Market movements are shaped by the buyers’ and sellers’ behavior, and often similar patterns can be found on the chart. Such patterns can form when the price reaches a certain level, leaving both sides to decide on who is in the driver’s seat.

Many traders rely on chart patterns for possible indications of trend continuation or reversal and, even though there are no methods that could predict the market behavior 100% of the time, patterns may be quite useful when used correctly.

What are candlestick patterns?

Patterns are formations of candles which are identified by connecting common price points such as highs and lows within a specific period of time. The connected dots form certain figures on the chart, based on which traders can make assumptions about the market’s next move. Patterns are different: some may appear more complicated to locate than others.

Candlestick patterns may be used for all kinds of timeframes, including intraday trading, weekly or even monthly charts. Depending on the pattern, it may contain anywhere from one to dozens of candlesticks.

Some examples of patterns are the three black crows, three white soldiers, head and shoulders and so on. And yes, patterns can consist of just one candle and still have an important meaning for the market: for instance, such patterns as the hammer or doji.

Trend reversal vs continuation patterns

There are two types of trading patterns: reversal and continuation candlestick patterns. Both are equally important for traders to recognize.

- Continuation patterns, as follows from their name, may signal that the existing trend is likely to continue after a brief pause. Such patterns can be found mid-trend, when the brief period of uncertainty is solved with the price continuing to follow its previous movement.

- Reversal patterns indicate that the existing trend is losing its momentum and that the price is soon expected to change its direction to the opposite. For instance, a paused uptrend may indicate that less and less traders are going bullish on the asset, and after a temporary stalemate bears take over, reversing the trend downwards.

Chart patterns peculiarities

There are several important things to remember when trading with candlestick patterns:

- A pattern is considered confirmed when the first candlestick after the pattern closes in the supposed direction: the same direction as the trend for a continuation pattern and the opposite direction for a reversal pattern.

- Normally, the longer it takes for the pattern to develop and the larger the movement inside it, the stronger the expected movement is, once it breaks out of the pattern.

- Trading patterns may provide signals for both entering and exiting of a deal.

- Chart patterns with a small number of candles involved might suit short-term traders, while investors focused on the long-term market may benefit from more complex formations.

Reversal chart patterns

When traders think of chart analysis, often the obvious choice are indicators. Then why even bother with chart patterns?

The reality is that chart patterns are another useful way of market assessment. Chart patterns may indicate the investors’ preferences at a certain point in time, and give the trader an idea of where the market might be heading. But in order to operate with chart patterns freely, one needs to familiarize themselves with different reversal patterns to be able to recognize them more easily.

With reversal patterns traders can spot trends that are losing volume and timely enter emerging trends. We will take a look at several patterns of trend reversal, starting from simpler formations and proceeding with the more advanced options.

Three Line Strike

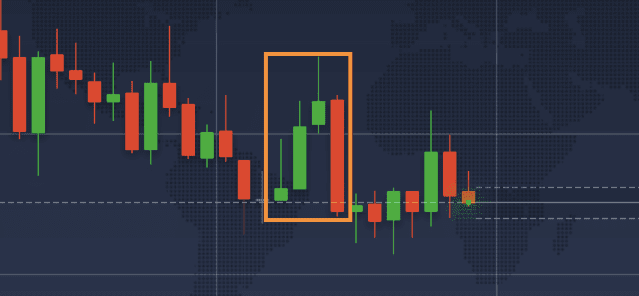

A candlestick formation that is focused around four candles may be implemented on short timeframes.

The bearish version of the Three Line Strike is presented in three bullish candles, each closing higher than the previous. The fourth candle opens at the same level or higher than the third, but reverses and closes lower than the first candle of the pattern.

The bullish version of this pattern consists of three bearish candles, each closing with a new low. The last candle opens at the same level or even lower than the third one, but reverses in an upward direction and closes even above the first candle of the sequence.

What to be looking for:

- For an uptrend: a sequence of three red candles, each closing lower than the previous one, followed by a fourth strong green candle, which closes above the first candle of the pattern.

- For a downtrend: three green candles, forming new highs, followed by a red candlestick. The red candle closes below the first candle of the sequence.

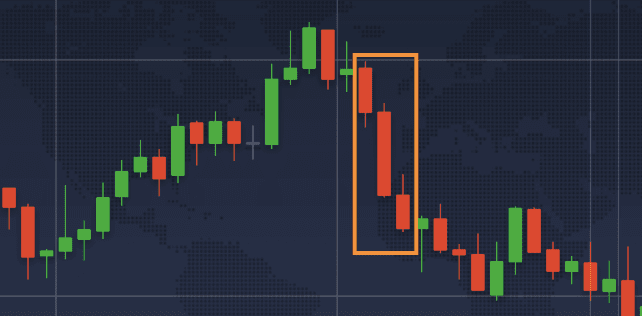

Three Black Crows

This bullish pattern is focused around three bearish candlesticks that appear after an uptrend on the market. The peculiarity is the candles’ position: each opens within the body of the previous one and closes near its low. The bars draw lower lows and the pattern may indicate a large-scale trend reversal.

What to be looking for:

- Three red candlesticks after a strong uptrend, each candlestick opening lower than the previous one

- If the first candlestick of the pattern starts higher than the previous candle, it may indicate on a stronger reversal

An opposite scenario, with three bullish candles following a bearish trend, is called Three White Soldiers. The principle stays similar, this pattern could signal a market reversal to the upside.

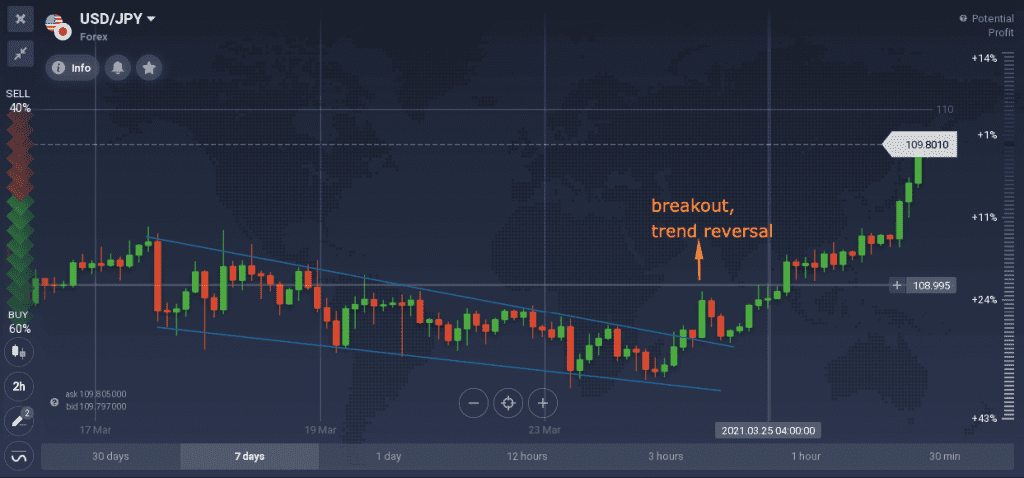

Falling wedge

With two descending trendlines pulling closer, the falling wedge pattern may be a signal for a bullish reversal.

What to be looking for:

- Two trendlines must connect the highs and the lows of the trend respectively

- The trend reversal is confirmed after the breakout above the upper trendline, with the chart moving in the upward direction

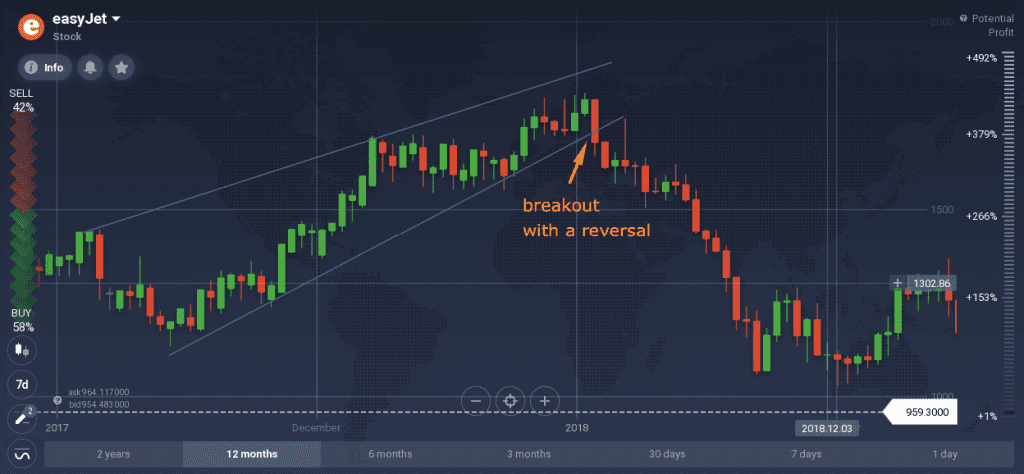

Rising wedge

A rising wedge consists of two rising trendlines, that are pulling closer together. A breakout to the downside confirms this pattern, and may signal a change of the bullish trend to a bearish one.

What to be looking for:

- Two trendlines must be placed at the highs and the lows of an uptrend

- A confirmation for the Rising wedge is received upon a downward breakout of the lower trendline

Conclusion

While it may not always be easy to distinguish trading patterns on the chart, they remain many traders’ go to analysis tools. Their versatility allows them to be used on charts of any instrument, be it Forex, Stocks, Crypto or any other trading asset. Reversal patterns in particular allow traders to find signs of emerging trends and decide on an entry or an exit on time.

It is important to note that patterns may give out false indications, just like all other analysis tools. Operating with chart patterns requires not only practice, but also composure and self-discipline.