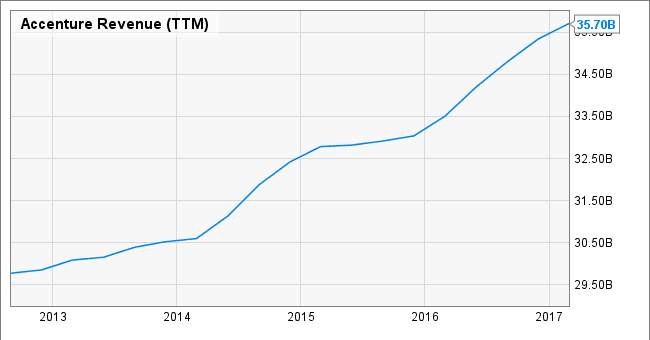

Accenture (NYSE:ACN) a global management consulting and professional services giant, will report its third-quarter fiscal 2017 results on June 22 before market open. The stock price will most definitely be affected by the data revealed in the report. The consensus EPS forecast for the quarter is $1.51. The reported EPS for the same quarter last year was $1.41.

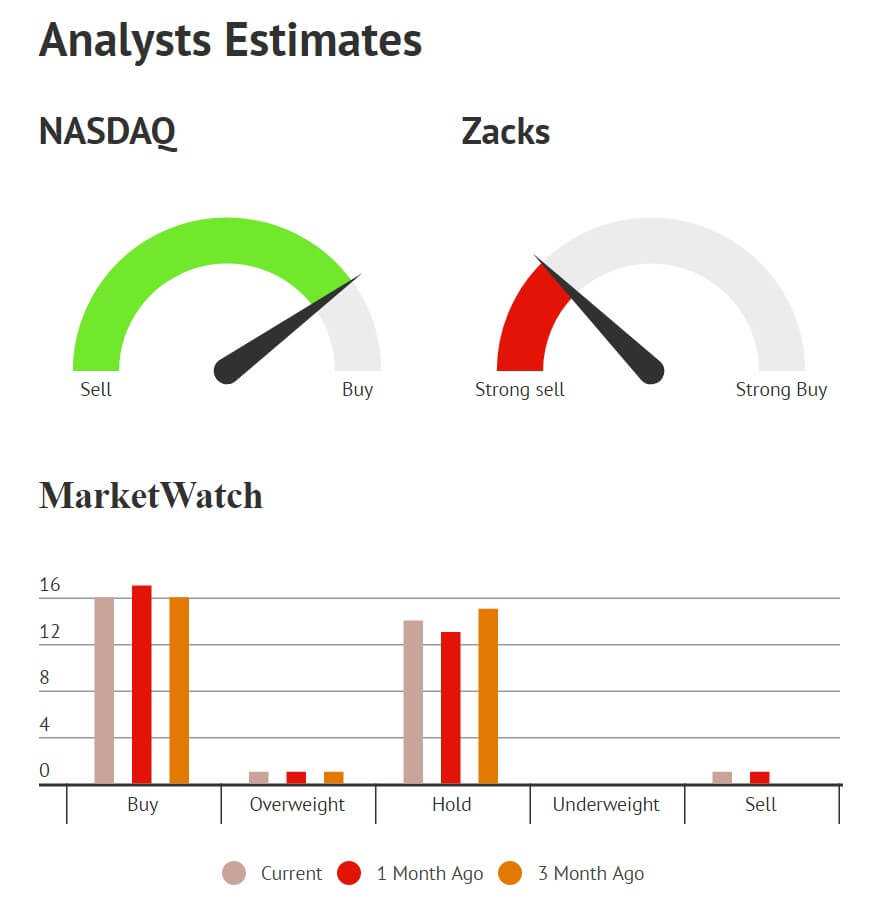

The valuation of ACN shares has been somewhat stable in the last three months. The stock price fluctuated in the range of $114 and $128. Ranked ‘Sell’ by Zacks, it is probably not the best long-term investment. The company can, however, produce a short-term return for investors who can predict the direction of the price action right after the earnings report is released.

Performance indicators

| 52 Week High-Low | $128.00 – $108.66 |

| Dividend / Div Yld | $2.42 / 1.90% |

| EV/EBITDA Annual | 11.95 |

| Consensus EPS forecast Q1 | $1.51 |

| Reported EPS Q2/16 | $1.41 |

| Forward PE | 21.76 |

Opportunities and Strength

Strategic acquisitions. Accenture has been utilizing the strategy of growth through acquisition for quite some time already and the latter has proved its worth. Twelve full-size acquisition deals have been signed or completed during fiscal 2016. Not only does this strategy provide solid growth opportunities for Accenture but also helps accumulate new knowledge and unique business practices, thus making the company even more diversified and responsive to ever-changing business conditions.

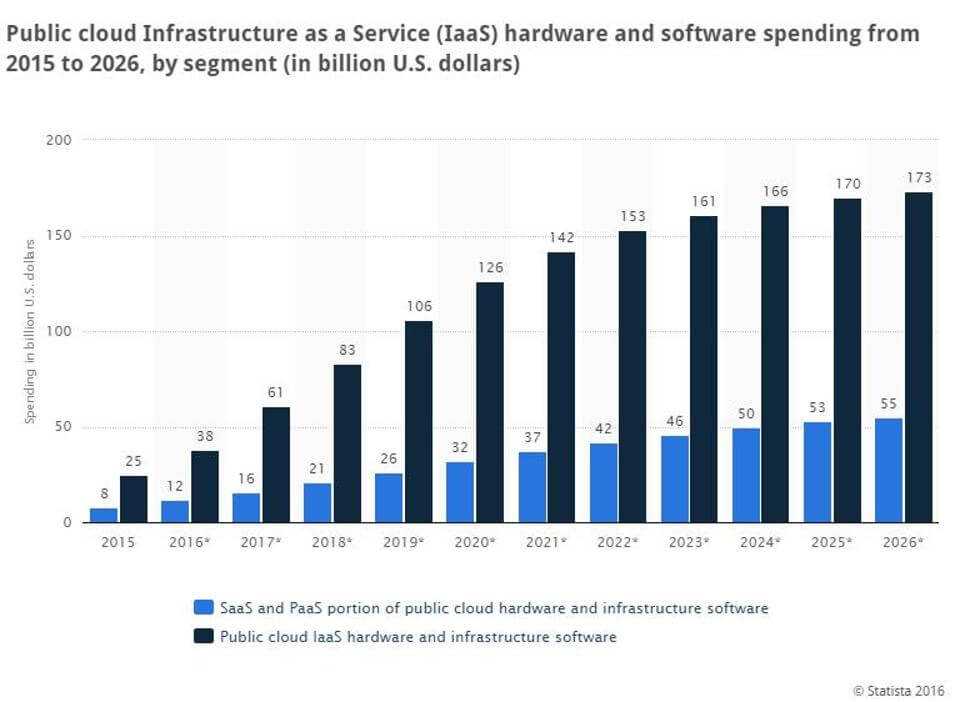

Cloud Capabilities. Cloud technologies are generally believed to be the future of computing. International Data Corporation, an expert in the field of technologies, predicts the cloud software market to grow at an annual rate of over 18%, reaching $112.8 billion by the end of 2019. Taking the dynamics into account, it can be said that cloud-related services offered by Accenture will become more and more popular over time. High growth rate is expected to add to the top line of the company.

Digital Marketing. Digital marketing capabilities of Accenture have been recently improved by the acquisition of dgroup, a Germany-based enterprise that specializes in management consulting services. Not only will ACN improve its own digital positioning but also provide customers with an extensive pool of marketing facilities.

Outsourcing Business. The outsourcing division of Accenture is on the rise. It is hard to tell though that the company’s management is responsible for its recent success. Macroeconomic conditions are in favor of outsourcing companies in general, and Accenture is just being smart enough to capitalize on them. Hi-tech outsourcing that Accenture is offering to its customers, helps companies make their operations smoother and most cost-efficient. Outsourcing revenues grew 6% in fiscal 2016, 7% in the first and 8% in the second quarters of fiscal 2017. Pfizer, Merck, GlaxoSmithKline and Eli Lilly are among the most notable clients.

Threats and Weaknesses

Stretched Valuation. With a trailing 12-month P/E ratio of 21.83 Accenture compares unfavorably both to market peers and its own past performance. Stretched valuation means the price of the asset is already high. For long-term value investors, a high Price/Earnings ratio is a red flag. For speculative short-term trading it, however, has little or no decision-making value.

Employment Issues. Accenture has announced that it would employ additional 15 000 people in the United States alone by 2020, which brings the question of related expenses up. According to calculations, up to $1.4 billion will be spent on training and education of newly arriving workers. Protectionist working visa policy, introduced by Donald Trump, is to blame. The company will not be able to rely on foreign specialists as much as it does now and, as a result, will incur additional losses.

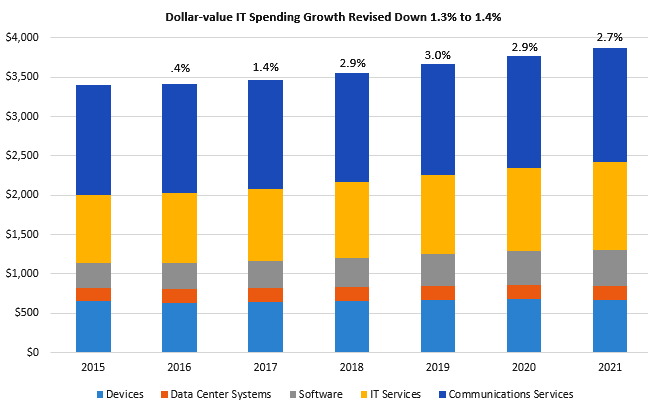

Decreasing IT Spending. Gartner predicts global IT spending to grow slower than previously expected. The IT spending growth rate has been lowered for the third time this year. Throughout 2017 the companies are expected to spend $3.46 trillion on this cause. Accenture, for which IT outsourcing is one of the key businesses, will be affected. Company’s short-term growth figures could be not as high as investors would want them to be.

Currency Fluctuations. Approximately 54% of Accenture’s revenue comes from abroad and in foreign currency. It means the company is vulnerable to negative currency impacts, which are more than possible when considering the appreciation of the USD. Should the dollar become too strong Accenture’s bottom line will be hurt.

Conclusion

Accenture is a diversified company with interests in different spheres and businesses. Certain areas of its expertise attract more attention than they previously did, while the others lag behind due to changing macroeconomic conditions. ACN stock can be expected to appreciate should the company report better than expected fiscal quarter results. Negative factors listed in this article can, however, suppress the growth if not addressed by the company’s top-management.