Balance of trade figures from Europe’s largest economy, Germany, were expected to show steady balance on hopes of improvements in both exports and imports. The reality is that both came in hotter than expected on increases in manufacturing, pointing to continued economic improvement in the Eurozone. Traders looking for signs of strength in the economy and reason for the ECB to tighten may have found it.

In Germany the balance of trade has been positive virtually very year since the data has been collected.

Over the past year it has risen to historic highs on the back of ECB easy money policy and the August read shows another increase. The balance for August was expected to widen as it did in July due to increases in manufacturing and exports, but by no means by the amount it did.

The total balance was expected to rise 0.8 billion euros to 20.3 billion from 19.3 on a 1% increase in exports and a 0.4% increase in imports. Both exports and imports and exports rose ahead of expectations leaving the surplus at 21.6 billion euros. This is a gain of 10.6% versus an expected gain of only 5%.

Exports rose at 3.1% on the month, more than double the expected rate, as manufacturing continues to ramp up and global demand improves. Imports also increased at more than double the expected rate, 1.2%, on improvements in the domestic economy. Exports are now up 7.2% YOY, Imports 8.5%, and both leading the euro higher.

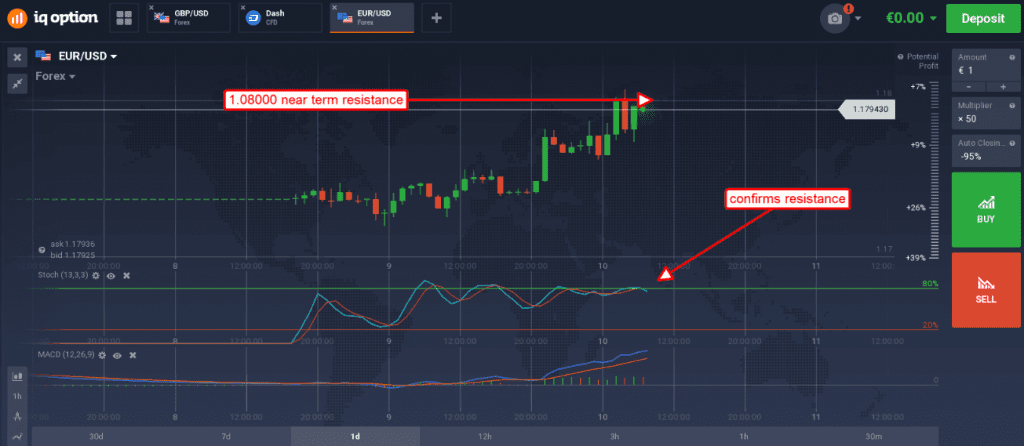

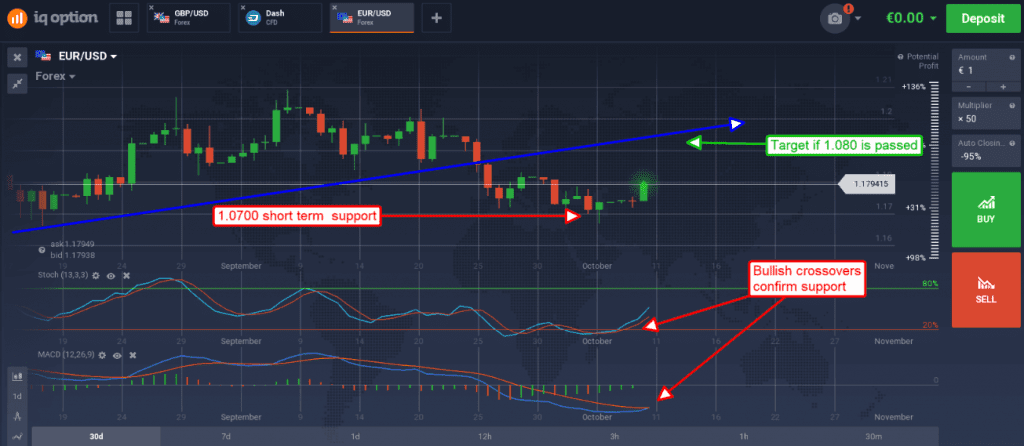

The EUR/USD has been flirting with support levels never 1.7000 for the past week or more as US inflation data points to further rate hikes from the FOMC. The Euro strengthened versus the dollar on today’s news as it raises the chances for ECB tightening actions. The pair gained a half percent in the wake of the German data release and is now moving higher with an eye on near resistance at 1.0800 and the next big hurdle for the currency markets; the FOMC minutes.

The daily charts show a pair bouncing up off of a strong support level. This level is confirmed by the indicators and moving averages, and in particular stochastic. Stochastic is showing a strong buy signal with upper targets near the bottom of an up trend line near 1.0925. This trend line is connecting important lows set over the summer and a critical juncture for this pair should it be retested. The only caveat is that there is potential resistance at the 1.0800. A break above this level would be bullish in the near term. Failing to break would be neutral to bearish with a possible return to retest support at 1.0700.

The minutes are not largely expected to reveal any new information but may give insights into how hawkish the Fed may be. Since the meeting signs of inflation have turned up in the ISM Manufacturing and Services and the NFP figures that have helped to strengthen rate hike outlook. These signs, hotter than expected increases in prices paid and hourly wages, are cornerstones of core inflation and leading indicators when it comes to the Fed.

The minutes are due out Wednesday afternoon at 2PM. Any signs of growing hawkishness within the Fed is likely to strengthen the dollar and cap gains in the EUR/USD.