Forex may be considered one of the most popular assets for trading among both experienced and novice traders. It may seem complicated at first, but learning the key principles doesn’t require a lot of time. In this article, we will cover the main points about forex and answer popular questions about forex trading on IQ Option.

What is Forex?

The term “Forex” is short for foreign exchange, often referred to as simply FX. The foreign exchange market is the largest and most liquid market in the world. It is not just one place, but rather a system of economic and organizational relations between banks, brokers and individual traders. Its main purpose is to create a space for making transactions with foreign currencies (buying, selling, exchanging, etc.).

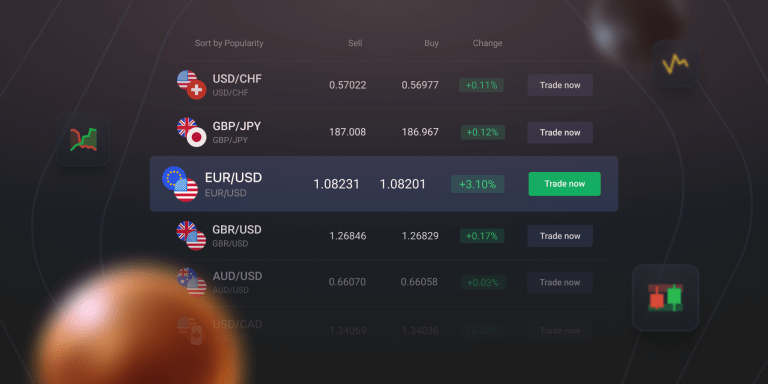

The foreign exchange market does not set an absolute value for a currency, but rather determines its relative value against another currency. That is why you’ll normally see currency pairs, such as EUR/USD, AUD/JPY and so on when exploring CFD forex trading on IQ Option.

How to trade forex on IQ Option?

There are a few key concepts you may want to learn before entering a forex trading platform.

Base and quote currency

The exchange rate always shows two currencies. In the pair, the first currency is called the base currency and the second one is the quote currency. The price of the base currency is always calculated in units of the quote currency. For instance, if the exchange rate for GBP/USD is 1.3, it means that one pound sterling costs 1.3 US dollars.

Based on that, a trader can better understand any forex price chart. If the chart on GBP/USD, for example, is going up, it means that the price of USD decreased against GBP. And the other way around, if the rate is going down, it means that the price of USD grows against GBP.

Major and exotic currency pairs

All currency pairs can be divided into major and exotic ones. Major pairs include the most widely circulated global currencies, like EUR, USD, GBP, JPY, AUD, CHF and CAD. Exotic currency pairs include currencies of developing or small countries (TRY, BRL, ZAR, etc.).

CFDs

One key aspect of forex trading on IQ Option is that currency pairs are traded as CFDs (Contract For Difference). When a trader opens a CFD deal, they do not purchase the underlying asset. Instead, they trade on the difference between the entry price and the exit price of the chosen asset.

When a trader opens a deal on a forex trading platform, they make a prediction about the upcoming price development. In case of a correct prediction, they may receive a positive outcome. By learning how to analyse the forex price chart and identify potential changes in the trend, traders might improve their chances of achieving positive results.

Is IQ Option good for forex trading?

IQ Option has multiple tools and features for forex trading suitable for both experienced and novice traders. They can help you understand the market sentiment in forex and make quick decisions based on thorough analysis. Here are some of the main features you may find useful.

Information about forex assets

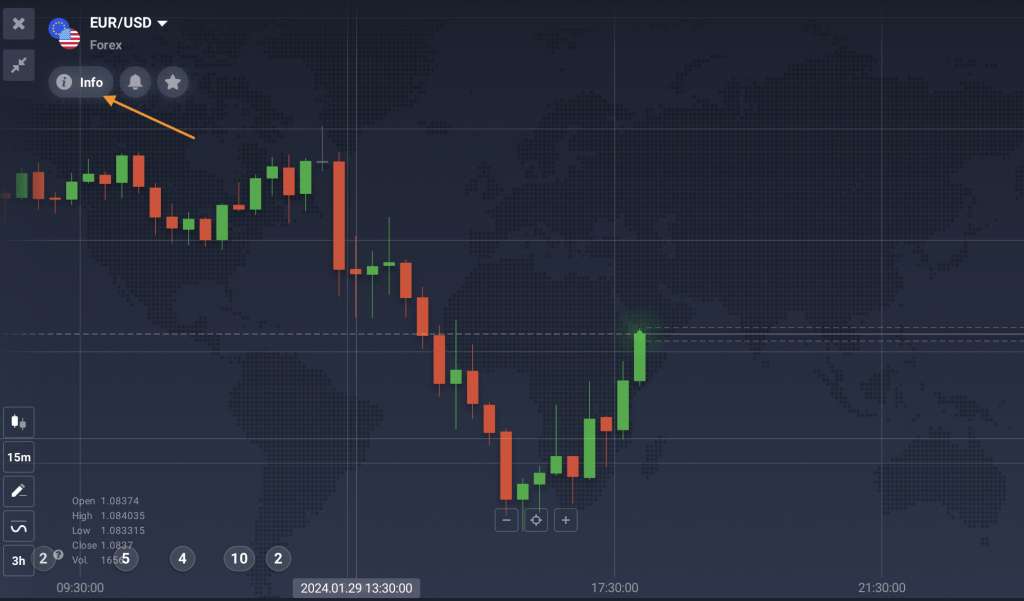

To learn the key points about a forex asset, click on the “Info” tab button under the asset symbol.

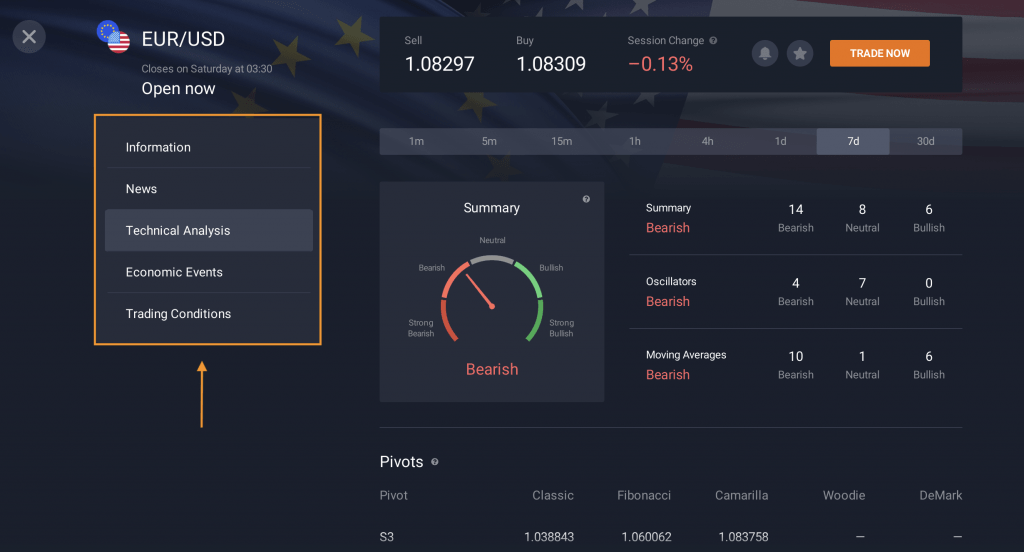

This tab opens an entire section filled with data for asset analysis. It includes:

- General information about the currency pair, such as recent price changes and trader sentiment;

- Important news and economic events that may affect the forex asset price;

- A summary of some technical analysis indications on different timeframes;

- Trading conditions for the asset, such as the trading schedule, spread, contract size, etc.

While these features of CFD forex trading on IQ Option may be useful for gathering information about a specific asset, they should not replace a trader’s own analysis. It’s important to make well-informed decisions based on thorough analysis. There are a few more simple yet effective tools that may help traders do that.

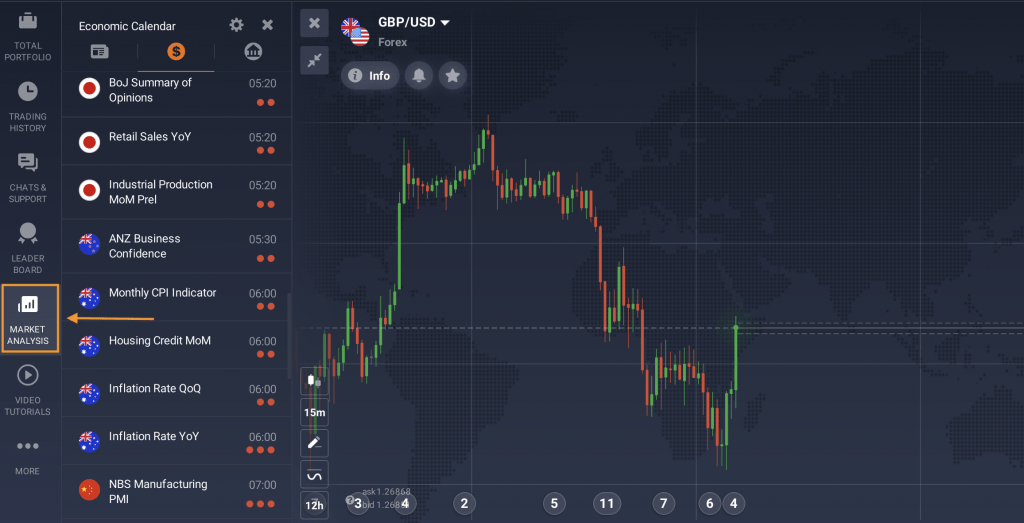

Market analysis

There is a special section in the traderoom dedicated to market analysis. You may access it through the menu on the left-hand side of the main screen. It includes the latest market news, the economic calendar and upcoming corporate earnings reports.

Forex trading on IQ Option has another useful feature to better understand market sentiment in forex. You may choose to track the latest news related to your specific CFD asset directly on the price chart. This might allow you to learn about the key events that may influence your trades faster and improve efficiency. To learn more about this feature and its set-up, have a look at this material: IQ Option Traderoom: Top Features You Need to Know.

Forex traders also need to keep in mind the world stock exchange opening hours to plan their strategy ahead. They will differ depending on your location, so be aware of the time difference to choose the best option for you. Here are the world stock exchange opening hours for the most popular exchanges.

| New York Stock Exchange | NYSE | Monday–Friday, 9:30 am – 4:00 pm (EDT) |

| London Stock Exchange | LSE | Monday–Friday, 8:00 am – 4:30 pm (BST) |

| Tokyo Stock Exchange | JPX | Monday–Friday, 9:00 am – 11:30 am, 12:30 pm – 3:00 pm (JST) |

| Australia Stock Exchange | ASX | Monday–Friday, 10:00 am – 4:00 pm (AEST) |

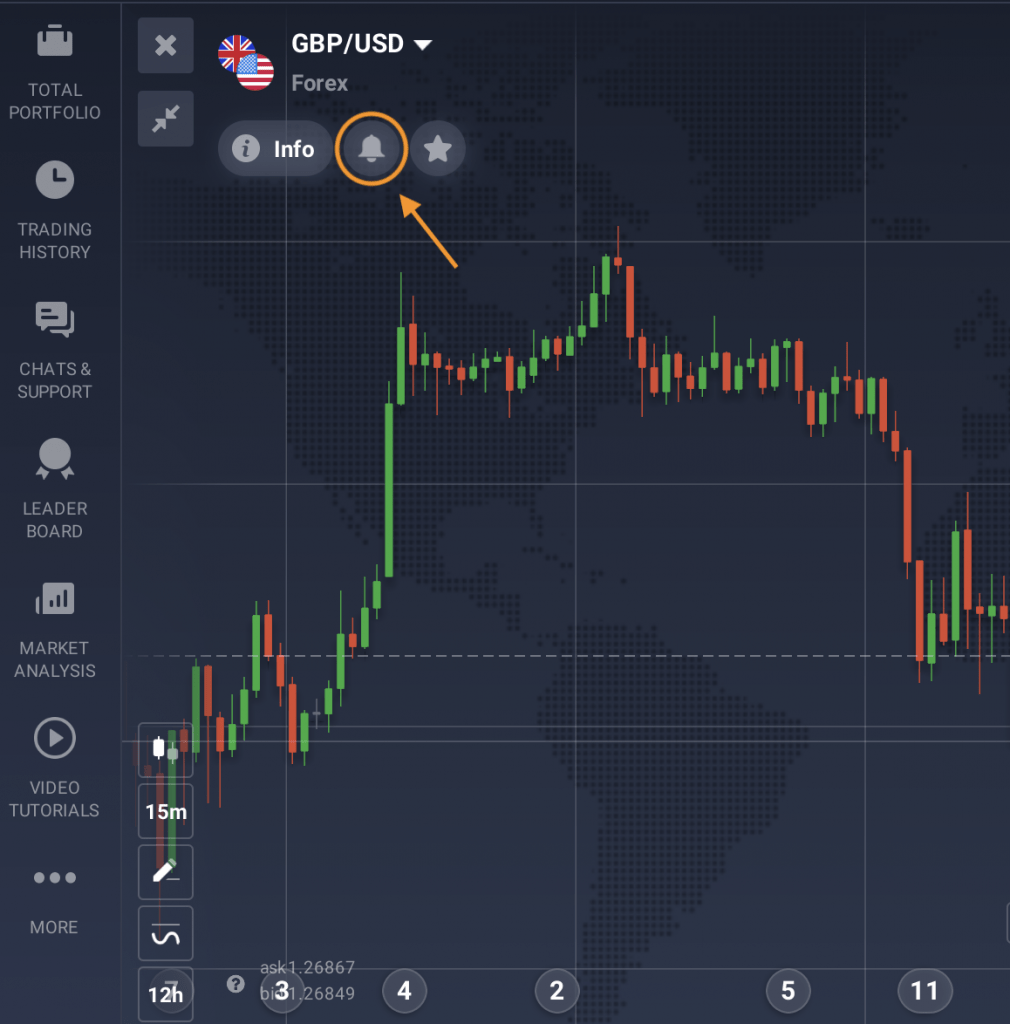

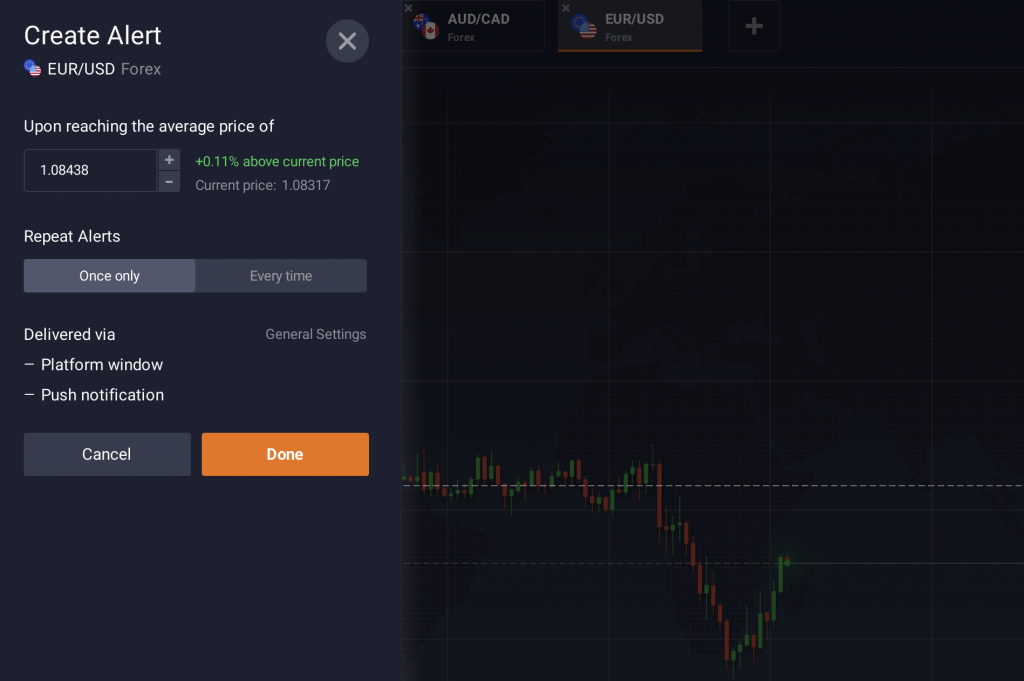

Price alerts

Sometimes you may be too busy to check your trades regularly. This is where another feature of this forex trading platform may come in useful. You can choose a certain price level for an asset and create an alert. This way, you will receive a notification when the asset price reaches the indicated level. To apply this feature, just click on the bell below the asset name and pick the suitable settings.

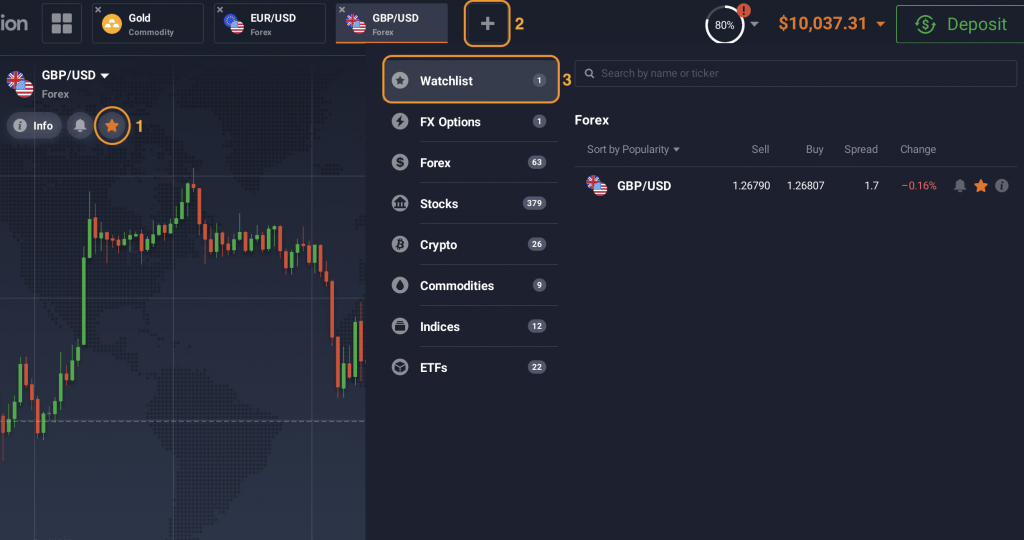

Watchlist

If you already have a few favourite CFD forex assets that you’d like to keep an eye on, you may add them to the watchlist. To achieve that, just click on the star symbol below the asset name. The chosen asset will appear in the watchlist section of the asset catalogue.

So, Is IQ Option good for forex trading? Indeed, the CFD forex trading platform offers a great range of tools and features for analysing and tracking forex assets, allowing for easy access to important information and valuable insights. However, it’s up to traders to decide which features they may want to apply to achieve their goals.

CFD Forex trading on IQ Option also offers a chance to test different approaches. You may learn more about the most popular forex trading methods in this material: 3 Popular Forex Trading Approaches: Pros and Cons. Applying technical analysis tools, such as indicators, may also assist you in conducting asset analysis and spotting potential trading opportunities. If you haven’t used technical indicators in your forex trading, have a look at the Best Technical Indicators for Forex Trading to get started.

But having the right tools and strategies isn’t all you need to succeed as a forex trader. You may find that doing some research and gathering information about different forex markets could be useful. For example, the Asian financial market can differ from the American or European markets, which also have their own characteristics.

Asian financial market: key facts

The Asian financial market is a dynamic and influential force in the global forex landscape. With major financial hubs like Tokyo, Hong Kong, Singapore, and Shanghai, Asia boasts a significant portion of global trading volume. This concentration of activity often results in heightened volatility during Asian trading hours, presenting both opportunities and challenges for forex traders. Here are some important points to consider when trading forex on the Asian financial market.

- Main currencies: Japanese Yen, Chinese Yuan, and Australian Dollar play pivotal roles, influenced by factors like economic data releases, central bank policies, and geopolitical events specific to the region.

- Market sentiment: it can be heavily swayed by news and events originating from within the region, sometimes causing sharp and unexpected price movements. Understanding the interplay between economic, political, and cultural factors in Asia is crucial for traders seeking to capitalize on the opportunities this vibrant market presents.

- Liquidity: Asian markets offer significant liquidity, especially during their peak trading hours, providing traders with ample opportunities to enter and exit positions efficiently.

- Economic Data: Key economic indicators from major Asian economies, like GDP growth, inflation rates, and trade balances, can have a profound impact on currency values and market sentiment.

- Volatility: Political tensions and developments in the region can trigger market volatility, so staying informed about geopolitical events is crucial for traders.

Ready to start your forex trading career? Head over to the IQ Option platform to test your skills and knowledge!