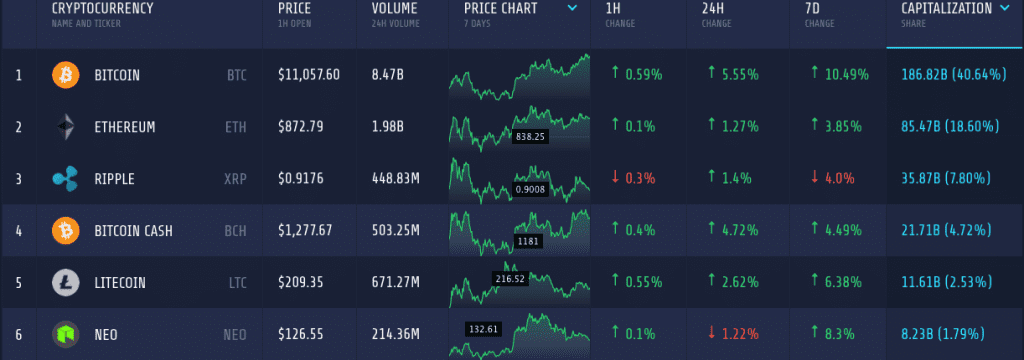

After a brief takeover of the bear on the market, most of the coins are back on track as they are rebounding by adding heavily to their values. In 24 hours, the market for cryptocurrencies have added $20 million – total market cap has now reached to $462 billion.

Tron

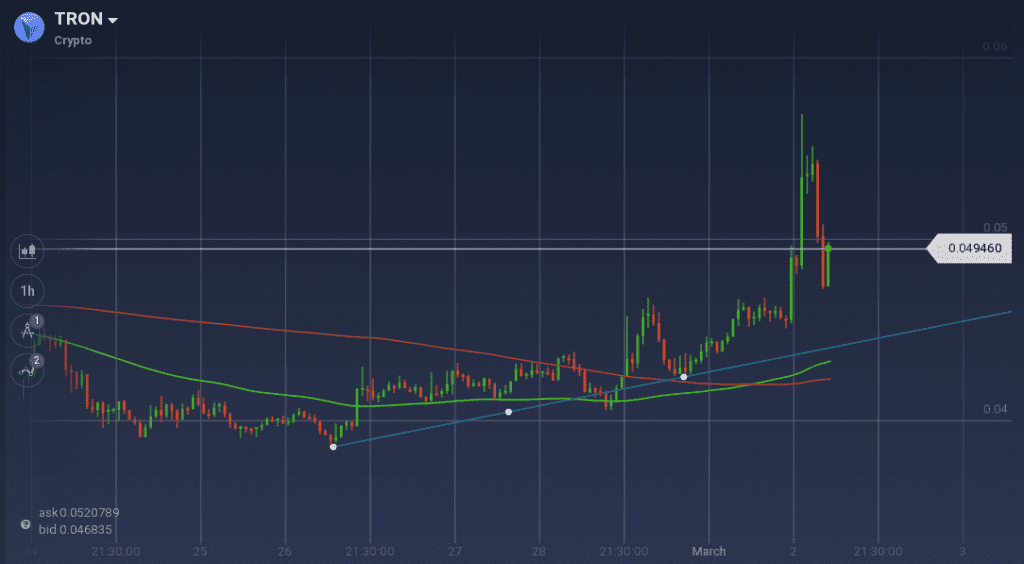

Tron becomes one of the market movers in the recent charts. The China-based firms issued token has added 11.2 percent on the daily chart and over 18 percent on the weekly. By trading volume, it is the fifth most traded coin in the last 24 hours with $508 million in volume. The coin holds $3.1 billion in market cap.

On the weekly chart, a strong support level held TRX as it went down from $0.044 to $0.039. However, a resistance also formed at $0.041. With some buying demand in the midweek, the coin climbed to $0.042, where it faced a strong resistance level. But support was also present around $0.041. Eventually, the coin jumped to $0.046, but the resistance there resulted in a quick pullback. After dropping to $0.042, TRX/USD rebounded and with a sudden spike, the pair touched $0.056. The coin also maintained a gradual bullish trend throughout the week and is now trading around $0.049.

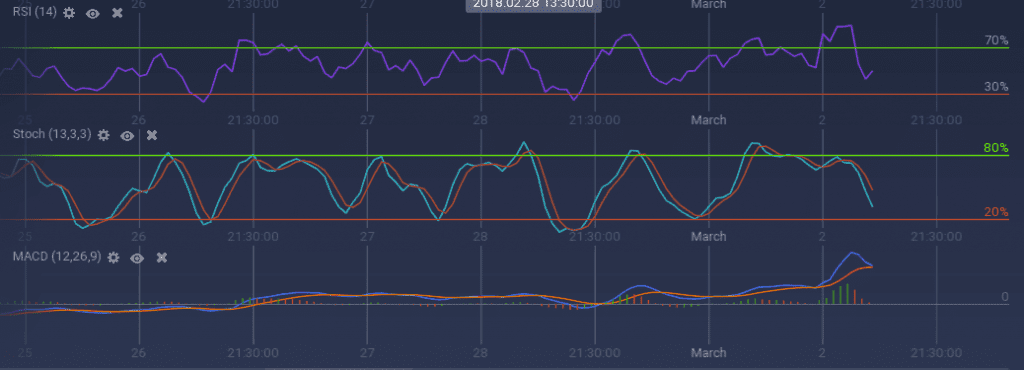

Due to the present anomaly the prices due to the spike, the technical indicators are contradicting each other. RSI, with its value at 51 percent is moving up, while, Stoch is in a freefall. MACD curves are also shown bearish signs. As the bull was dominating, 100 SMA went above 200 SMA.

Bitcoin Cash

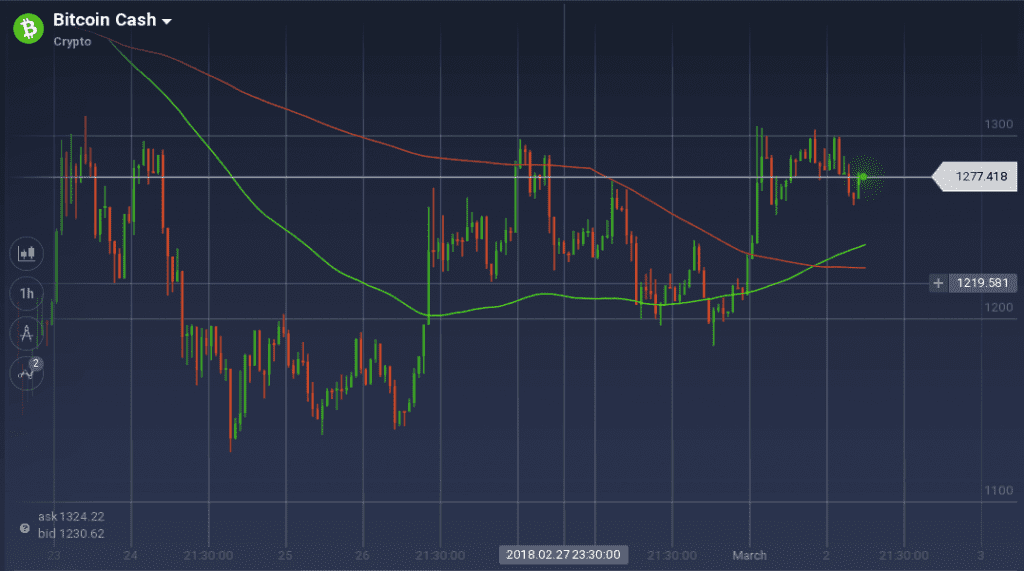

The forked sibling of Bitcoin – Bitcoin Cash – had a roller coaster ride this week. The fourth largest coin with $21.7 billion in market cap has appreciated by more than 4 percent in both daily and weekly chart. The coin is also attaching a large number of traders’ attention as in the last 24 hours trading volume was $503 million.

After climbing to $1295, the coin faced a stiff resistance, however, with support at $1220, it tested the level but failed. As the bear took over, BCH dropped to $1128, but it found support at $1140. However, the resistance at $1194 checked any growth. With a midweek rage among the buyers, the price of BCH soared to $1260 from $1142. But the coin aging faced the previous resistance at $1295. Despite the presence of support at $1230, the coin dipped until it found another support at $1200.

On the daily chart, the coin again climbed up to face resistance at $1300. With support at $1265, the coin is testing the resistance over and over.

As the coin found the support, the indicators are signing positive move. Stoch is rebounding from the overselling zone and RSI is also moving upward with the current value at 55 percent. The support is at the 38.2 percent Fibonacci level and currently, the price curve is running above 23.6 percent.

Market Update

In a U.S. Senate hearing earlier this month, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) both emphasized the need for more regulation while highlighting the importance of better understanding its risks and benefits first. Now the SEC is taking steps to crackdown on crypto by launching an official probe into initial coin offerings (ICOs). As reported by the Wall Street Journal, the SEC has sent subpoenas and information requests to scores of advisers and technology companies involved in cryptocurrency.

Germany’s Ministry of Finance has issued a guidance regarding the tax treatment of bitcoin and other cryptocurrencies, according to which, converting bitcoin and other cryptocurrencies into a fiat currency or vice versa is “a taxable miscellaneous benefit.” But using cryptocurrencies as a method of payment is not taxable similar to using any legal tender.

Luxury car manufacturer Porsche, in collaboration with Berlin-based start-up XAIN, is testing the application of blockchain technology directly in vehicles, making it the first automobile manufacturer to do so.

Conclusion

Though cryptocurrencies are rebounding, many coins are still available at discounted prices. So it might be a great time for the long haul investors to put some bucks in their trusted coins.