The Vortex Indicator is an oscillator that is used to determine the beginning of a new trend and to confirm an ongoing trend, its direction and strength. The indicator consists of two lines that capture positive and negative trend movements: the uptrend line (VI+) and the downtrend line (VI-).

The essence of the vortex pattern lays in connecting the highest and lowest points of the market’s price bars or candles. The principle behind the indicator is quite simple — the greater the distance between the low of the current bar and the high of the bar that comes next, the greater the upward movement. Similarly, the greater the distance between a bar’s high and the following bar’s low, the greater the downward movement is.

The indicator can be applied to all assets, on all time frames by both experienced and novice traders.

The origins

The Vortex indicator was developed by Etienne Botes and Douglas Siepman, who were inspired by the work of an Austrian inventor, Viktor Schauberger. He, in turn, based his ideas and discoveries on the phenomena that he observed in nature. He examined the flow of water, and, following the idea, the creators of the indicator suggested that the movements within financial markets may resemble the vortex motions in the flow of water. Additionally, the concept of directional movement was taken into consideration, adding true range into the calculation of the indicator.

How to set up

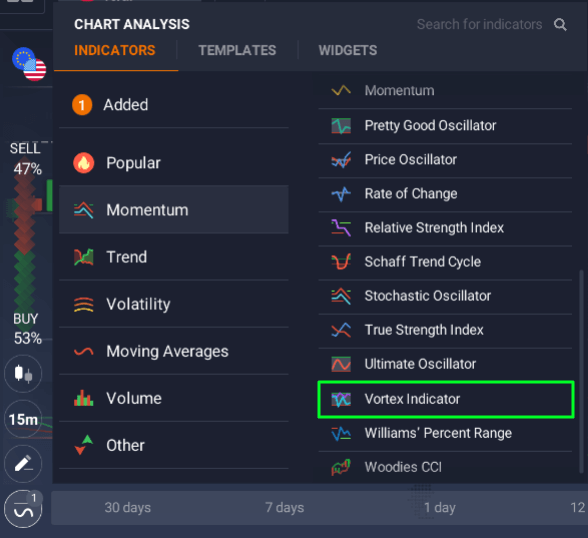

This indicator falls into the category of “Momentum” indicators and can be found in the respective tab of the indicators menu.

The default setup suggests the period of 14 for the main lines and sets the overbought line at 1.1 and the oversold line at 0.9. You can keep the default settings or change them according to your needs and trading style.

How to trade

Once you have applied and set up Vortex, it is time to learn how to read its signals. Here is how to do it.

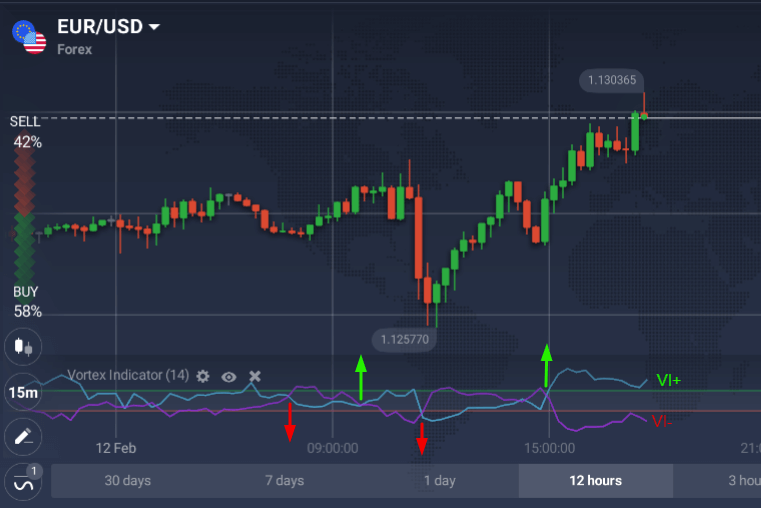

By default, the uptrend line is blue and the downtrend line is purple. As a rule, the line that is on top points to the prevalent trend (an uptrend or a downtrend). It is important to pay attention to the crossing points of the two lines, as well as their position in relation to the overbought and oversold levels.

<Buy> signal is received when VI+ line is below the VI- line, crosses above it and stays on top. <Sell> signal is received when VI- line is below the VI+ line, crosses above VI+ and stays on top. It is worth noting that not all signals you receive should immediately translate into an open position. Rather, it is a signal for you to pay close attention to the market, analyse the performance of the asset at hand and consider opening a deal in the corresponding direction.

On the picture above you can see the Vortex indicator being applied to the EUR\USD chart. In this particular case, the crossovers clearly marks the shift in the trend direction. The distance between the lines reflects the trend strength.

Complementing Vortex with other indicators can help avoid false entry signals. MACD or ADX will work just fine. When developing a trading system of your own, avoid combining two indicators of the same type as their signals can stem from the same source, decreasing their predictive power. Trend-following indicators can be a good match for Vortex. It can also be helpful to use stop-loss and take-profit levels when trading with Vortex to better manage the risks since no trading strategy, no matter how good, can provide accurate signals 100% of the time.