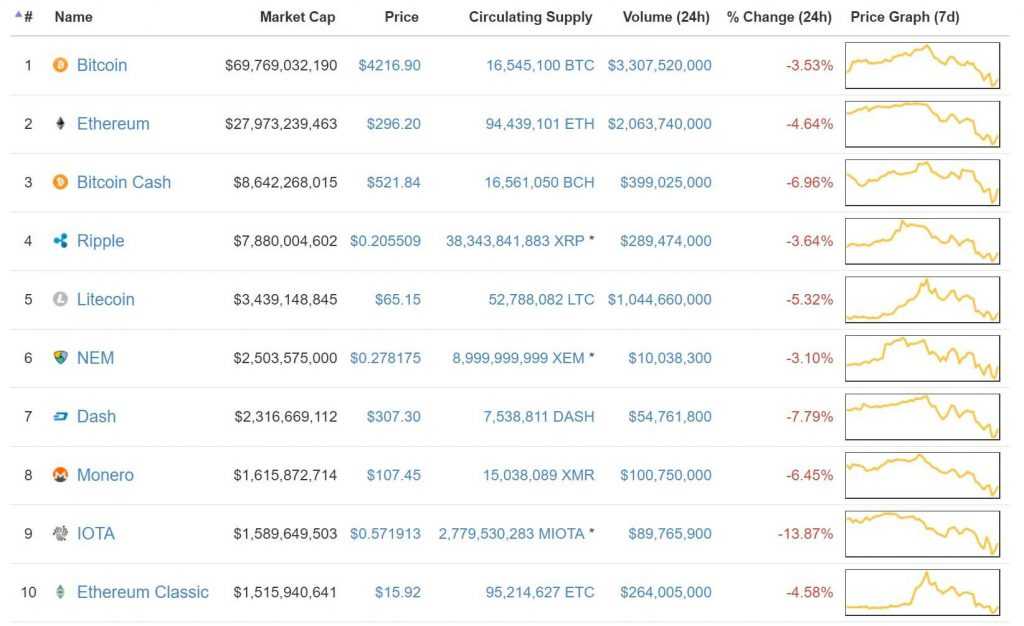

Following a massive sell-off on the cryptocurrency market, Litecoin has lost 25% of its value over a course of only four days. What does the most recent plunge mean for the currency and what should traders expect from LTC price action in the coming days?

To start with, Litecoin is not the only cryptocurrency to be affected by the most recent market correction. Top 10 cryptocurrencies have lost — and still keep losing — an impressive portion of their value after reaching all-time highs during the previous week. Some believe the sell-off was long-awaited, yet it was the ban of ICOs in China that triggered the event. Others state that the market was too hot and simply did what it had to. Whatever the reason, the bear trend offers a number of opportunities if approached correctly.

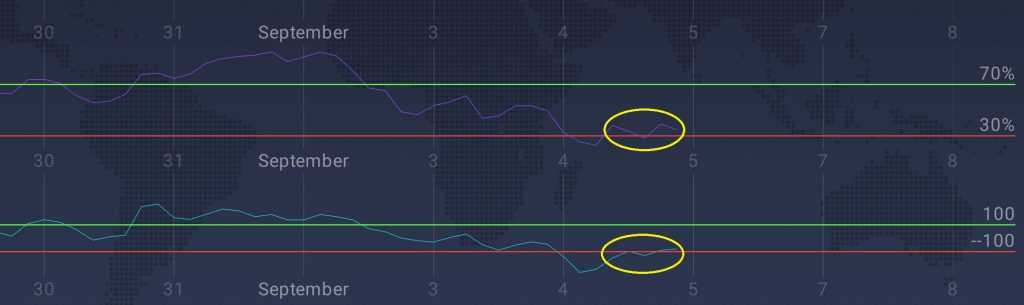

Technical analysis indicators can provide us with some information to consider. According to CCI and RSI indicators, Litecoin is currently approaching the oversold position, which can be interpreted as a good entry point.

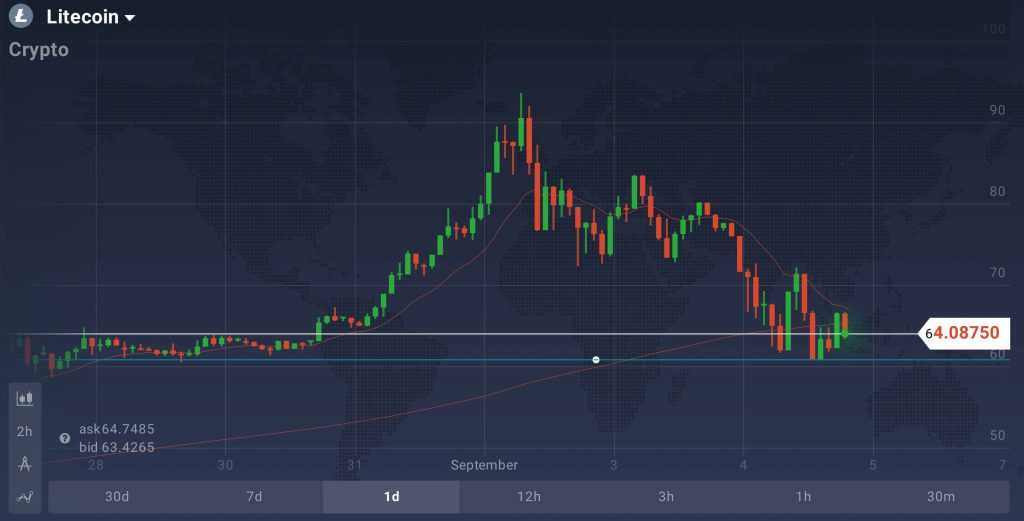

Despite the recent nosedive, the general trend, displayed as a 140-period SMA, is positive since the moment of the price takeoff on March 30. Long-term upward movement can therefore be expected to stay present. Slight support can be observed at around $60.9, not letting the price cross below this level.