An innovative agrochemical and biotechnology giant from Missouri will disclose its fiscal 2Q17 earnings on April 5 before market open. Ranked “Buy” by Zacks, Monsanto’s (MON) Stock shares are praised highly by bullish investors. Monsanto is set to merge with Bayer AG by the end of 2017.

- What should one expect from company’s financial performance in the near future?

- How to capitalize on the US-based seed maker powerhouse?

We will try to answer these two questions in today’s analysis of Monsanto Company.

Industry expectations

The agribusiness environment for 2017 is yet to be defined. Companies in the industry have been affected by bumper crops, harvested over the past few years. Increased inventories of key crops and decreased prices are among the most obvious consequences. The overall picture for the current year looks promising, though. The majority of companies in the industry have a chance to reverse the negative trend, prevailing for the last two years, and Monsanto is one of them.

Merger with Bayer AG

Companies in the agribusiness and related fields often turn to mergers and acquisitions as a source of strategic cost synergies. According to market analysts, Monsanto’s performance is likely to boost when the deal is closed. Both companies can benefit from the $66 all-cash deal. Bayer AG is ready to offer as much as $128 per share. That’s far above the current market price of $114 (as of March 30).

EU authorities can meet the deal with a requirement to divest and sell assets. The formal process of deal approval is set for the second quarter of 2017.

Financial well-being

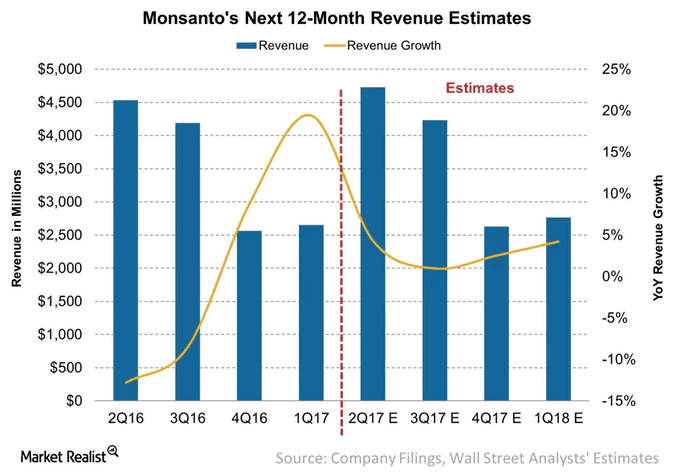

The lion’s share of Monsanto’s sales occur in the second and third quarters of the year due to the nature of the agribusiness itself.

The company has a history of reporting negative revenue growth. In happened in 2015 and 2016 when Monsanto lost 5.4% and 10% of its revenue respectively. However, current macroeconomic agribusiness situation looks positive to both Monsanto and its competitors. Global population growth will stimulate demand for agricultural products, which in turn will bolster sales of supplement products.

In 2017 the company is expected to experience 4.3% revenue growth, which is higher than that of Syngenta and FMS. Gross margin is estimated to grow from 52.5% to 52.8%. The growth of company’s incomes is expected to outpace the growth of sales, that can be an indicator of successful cost-cutting/cost-efficiency programs.

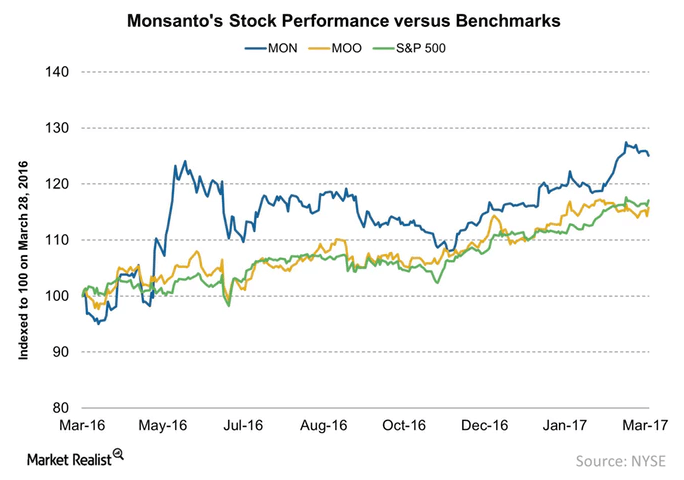

Compared to the S&P 500 index, Monsanto’s stock has almost double the performance, returning 8.7% YTD. Bayer is offering $128 for one Monsanto’s share, which means that as at 30 March MON stocks are trading at an 11% discount. Analysts’ consensus price target for the company is $122.7 for share. Upward price movement can be expected from a stock with such characteristics.

Risk assessment

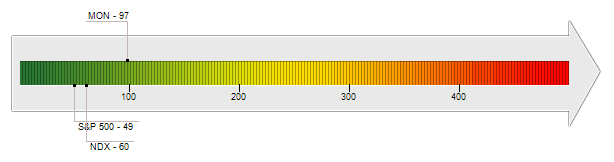

The company is not considered to be a risky asset by RiskGrades. On the contrary, experts believe that Monsanto’s stock is a safe haven for risk-averse investors and is only two times riskier than S&P 500 (note that risk-assessment refers to underlying asset and not the derivatives).

Estimates

In the upcoming second fiscal quarter the company is expected to generate $4.7 billion in revenues ($0.2 billion or 4.3% rise YOY). The most accurate estimates promise Monsanto’s sales to reach $14.1 in fiscal 2017, a 4.5% increase compared to the previous year. Its EBITDA is forecast to grow as high as 6.9%. Zacks consensus EPS forecast is $2.76. The reported EPS for the same quarter last year was $2.42. Almost all key financial metrics are expected to grow in fiscal 2017, which is a great sign of long-awaited recovery.

All of the above can be an indicator of possible price spikes at the moment of earnings report release.

Conclusion

Promising financial performance and great growth opportunities make long-term investors believe Monsanto is the company worth investing in 2017.

Unless a major disruption happens, Monsanto’s stock can be expected to appreciate in the coming days.