Traders fled the US dollar Thursday afternoon on news President Donald Trump was going to enact new tariffs on steel and aluminum imported into the United States. The news was a shock to global markets already nervous about the FOMC, economic growth and geopolitical tensions. The tariffs are part of the President’s determination to live up to campaign pledges but have receive much support. Negative criticism is coming from all sides, supporters and opposition alike, as this first shot in what could become a global trade war threatens US and global economies.

The nation most likely to be hurt is Canada. The US is Canada’s largest trade partner and receives more of its steel, iron and aluminum than any other nation in the world. The bigger issue is NAFTA. If the tariffs cannot be avoided in some way through NAFTA, the whole renegotiation could fall apart leading to bigger trade issues throughout North America. The US dollar fell on the news but regained the losses in early Friday trading as Canadian GDP missed expectations. The annualized quarterly growth came in at 1.7%, far below the 2.0% expected, a sign of lingering sluggish in the Canadian economy. A trade war would not be good.

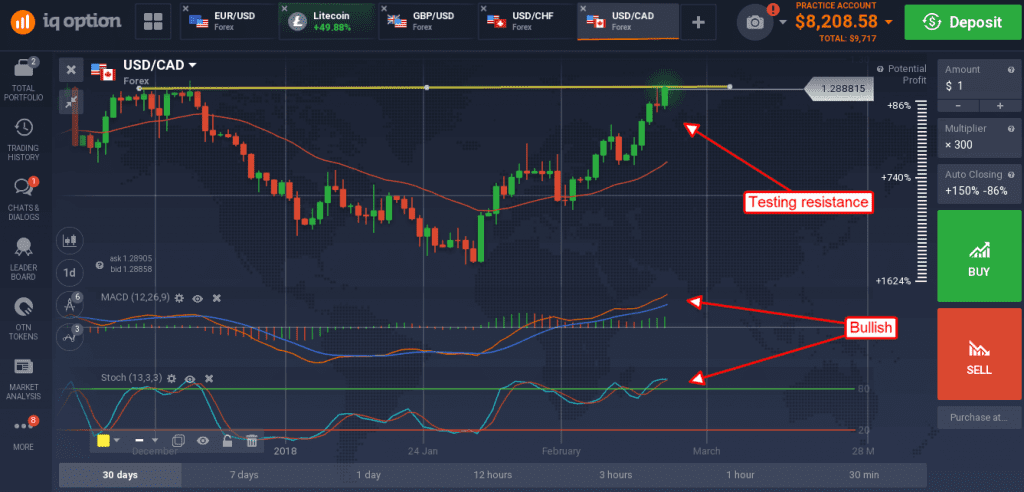

The USD/CAD moved up in early Friday action to approach resistance at 1.2900. This is a long-term resistance level that has been in place seven months and tested three times. The pair is in uptrend with bullish momentum, so a retest of resistance is likely. A break above resistance is questionable, economic activity is expected to pick up within Canada this spring, but still possible. Once broken the upside target is 1.3000 and then 1.3200.

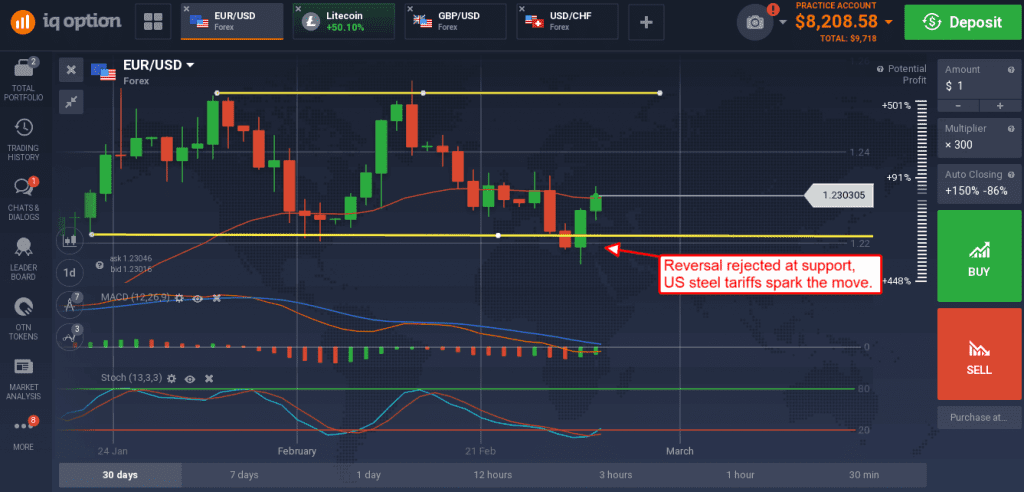

The dollar fell versus the euro as trader’s flood into the single currency in hopes of finding some safety from trade war concerns. The move extends the Thursday bounce from support that began when the news was released. The pair has rejected reversal soundly but is not out of the woods yet. The true effect of the tariffs is not yet known, US economics are rapidly improving, and the FOMC is expected to raise rates at the next meeting which all point to dollar support if not strength.

The EUR/USD pair moved up more than a quarter percent on the news, moving above the short term moving average, and heading higher. The indicators are consistent with support and a move up in prices within the trading range but there is resistance ahead. The first target is at 1.2360, if that is broken the next target is at the top of the trading range near 1.2550. The next few days are going to very important for the market. Fallout from Trump’s move has only begun to emerge, reciprocation by the US’ trading partners or the abandonment of NAFTA could send this pair to new highs.