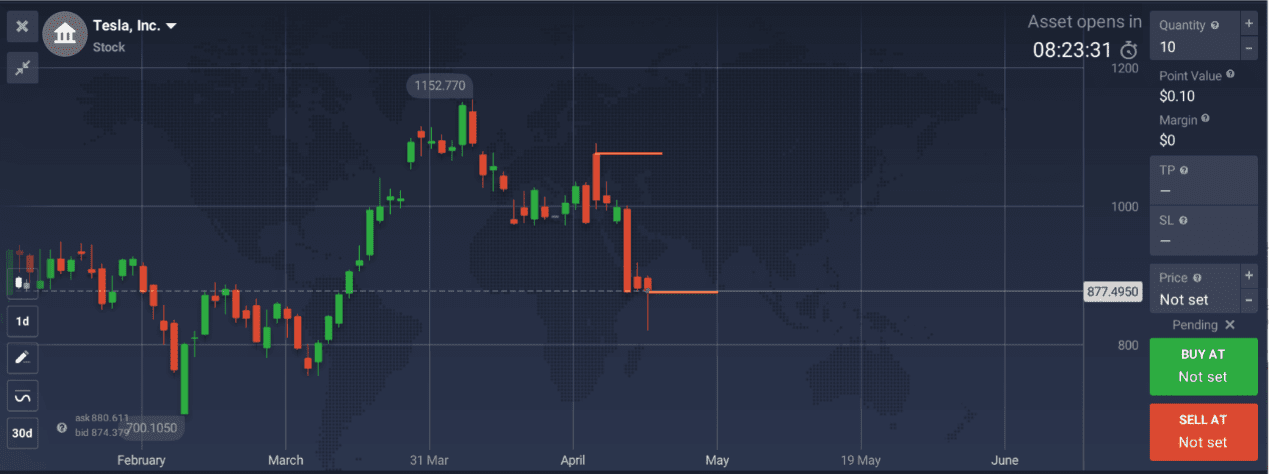

Tesla stock analysis shows that the share price of this large automotive company continually decreased in April. After its CEO Elon Musk’s announcement regarding the acquisition of Twitter, it went down even further.

To pay for Twitter, Elon Musk will need to gather significant funds, including taking out bank loans with his Tesla stock as a collateral and potentially selling some of it as well. This might be contributing to the recent price instability.

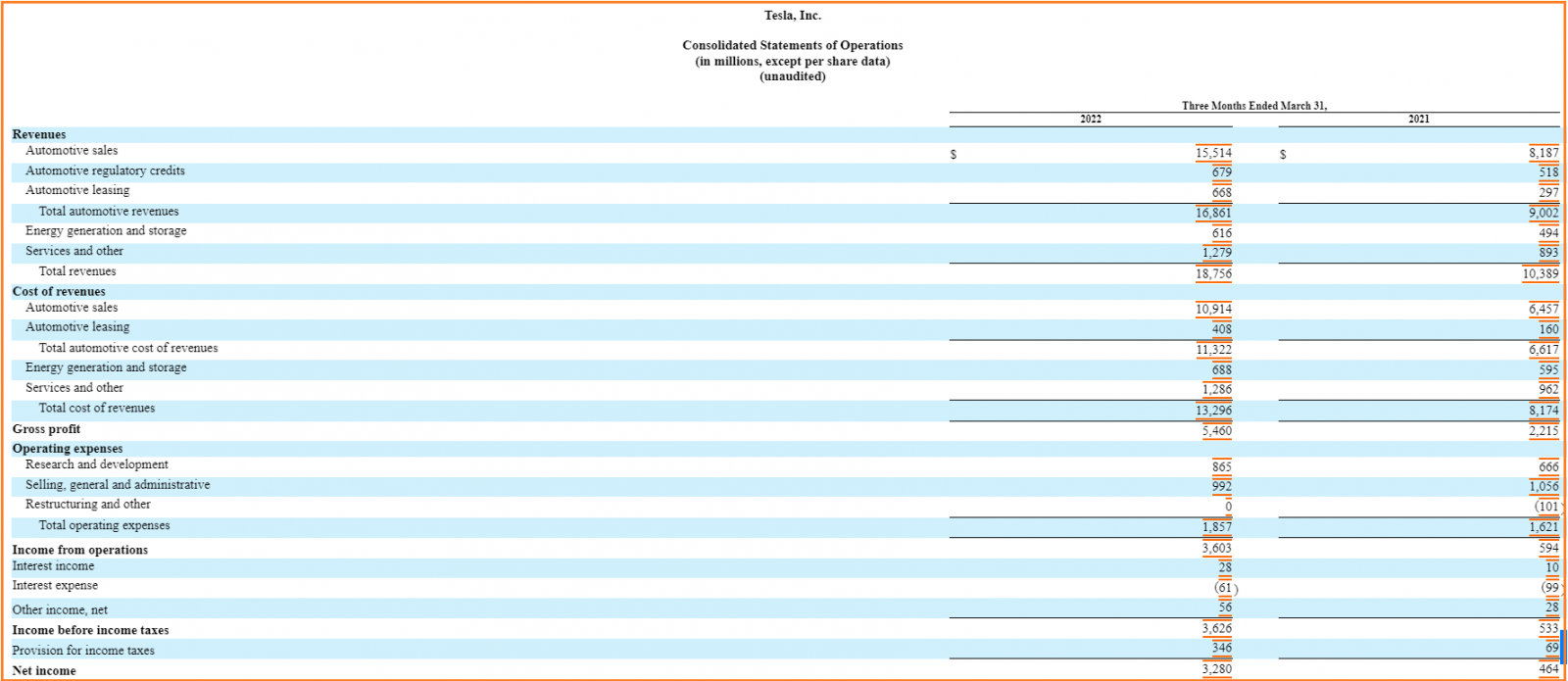

However, the company’s financial report for the first quarter of 2022 showed promising results with high profits.

Challenges Ahead

Production

Many producers in the automotive industry have recently faced issues with supply chains. There have been shortages of chips, batteries and other necessary components for production. Lockdown measures due to Covid-19 in large cities in China, including Shanghai, have also negatively affected some factories. So it may become more difficult to sustain the production volumes in the near future.

Tesla has also recalled some of its cars sold in the past few years due to various technical issues and safety concerns. The most recent large recall happened in April 2022 in China: over 127 000 electric vehicles have been recalled to fix issues with semiconductor components.

Competition

There is also growing competition from other companies producing electric vehicles that are fighting for their share of the market. One is Ford Motor Company, which is planning to create a new generation of all-electric passenger cars and vans by 2024. They are setting ambitious goals for future sales and focus on European consumers.

So if you are interested in this industry and looking for trading ideas, it might be useful to follow different companies and monitor economic news. To stay informed, you may use the economic calendar on IQ Option. To learn how it might provide trading ideas, take a look at this article with step-by-step instructions: How to Make Sense of the Economic Calendar.

Exxon Mobil

Background Information

The Pandemic Aftermath

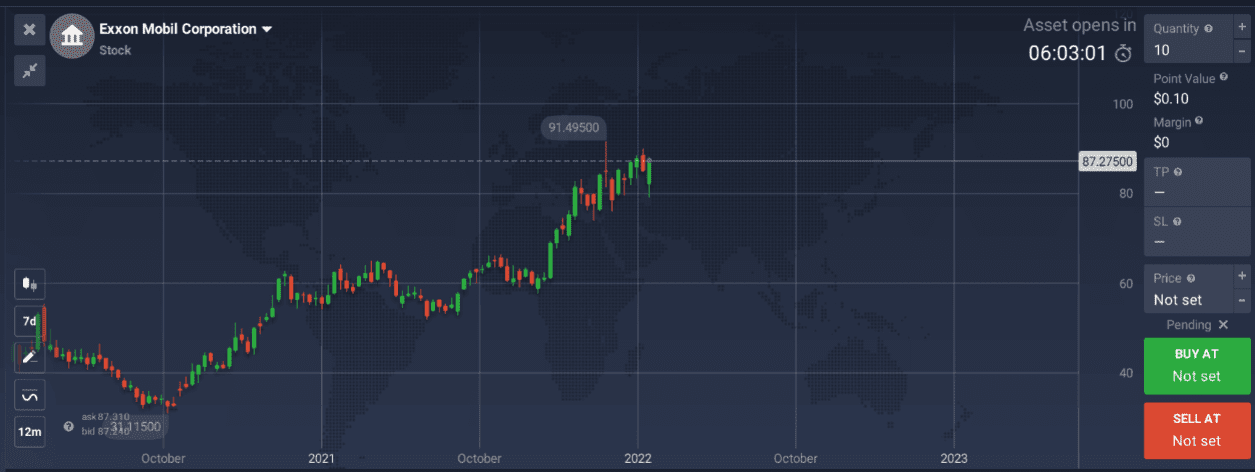

This multinational oil and gas giant experienced a financial hit due to the Covid-19 pandemic: with world-wide lockdowns, the demand for fossil fuels dropped. It had to cut the spendings and even some of its workforce. In August 2020 Exxon was removed from the Dow Jones Industrial Average – important stock market index.

Climate Change

ExxonMobil has faced some issues over its activities related to climate change prevention. For decades it refused to take actions to fight global warming and look for alternative energy solutions. For instance, ExxonMobil was one of the founders of the Global Climate Coalition (1989-2001) – an international advocacy group opposing policies related to emission reduction and questioning the science behind climate change.

However, in the past years the company has changed its position and took steps to address the climate change issue. There are several reasons for this shift. External pressure might be considered one of the most important among them.

In 2021 an activist hedge fund Engine No.1 challenged the management of Exxon to a proxy fight over seats on the board of directors. They claimed that Exxon was not doing enough to reduce emissions and transition to a low carbon economy. Engine No.1 only had 0.02% of shares in Exxon, but still managed to get 3 of its board members elected. This created new conditions for the company’s development and might lead to further changes in its long-term strategy.

What comes next

The company’s past activities connected to climate change have been under scrutiny. There is an ongoing investigation by the government to understand whether Exxon may have misled consumers and/or investors on the impact of fossil fuels on climate change. It is not finished yet, forcing the company to defend its actions related to this issue in court and in front of the general public.

Exxon now claims to be working on reducing greenhouse gas emissions from its operations and investing in new energy solutions. According to Exxon Mobil’s Progress Reports, it is planning to reduce absolute greenhouse gas emissions by an estimated 30% for the Company’s Upstream business and 20% for the entire corporation.

There may be more changes affecting the fossil fuel industry and some of them might affect ExxonMobil’s stock, as well as oil prices. So whether you are interested in trading stock or commodities, following the news from this sector might provide some trading ideas. Keep in mind that price fluctuations may be hard to predict even after thorough analysis. So carefully consider the risks before making trading decisions.

Netflix, Inc.

Background Information

Netflix is a major player in the online streaming market with over 221 million paying subscribers in the first quarter of 2022. This industry was one of the few that benefited from the Covid-19 pandemic, and the stock price increased all through 2020 and 2021.

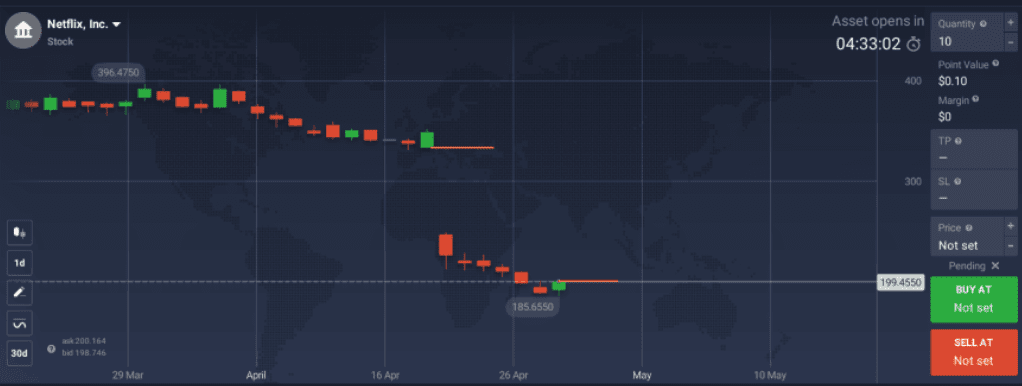

However, the service is now for the first time in history seeing a decline in the number of subscribers. This is reflected in the first quarterly financial report of 2022: number of paying subscribers reduced by 200 000 from the previous quarter. The stock price of Netflix plummeted on April 20, 2020 after the publication of the financial results. This follows the loss of thousands of subscribers after the suspension of Netflix services in Russia in March 2022.

What to expect next

The company is looking for new ways of development in the future. Netflix has recently announced plans to address the password sharing practice. In its letter to shareholders published on April 19, 2022, it said that the 221 million paying subscribers may be sharing accounts with over 100 million additional households. This slows down the company’s revenue growth and should be addressed.

As a solution, Netflix is considering adding an extra fee for the users sharing their password. It would mean that people will no longer be able to share their accounts with others for free. They have already started to test this new feature in some regions to see how users are reacting to the change. It will then be expanded to users all over the world, which might affect the public’s attitude towards the company and Netflix’s stock price.

Summing Up

When looking for trading opportunities, you may find it useful to analyze the information related to influential companies affecting the global economy. Following the news and checking the financial reports might provide insight into market trends and lead to trading ideas. However, you should always weigh all the risks before making trades, as even the most detailed analysis cannot guarantee positive results.