Imagine a giant ocean with major tides, regular waves and small ripples. Short-term traders tend to focus on the ripples — small market movements that occur day to day or intraday. Less experienced traders might make a mistake of trading these ripples without considering the general direction of the tides and the waves. In this case, even the most detailed technical analysis may be useless. Using the Stochastic Oscillator for day trading may assist in trading the ripples when they are in line with the larger waves and even the tide, ensuring a solid foundation for decision-making.

Stochastic oscillator for day trading

Imagine a man walking a dog on a leash. The dog moves side to side at random based on whatever grabs its attention. But the general pattern of randomness follows the path the man is walking. The Stochastic Oscillator works similarly. It assumes that near-term market movement is random, but the pattern of randomness may follow a longer-term trend.

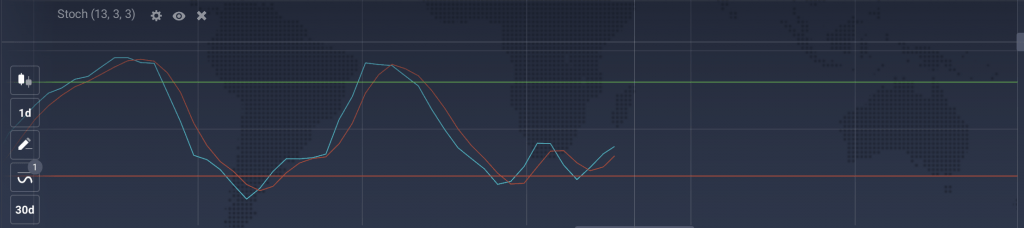

The Stochastic Oscillator may offer traders multiple indications. The most basic is the trend-following crossover. Crossovers might occur when the two stochastic lines, %K (the dog from the example above) and %D (the man), cross each other. Or, alternatively, when they cross the upper line (green) or the lower line (red), which may indicate overbought or oversold levels for an asset.

This trading approach involves multiple timeframes.

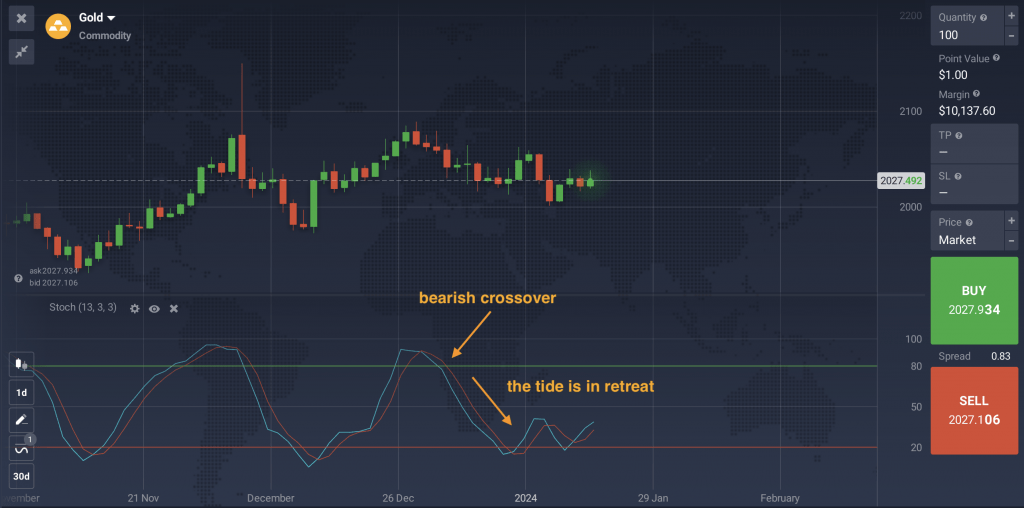

- The longest time frame (daily chart) is supposed to set the tide or the general trend of the market.

- The middle time frame (hourly chart) represents the waves.

- And the shortest will be the ripples – short-term price movements (anything from 1 minute to 10 minutes, depending on your preferences and goals).

Let’s have a look at them separately to understand how this method may be applied.

The daily chart

When using the Stochastic Oscillator for day trading, you might first look at the daily price chart. Normally, traders may look for a point when both stochastic lines are moving in the same direction as the crossover. This might often follow important market news or some other event that generates a strong movement.

☝️

The hourly chart

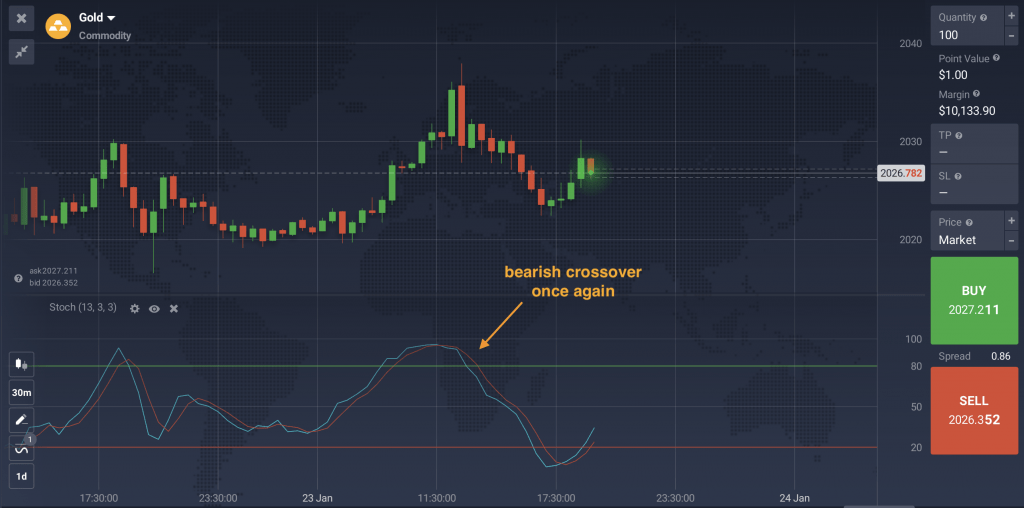

Once you’ve spotted the crossover and the general trend direction on the daily chart, it may be time to move on to the hourly chart. At this point, traders might look for a similar indication that they observed on the daily chart.

If that doesn’t occur, they may need to wait for the next crossover. It’s also important to double-check the daily chart to confirm any potential indications they observe. Keep in mind that no indicator can offer 100% accurate information about price movements. That’s why traders may apply appropriate risk-management tools to manage potential risks.

Let’s assume the daily and hourly price chart offer similar indications. This may show that the tide and the waves are moving in the same direction.

In this case, some traders may consider the crossovers in line with the analysis as potential entry points on the shortest time frame (from 1 minute to 10 minutes).

Keep in mind that short-term price movements normally don’t last long. So it’s important to carefully consider your timing and make informed decisions based on your analysis.

Stochastic oscillator settings for day trading

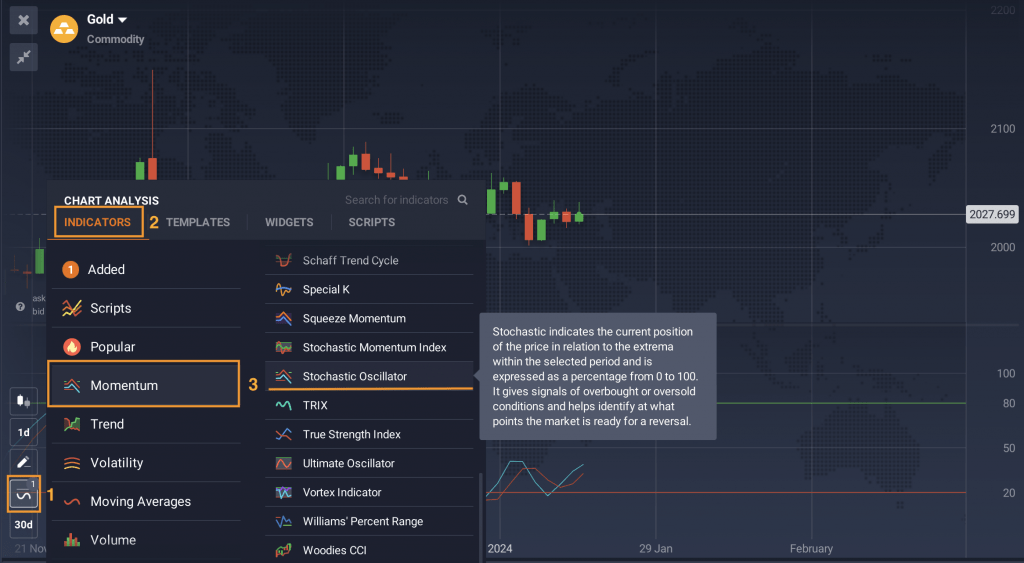

You may apply this tool in the ‘Indicators’ section of the IQ Option traderoom. When choosing the Stochastic Oscillator settings for day trading, most traders start by using the default settings. They may later adjust them according to their preferences and trading goals.

If you aren’t sure which Stochastic Oscillator settings may best suit your trading approach, have a look at this material: How to Adjust Indicator Settings? It may answer some of your questions about default indicator settings and potential ways to adjust them to achieve different goals.

In Summary

When choosing a suitable short-term approach, you may consider applying the Stochastic Oscillator for day trading. This method analyses the price chart on several timeframes. By observing the daily and the hourly price charts, traders may spot similar indications and look for potential entry points. You may also choose to adjust the Stochastic Oscillator settings depending on your goals.