A Miami-based cruise and vacation giant will report its Q1 2017 profits on the 28 March 2017 before the opening bell. Expected to surpass investors’ forecasts and rated “Hold” by Zacks, Carnival shares can be a good option for patient long-term investors. It is highly possible that trading Carnival classic options can be profitable in the short-term, too. On Tuesday the company will reveal its key financial performance metrics, based on which the market will decide if the share price deserves to go up or down.

Let’s take a closer look at the company and decide whether it is worth to invest in.

Growth Factors

Financial performance

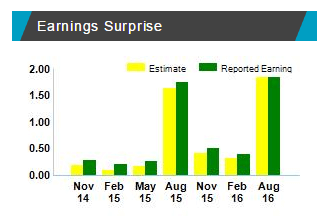

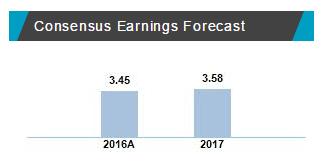

Carnival stocks have witnessed above the leisure and recreation industry’s average growth in the last one year (19.2% against 13.4%) and this trend is not expected to end soon. It is highly possible that Q1 2017 numbers will prove that the company still outperforms the industry. Carnival Corporation also has a history of positive earnings surprises for all the four quarters of 2016. This tendency can be expected to continue in the beginning of 2017.

Global leader

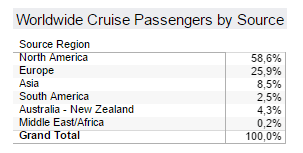

Thanks to the company’s global leading position, Carnival is able to reach a wider audience and do it in a more price-efficient way than its competitors. Asian and European directions become more popular over time and attract customers who never thought of going on a cruise before. Being number one is also beneficial in terms of pricing and fleet expansion capacity. The EPS is expected to show some growth, too.

Expanding the fleet

The company has recently introduced a number of new cruise ships and continues to work on the upcoming ones. More than that, the fleet is becoming more diversified and consumer-oriented. In this way, AIDAperla — one of the most environmentally friendly cruise ships — will be introduced to the German market, while clients from China will get a chance to board Majestic Princess tailored specifically their needs. Three new ships are expected to be launched in 2017. All in all, 22 new ships will be delivered before 2022. Continuous introduction of new high-class vessels is a part of the company’s long-term strategy.

Leap to Asia

The company actively seeks opportunities in the previously unexplored parts of the world, heavily relying on geographic diversification. According to its latest plans, Carnival will be focusing on Japanese and Australian markets. Growing middle-class population and rising demand for luxury recreation are among the possible reasons. China is a separate market with its own rules and a whole four brands meeting the needs of local clients. Asia is the fastest growing region in terms of new vessels: over the next four years, three new ships will be introduced there.

Cuba and the rest of the Caribbean are becoming a popular destination among tourists. In order to capitalize on this trend Carnival has scheduled more cruises to Cuba than any major US-based operator.

Cost cutting

The company has taken a number of steps to improve revenue yields, launching the yield management system, increasing advertisement-related expenditures and promoting its services to the wider audience. Carnival corporation is paying attention to environmentally friendly technologies that do not only contribute to the well-being of the planet but also cut expenditures. Fuel consumption has been cut by 28% since the beginning of this effort. In 2016 the company managed to cut expenses by $95 million thanks to cost-saving programs.

Possible Headwinds

Overvalued?

Cruise companies are capital-intensive and therefore their valuation is based on EV/EBITDA ratio (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization). With the current EV/EBITDA equal to 8.62, Carnival is exceeding not only the industry’s average of 7.9 but its own historical values, as well. In this situation, some investors may be unwilling to pay an additional premium for the already overvalued stocks.

International challenges

With the majority of company’s clients and revenues coming from Europe and Asia, negative currency translation can become a major problem for Carnival’s financial well-being.

Macroeconomic threats pose serious risks to many international companies, but cruise providers look especially vulnerable. Political struggles in Europe and other parts of the world, as well as Zika virus, can hit the industry hard and without warning.

Conclusion

Overall the outlook is moderate to positive for Carnival shares as the company continues to grow steadily. Its financial performance leaves the industry behind. However, geopolitical and macroeconomic factors can suppress the growth, so Carnival share prices may go up once the earnings report is published.