In the dynamic world of trading, navigating the markets often requires a strategic approach. With that in mind, many traders consider the risk-reward ratio an essential component of their trading approach. This concept is used by traders to manage losses and positive outcomes by making informed decisions based on statistical data. In this article, we will cover the main points of the risk-reward ratio in trading. We will explore the concept and look into how it may be calculated. Additionally, we will consider potential ways to determine suitable ratios for different trading styles.

What is the risk-reward ratio in trading?

The risk-reward ratio in trading is a fundamental principle for calculating the potential positive outcome relative to the risk of a trade. In fact, it is a concept that might assist in maintaining a balanced and calculated approach to trading. By evaluating the potential profit against the potential loss before entering a trade, traders may enhance their risk-management approach.

Traders may employ the risk-reward ratio in trading to strike a balance between risk and payouts. The main goal is to try to avoid disproportionate exposure to losses. This ratio may aid traders in making decisions that align with their risk tolerance and overall trading objectives. Keep in mind that this method does not guarantee positive results. It is simply a tool that may be useful in improving a trader’s ability to navigate the volatile markets.

How is the risk-reward ratio calculated?

Understanding how to calculate the risk-reward ratio is crucial for implementing effective risk-management approaches. The calculation involves dividing the potential profit of a trade by the potential loss. Here is the basic formula:

- Risk-Reward Ratio = Potential Profit / Potential Loss

For example, a trader is considering buying several shares of some stock. With the take-profit of $200 and a stop-loss set at $100, the risk-reward ratio would be calculated as follows:

- Risk-Reward Ratio = $200 / $100 = 2:1

In this scenario, for every $1 at risk, there may be a potential reward of $2. This approach enables traders to assess whether such a trade aligns with their risk tolerance and trading goals. However, it’s crucial to keep in mind that the risk-reward ratio in trading may only help assess risks. It doesn’t affect the probability of achieving the desired results. So traders should consider this method as an addition to their risk-management approach.

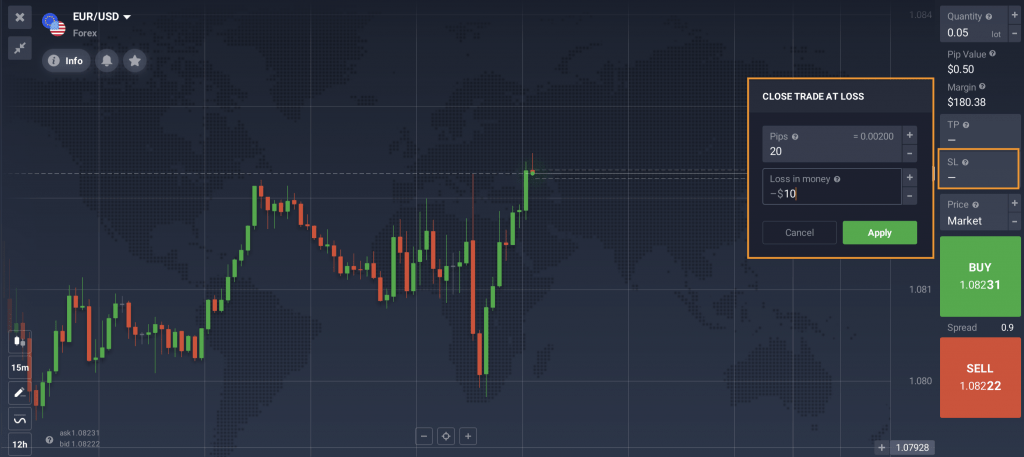

When it comes to trading CFD assets, the general principle of the risk-reward ratio in trading remains the same. For instance, a trader is looking into a possible trade on the forex pair EUR/USD via CFD.

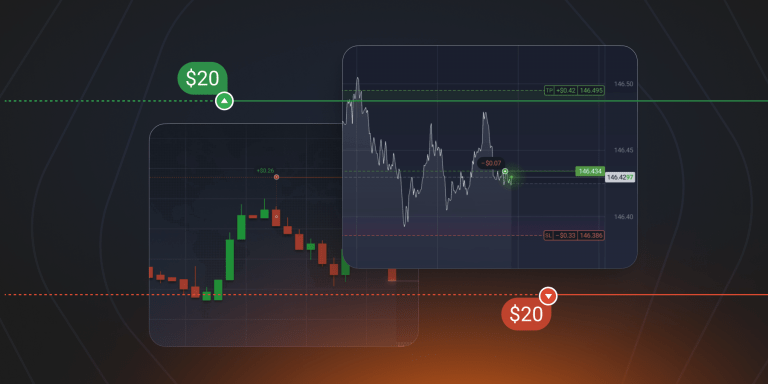

Let’s suppose this trader is willing to risk $10 on a trade that may bring $20, placing the risk-reward ratio at 2:1. With that in mind, he or she might consider setting the stop-loss and take-profit values to fit this goal. By placing the stop-loss at $10 and the take-profit at $20, a trader may maintain the chosen risk-reward ratio of 2:1. This way, in case of a losing trade, the lost amount would be limited by $10.

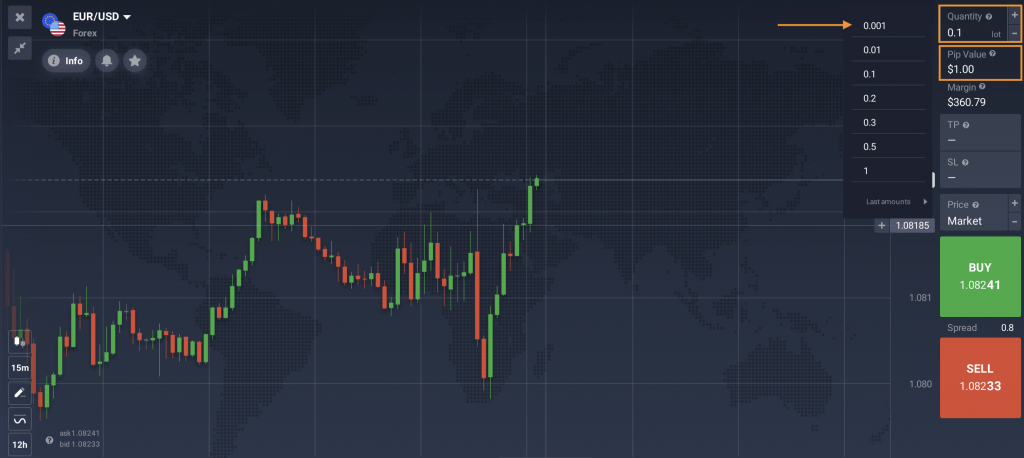

Traders may also adjust the quantity of a CFD asset and the pip value to pick suitable trade settings for their goals.

What is the best risk-reward ratio in trading?

Determining the best risk-reward ratio in trading is not as straightforward as it may seem. As individual trading styles and objectives may vary, there is no universal solution. So, traders should base their decisions on their goals and preferences. However, there are some common risk-reward ratios.

A 2:1 risk-reward ratio is often considered a balanced starting point, providing a reasonable potential payout relative to the risk involved. More aggressive traders might opt for a 3:1 ratio, seeking higher potential payouts, but with an understanding of the increased risk. Conversely, a conservative approach might involve a 1:1 ratio, where the potential profit equals the potential loss, emphasizing capital preservation.

Ultimately, the best risk-reward ratio in trading is a personal choice that aligns with a trader’s risk appetite, market conditions, and overall trading approach. It is important to carefully evaluate each trade’s risk-reward dynamics to make informed decisions in the ever-changing landscape of the financial markets.

In Conclusion

Mastering the risk-reward ratio in trading may be a crucial aspect of risk-management approaches. This method allows traders to approach the markets with a calculated mindset, balancing potential gains against potential losses. While there is no one-size-fits-all solution, understanding how to calculate and apply the risk-reward ratio might assist traders in making informed decisions that align with their individual goals.

The Company offers CFDs.