The FOMC meeting is sure to bring volatility to forex markets. Here is what you need to know before it happens.

The FOMC is going to surprise the market

Granted, it’s not really a surprise if you know what’s going to happen before it does but not everyone has the same opinion I do. The FOMC is going to surprise the market when they release their policy statement later today.

Why? Economic data in the US has been edging higher, inflation pressures are becoming more visible and the market is increasing its expectation for aggressive action from the Fed. The data, the trends and the outlook support the idea of 2% inflation this year and reason enough for the FOMC to strike a hawkish tone in today’s statement. For most this means an increase in the expected pace of interest rate hikes but what could be more aggressive than a preemptive strike indicating not 2 but 3 more hikes this year, or even a surprise rate hike today?

The USD has strengthened against most pairs over the past two weeks as FOMC outlook firms. The EUR/USD has shed more than 40 pips in that time, breaking out of a solid trading range and setting a four month low. It hit minor support in the wee hours leading up to the meeting but that support does not appear to be very strong.

EU data released today is positive, PMI edged up a little more than expected and GDP was inline with expectation, but not enough to move the pair higher. The indicators are both bearish, pointing higher and convergent with the new low suggesting a hawkish tone from the Fed will send this pair lower.

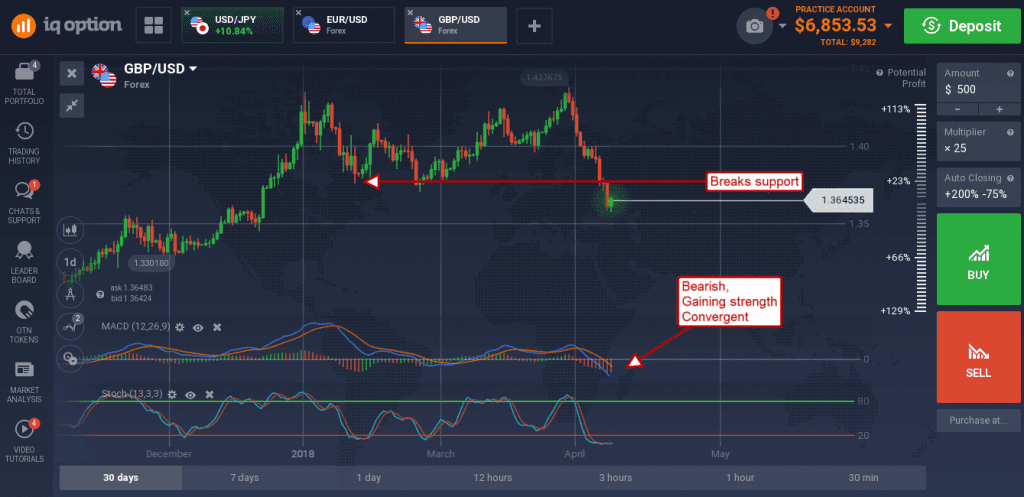

The GBP found some support in early Wednesday trading as well. The pair has been in downtrend as the dollar strengthened on FOMC outlook. Today’s data firmed the pound sparse as it was. UK construction PMI suggests expansion is accelerating in the UK which supports the idea of a BoE rate hike at their next meeting two weeks from now. The indicators are bearish however, pointing lower and convergent with the new low, suggesting underlying weakness in this market. Support is near 1.3600, a move below there following the FOMC statement would be bullish for the dollar and bearish for this pair. My target is near 1.3400.

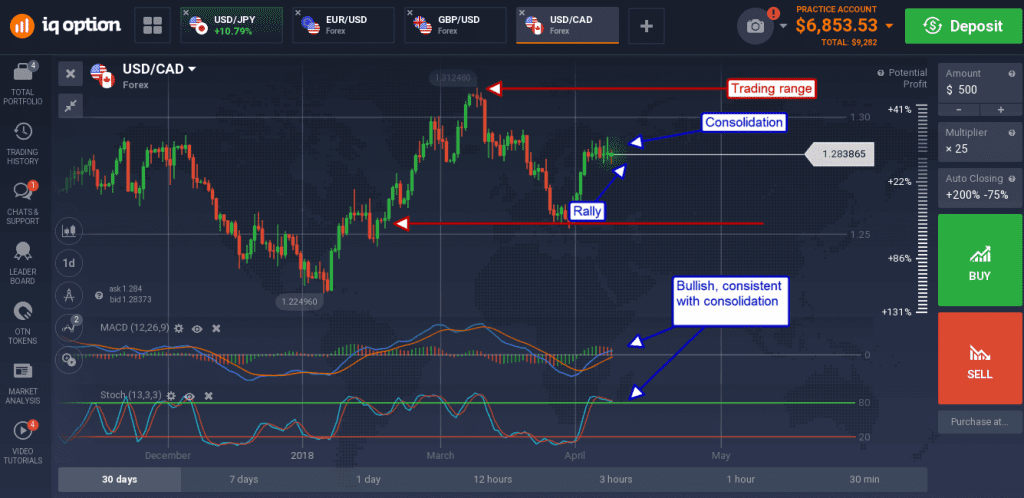

The USD/CAD has been treading water over the past week, near the mid-point of a long-term trading range, as traders wait on the FOMC. The pair appears to be forming a bullish flag continuation pattern that is supported by the indicators. MACD is bullish and ticking higher in evidence of rising momentum while stochastic moves sideways within the upper signal zone in a sign of market strength. A break above 1.2900 would be bullish with a target near 1.3100, a move below 1.2800 would be bearish with a target near 1.2550.