Surprise strength in US data capped gains for most major world currencies in early Wednesday trading. The news, housing starts/permits and industrial production, both show acceleration within the US economy that will drive growth over the next 6 to 12 months.

On the housing side permits for new single-family homes jumped 2.5% versus the expected 0.7% and is now up 7.5% YoY. This news bodes well as housing has been a lagging segment of the economy. On the industrial front production grew a surprising 0.5% in March while trade war fears dominated the headlines. The YoY figure was as expected at +4.3% but the MoM figures suggest growth is accelerating into the busy summer months.

The news is a surprise because most data, US and elsewhere, has been tepid over the past 2-3 months. The strength shown in the US data suggests the winter slump has come to an end. The takeaway for forex traders is the news has put a bid back into the dollar as it supports the idea of inflation and interest rates rising at a faster than expected pace.

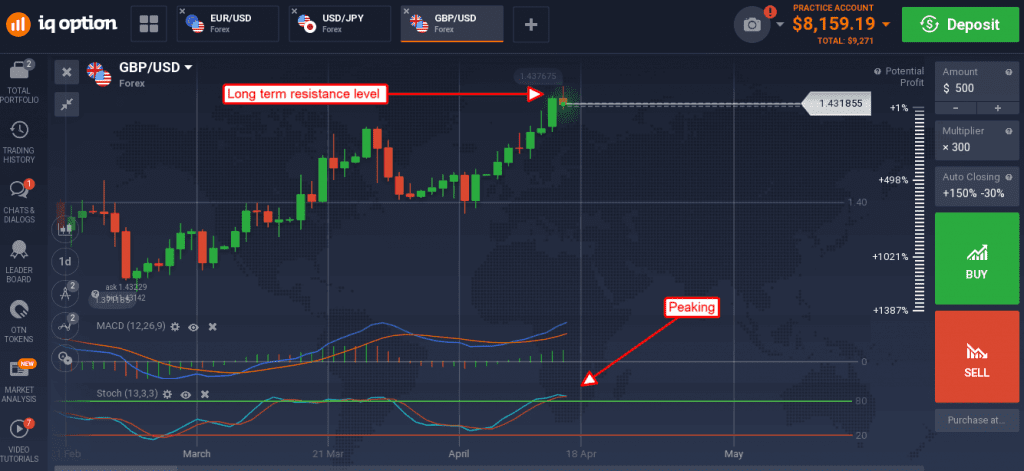

The GBP/USD surges in the early morning hours on strong data in the UK. Hourly earnings grew at a rate of 2.8% on the headline and ex-bonus, as expected and in support of the BoE’s plans to hike rates in May. The better news was a surprisingly large decline in unemployment claims and overall unemployment, down a tenth to 4.2%, that shows a marked improvement in UK labor markets. Gains in the GBP/USD were capped with the release of US news, forming a small red candle with visible upper shadow, confirming resistance at the long-term high near 1.4350. CPI data from the UK, due out Wednesday morning, may send the pair back above resistance, the caveat is the FOMC Beige Book due out later the same day.

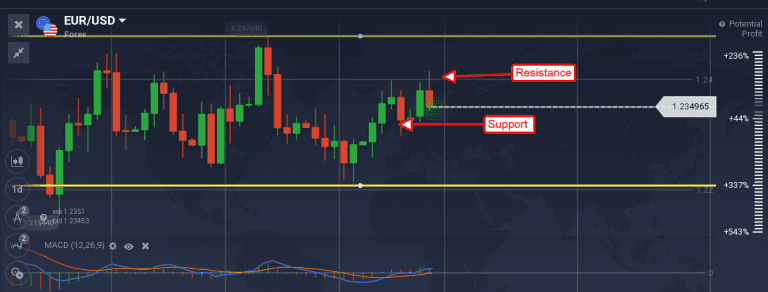

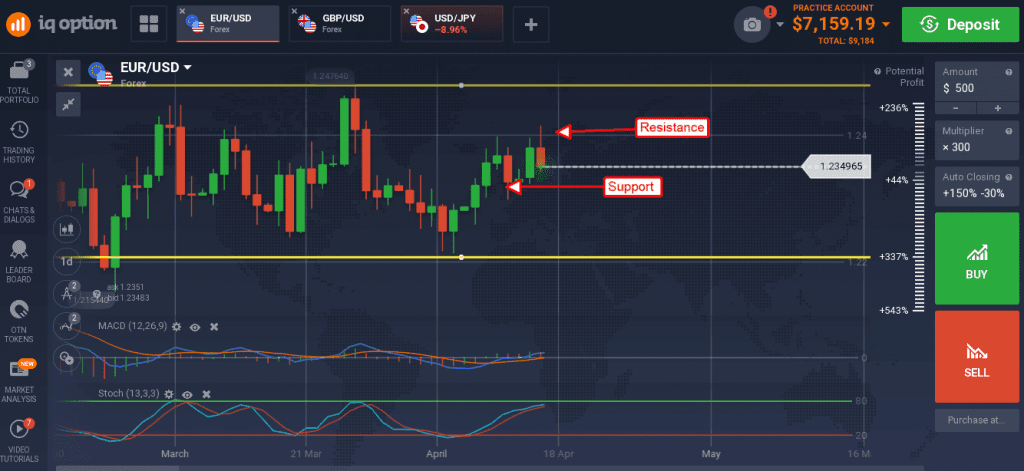

The euro fared no better. Weaker than expected, much weaker than expected, sentiment in the EU sapped strength in the single currency allowing the dollar to advance. The EUR/USD fell hard on the news, shedding more than 0.20% from Monday’s close, to retreat to its neutral point near the mid-point of a short-term trading range. The indicators are bullish but don’t be fooled, this pair is firmly range bound with little to no sign of emerging. CPI and PPI data from the EU, along with a host of US data, will drive volatility within the range all week. Support is near 1.2300 currently, resistance just above 1.2400.

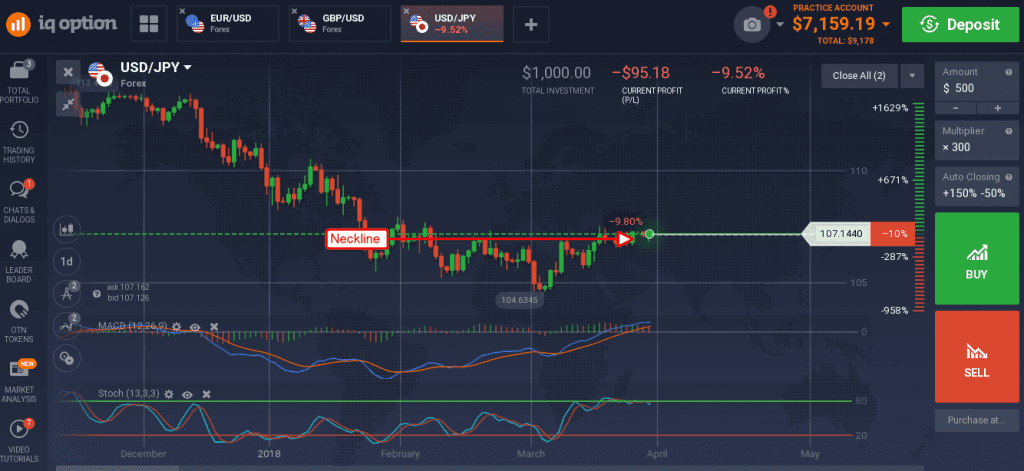

The USD/JPY continues to exhibit signs of reversal. The pair is sitting above the short-term moving average following a crossover and confirming support at the neckline of a head & shoulders pattern.

This move is supported by the data which yesterday shows surprise slowing in Japanese industrial production at the same time US production expandedre faster than expected. The pair is likely to move up over the next few weeks with targets at 108 and 111.