J.B. Hunt Transport Services, Inc. (JBHT: NASDAQ) is a transportation and trucking company based in Lowell, Arkansas. It currently operates 16 000 trucks with a help of 19 000 employees. JB Hunt is a part of composite DJTA and S&P 500 stock market indices. The company is expected to release its earnings report on 17 April 2017. The latter can and most probably will influence the stock price.

Performance Indicators*

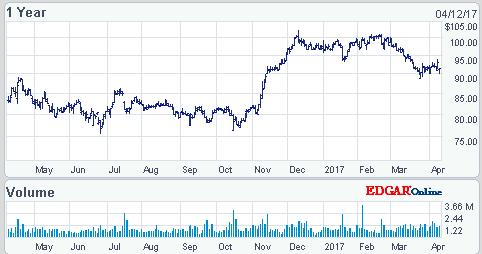

| 52 Week High-Low | $102.38 – $75.71 |

| Dividend / Div Yld | $0.92 / 0.99% |

| EV/EBITDA Annual | 10.49 |

| Consensus EPS forecast Q1 | $0.88 |

| Reported EPS Q1/16 | $0.88 |

| Forward PE | 22.24 |

Reasons for JBHT stock prices to go up

There are several reasons for the company’s stock prices to go up, among which are:

Higher than average stock performance. In the last two years, JBHT shares outperformed the Transportation — Truck industry. While the industry lost nearly 7% of its value, JB Hunt company’s stock rose by 5.8%*.

Growing revenues. The company managed to surprise its investors with higher than expected revenues in the last quarter of 2016*. Total operating revenues grew 6% and hit $1.72 billion level. Operating revenues grew 6%, as well, if calculated without fuel surcharges. Intermodal transportation, responsible for 57% of JB Hunt’s sales in the last quarter of 2016, is very likely to remain the engine of company’s further growth*.

Dividends and repurchases. The company shows loyalty to existing shareholders by rewarding them with dividends and organizing regular share repurchases. Thus, in January 2016 the company increased its quarterly dividend by 5%, making it equal to $0.22 per share. During the Q4 JB Hunt spent over $75 million to repurchase 880 000 of its shares.

Reasons for JHBT stock prices to go down

According to the experts, however, there are more reasons for the stock prices to go down.

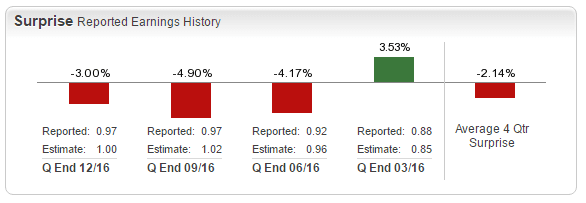

History of negative earnings surprises. The company has a history of reporting lower than expected earnings. For the last three quarters of 2016 earnings surprise remained negative, ranging from -3% to –4.9%*. Should the company report lower than expected earnings once again, it can become a serious concern for investors and the stock price will apparently go down.

Insider activity. Corporate insiders get rid of the stock at too fast a rate. Such kind of activity raises suspicions and can motivate other investors to drop the stocks. Whether it is the fault of the industry or JB Hunt itself, directors and average employees do not want to possess JBHT shares anymore.

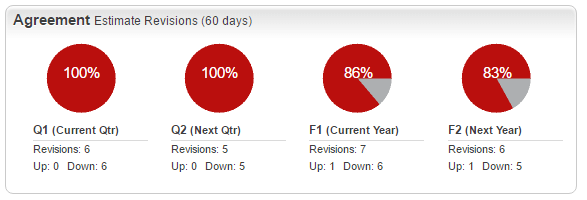

Estimate revisions. Most investors revised their estimates, and the revision is not positive. Six out of six agreement estimate revisions for the current quarter in the last 60 days turned out to be negative, which is a bad sign for the company, at least for its short-term stock prices.

EV to EBITDA ratio, often used to value trucking companies, shows that JBHT’s stock is overvalued. While the industry demonstrated this multiple to be 7.2, for the company it goes as high as 10.94 over the period of the last 12 months8.

Volatility in oil prices should be a major concern for the company in the upcoming quarter. As for any transportation/trucking company, the cost of fuel constitutes a substantial part of company’s overall expenses.

Declining demand and low fuel surcharges can be another problem for JB Hunt. The bottom line of the company declined 4% on a YoY basis*.

Conclusion

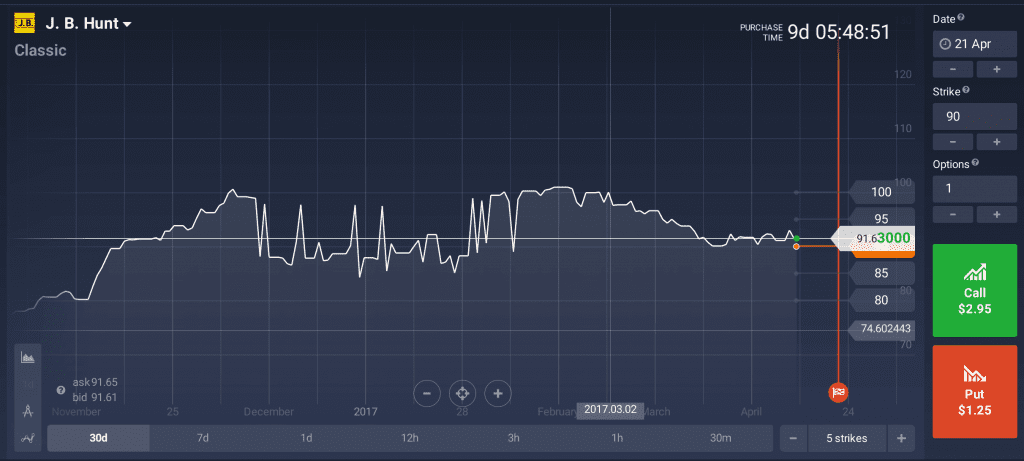

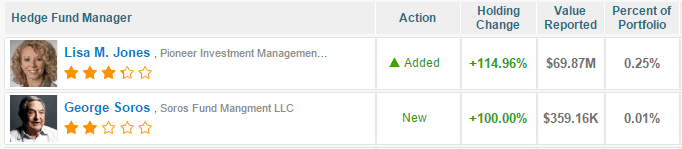

Though major hedge funds and notorious investors, including George Soros himself, have recently increased their holdings in JB Hunt, it doesn’t necessarily mean that in the short-term, and especially after the release of the earnings report, stock prices are expected to go up. Quite the opposite is actually possible.

The overall forecast is negative to moderate. It can be expected that JBHT shares will lose a portion of their value once general public receives the information on the company’s recent performance**.

* – Past Performance is not a reliable indicator of future performance.

** – Forecasts are not reliable indicator of future performance.