What are the most important first steps that novice traders may consider in order to learn how to trade on IQ Option? If you have been wondering how to start trading, this article will give you an idea of what you may consider while using the platform. From registration to making the first deal, this guide may enhance your knowledge accordingly.

Here are the 4 main steps on the way to becoming a trader and an IQ Option platform expert.

1. Learn About the Available Trading Instruments

The very first step in getting acquainted with IQ Option, after you have registered an account, is to learn what the available trading instruments on the platform are. To find out, you may open the traderoom and check the asset menu. You will find such instruments as Binary Options, Digital Options, Stocks, Forex, Cryptocurrencies, ETFs, and Commodities. Let’s take a brief look at each of them to understand them better.

Binary Options

The main idea of binary options is to profit from making the correct prediction about the price direction. You can open a deal by clicking “Higher” if you think the price will continue rising, or click “Lower” if you think that it might fall. The profit is received if the prediction is correct at the moment of the expiration. To become a binary options pro, read the full guide on trading binary options.

Digital Options

While being similar to binary options, digital options have a twist: you can predict not just a direction, but a certain price which you expect the asset to reach. In the example below you can see that the further the strike price is from the spot price (current asset price), the higher the potential payout. However, the further you set the strike, the more risk you take on as well.

Forex

You can trade foreign currency pairs without expiration with Forex. Both major and exotic currencies are available, so you can take your pick among several dozens of assets. Forex trading, as well as stocks, ETFs, cryptocurrencies, and commodities, is CFD-based.

☝️

There are two types of deals — Long and Short. You open a Long position by clicking Buy. It means that you expect the asset price to go up over time. To open a Short position, you need to click Sell, which means that you expect the asset price to drop. Notice that it is, thus, possible to speculate on both positive and negative price movements.

If you haven’t traded CFDs before, check out this video tutorial to find answers to your questions. It covers the main characteristics of these assets and explains all you need to know about trading CFDs on IQ Option.

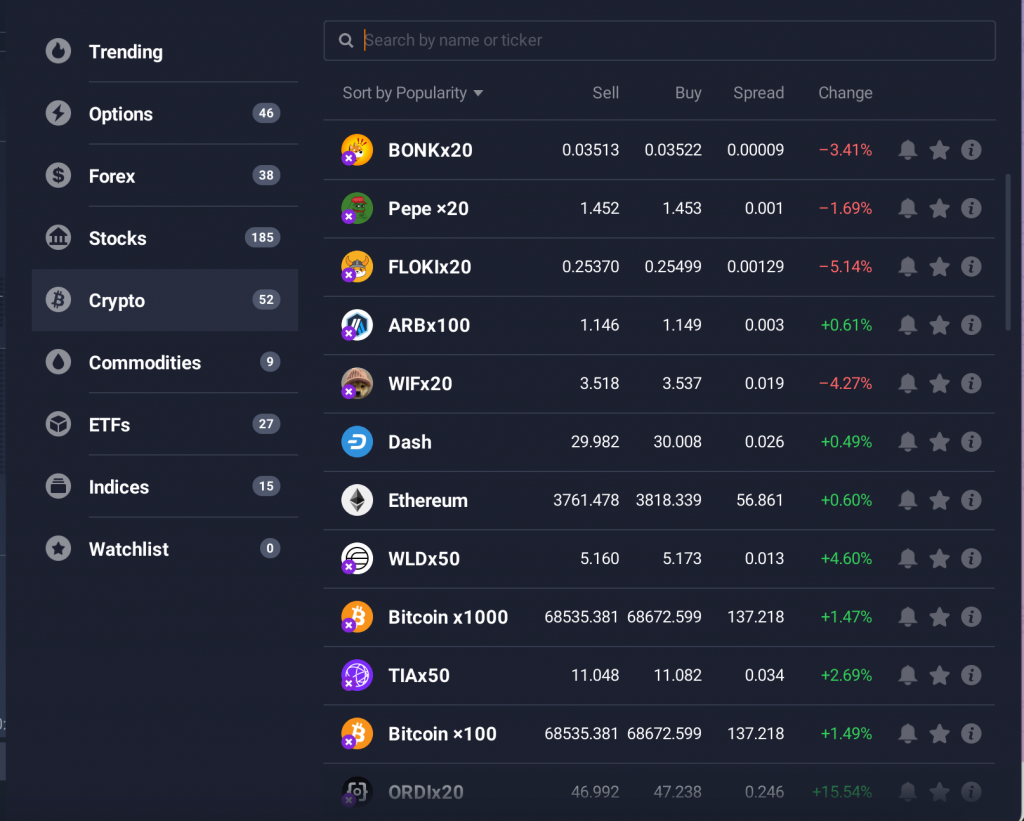

Cryptocurrencies

If you prefer cryptocurrency trading, you will be pleased by the vast choice of crypto assets on the platform. You can trade big cryptos like Bitcoin and Ethereum, or choose smaller coins like Pepe. Some cryptos are available with a preset multiplier, which increases the potential returns but also increases the risk. You can hold your trade for days, weeks, or months, but make sure to set the appropriate Take Profit and Stop Loss levels to close trades automatically when a certain condition is met. This will also let you control the desired risk-return ratio better.

The best part about CFD trading on crypto is that you don’t need a crypto wallet to start. You can trade cryptos right in the trade room.

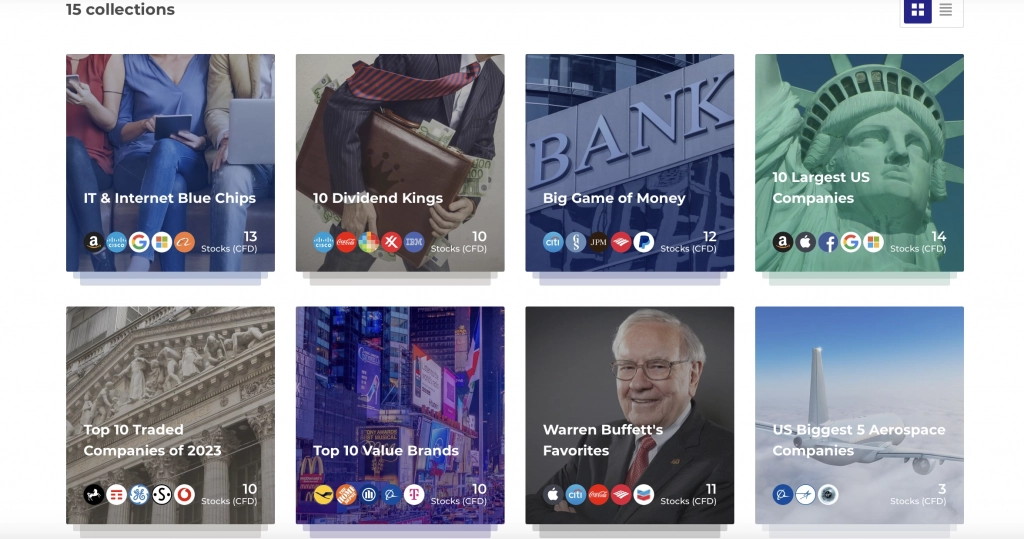

Stocks and ETFs

Buying shares of a company is a sure way to benefit from the company’s performance. On IQ Option, stocks are traded as CFDs, which means that you can benefit from the price change without having to own the actual shares. The platform presents shares of companies from different industries: technology, finance, food, beauty, AI, and many more.

Exchange-traded funds (ETFs) are an option for traders who seek diversification: they allow you to trade an entire basket of assets at once. Learn more about the difference between ETFs and regular stocks here.

Commodities

Last but not least, you can trade CFDs on commodities if you wish to trade gold, silver, crude oil, and other commodity assets. For example, precious metals like gold are considered to be hedging against inflation, since their price often moves inversely to the US dollar.

All of the available instruments on the platform have corresponding video tutorials which you can find in the section of the same name in the traderoom.

2. Apply Market Analysis and Technical Tools

One more thing to do before getting straight into trading, is to learn to analyze the assets to understand how their price might develop. There are two general ways to do so: fundamental and technical analysis.

Fundamental Analysis

Fundamental analysis concentrates on financial and world news. These include, for example, earnings reports, presidential elections, conferences, or even natural disasters and weather anomalies.

All kinds of events can influence the price of the asset, so it is important to check the relevant news before trading, in order to understand where the price might be heading. This type of analysis is largely used by long-term traders. However, it might be helpful to any trader that wishes to understand the overall tendency of the price.

You may stay on top of the economic news and events without leaving the IQ Option traderoom. Just open the ‘Market Analysis’ tab and check the section you are interested in: News, Economic Calendar or Company Earnings Calendar.

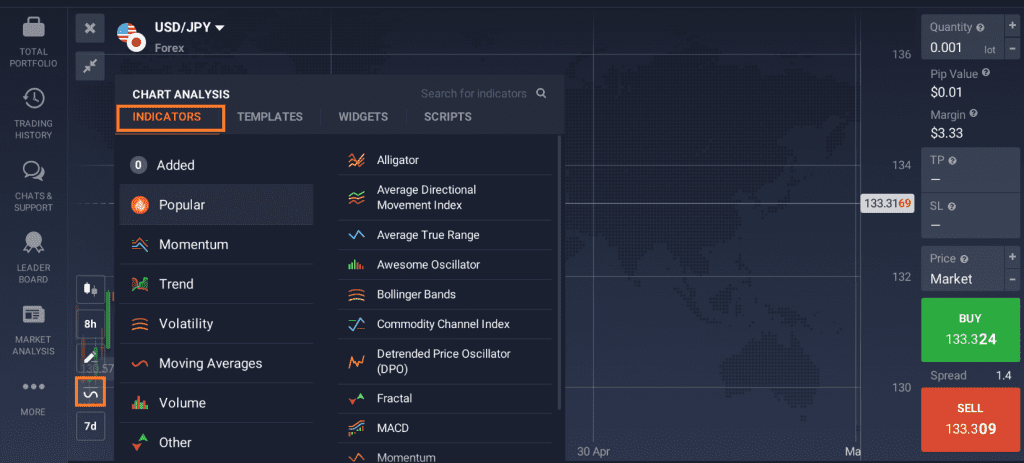

Technical Analysis

Technical analysis relies on past events and past price action to attempt to predict the future. However, keep in mind that past performance is not an accurate indicator of future performance.

☝️

There are over 100 technical indicators available in the IQ Option traderoom. These instruments can be used alone or in combination, depending on the trader’s goals. Some of the popular combinations are described in this article: Best Technical Indicators for Forex Trading.

It is important to remember that there is no analysis type that can provide 100% correct predictions. This is why many traders mix technical and fundamental analysis and use several sources of information in order to make informed decisions.

3. Use the Practice Account

When you register on IQ Option, you automatically get a practice balance. This money is free and can be used to test any asset, trading method or idea. Of course, the money is given only to practice with, so you cannot withdraw it.

The demo account is a great way to learn how to trade and get some experience. Since all the data and charts are identical to the real balance, traders can plan their trading routine ahead, without spending any funds on practicing and without any risks. This money can be replenished as many times as needed. You may always switch to this demo account to test new ideas and approaches before making a real deal.

The practice balance is a perfect opportunity to try out the technical and fundamental analysis and see what works best for you. Many of the approaches and strategies described on the IQ Option Blog can be tested there without any extra costs.

4. Make a Trade

While it’s important to spend some time practicing trading on the demo account, at some point you may want to start trading with real funds. To make your first trade, you need to make a deposit. There are many deposit methods available to traders depending on their location, so you may choose the one that suits you best.

Some novice traders may be tempted to delay trading on the real account because they are afraid of losing. Keep in mind that even the most experienced traders sometimes make bad trades. What makes them stand out is that they learn from their errors, keep testing new methods and moving forward.

Stay realistic about the financial outcome of your trading endeavor. Ask yourself: “If trading was that easy, why would people like Warren Buffett spend decades building their fortune”? Trading is a not get-rich-fast type of thing. Rather it is a slow but steady journey. Understand that the trading process is as important as the result you receive.

When you begin trading with real money, start small, find the strategy that fits you and develop a trading plan. Once your strategy is ready, stick to it and do not let your mind wander. Do not forget to abide by the risk management rules, as they can make or break most of your deals. It is risk management rules that will protect your funds and turn you into a goal-oriented trader.

Take a look at the article 5 Most Common Mistakes in Day Trading: it may help protect you from popular trading mistakes to avoid.

How many types of trading are there?

This is a common question among beginners just entering the world of trading. In fact, there are different types of trading strategies you can use, which include short-term and long-term approaches. Your choice depends on various factors, which include your schedule, personal preference and time commitment. If you are ready to follow the trades throughout the day and quickly react to market changes, you may try scalping. On the other hand, if you’re busy and can trade only at certain times during the day, swing trading may be your best option. Have a look at this article to find the optimal strategy for you: How to Choose a Strategy? Decide What’s Best for You.

Conclusion

There are 4 main steps to learning how to trade on IQ Option: understanding the trading instruments, applying fundamental and technical analysis, using the demo account, and making a trade. If you want to prepare yourself for trading, do not skip any of the steps explained above. Remember that there is no one trading method that works for everyone, so it’s important to spend time learning and testing different approaches to find those that will work for you.