The Exchange-Traded Fund (ETF) market is not just growing; it is dominating. With the Global Asset Under Management (AUM) surging to nearly $14 trillion in 2024, ETFs attracted over $1 trillion in new money, and active funds now make up 26% of inflows, from just 1% a decade ago.

These funds give investors access to fields of fast growth without giving up the liquidity and flexibility that make trading ETFs so attractive. Being informed on which ETFs are currently working well is not just about seeking profits; it goes beyond that. Smart traders analyze the factors driving performance, measure the risk involved, and fit these funds into their overall plan.

What Makes an ETF “Top Performing” in 2025?

Performance metrics only take you so far. You have to think through a number of different considerations when examining ETFs’ quality and potential.

Performance Metrics

Year-to-date numbers make headlines but aren’t equal to future success. Look instead at risk-adjusted returns. The Sharpe ratio will inform you of how much extra return you are getting for the volatility you are accepting. The higher the Sharpe ratio, the more attractive the risk-adjusted return.

Think about three-year and five-year returns, too. Longer time horizons filter out market noise and show you consistency.

Risk-Adjusted Returns vs. Raw Performance

A fund might deliver a 50% return, but if it plunged 40% just six months ago, the volatility may be too steep for many traders. Therefore, volatility matters, especially if you are trading on lower time horizons or using leverage. Maximum drawdown will inform you of the worst peak-to-trough decline. This is how much misery you can anticipate enduring through bad times.

Liquidity and Trading Volume

High trading volume results in tighter spreads and better execution. You require cash that trades a minimum of 100,000 shares daily for easy entry and exit. Assets under management (AUM) matter too. Funds with less than $50 million in assets are at risk of closure. Stay with solid funds with good backing.

Sector Highlights: Top ETFs by Theme

Technology and Innovation ETFs

Most ETFs in the sector are providing sensational performance while positioning traders for future gains.

AI and Robotics ETFs

Artificial intelligence is further transforming entire industries. The Global X Robotics & Artificial Intelligence ETF (BOTZ) has experienced solid demand, with additional companies starting to implement AI into their operations. These funds typically invest in semiconductor companies, software engineers, and automation specialists. The secret is to locate funds that combine seasoned players and emerging innovators.

Semiconductor Sector Performance

Chip stocks have roared back in a big way since 2023. The VanEck Semiconductor ETF (SMH) tracks the industry leaders like NVIDIA, AMD, and Intel. Semiconductor stocks, however, are cyclical. They perform well when the economy is booming but falter when it slows down. Time your entries carefully and avoid chasing momentum mindlessly.

Space Exploration Funds

Space technology has progressed from science fiction to investment reality. The Procure Space ETF (UFO) offers exposure to satellite communications, space exploration, and other space technologies. This is a long-term holding that requires patience. Most of the companies are still working on their technologies, so this is a longer-term play and not a fast trading event.

Trading Insights for Tech ETFs:

- Watch quarterly earnings seasons when volatility spikes

- Employ dollar-cost averaging into positions rather than attempting to time entries

- Track regulatory developments influencing large technology firms

- Maintain position sizes that are acceptable because of volatility

Defense and Security ETFs

Geopolitical tensions have increased defense expenditures worldwide. Some of the ETFs within this category have returned remarkable values while providing portfolio diversification.

Geopolitical Drivers of Performance

Increased defense budgets among NATO nations are driving sector growth. The Russia-Ukraine conflict emphasized the need for military preparedness, which saw government expenditure increase. Defense contractors have long-term contracts and consistent revenue streams. The security they offer keeps them in demand in unstable times.

Defense Spending Trends

Defense expenditures globally reached record levels in 2024 and continue to show no indication of abating. The iShares U.S. Aerospace & Defense ETF (ITA) taps this trend with exposure to major contractors. Several of these companies are multinational in scope, providing currency diversification along with defense exposure.

Featured Defense ETFs:

- DFEN (Direxion Daily Aerospace & Defense Bull 3X): Leveraged exposure for aggressive traders

- PPA (Invesco Aerospace & Defense ETF): Increased sector exposure

- ITA (iShares U.S. Aerospace & Defense ETF): Conservative exposure with the largest holdings

Trading Considerations:

- Defense stocks are susceptible to political changes

- Government budgets impact contract awards

- Global tensions generate near-term volatility

- Long-term growth opportunities are positive

Commodity and Precious Metals ETFs

Fears of inflation and supply disruptions have once again brought commodities into the spotlight. A few ETFs in this space offer exposure to physical commodities and commodity-related companies.

Gold ETFs Performance in 2025

Gold has remained a favorite as an inflation hedge with a strong 2025, and investor demands for gold ETFs are expected to increase into 2026. The SPDR Gold Trust (GLD) tracks gold prices directly, and the VanEck Gold Miners ETF (GDX) provides leveraged exposure through mining stocks. Mining stocks outperform gold in bull markets but carry additional operating risk. Choose according to your market forecast and risk tolerance.

Energy Sector Recovery

Oil and gas companies have been resilient in the face of alternative energy transitions. The Energy Select Sector SPDR Fund (XLE) offers diversified exposure to energy giants.

Energy stocks remain event-sensitive and volatile. They are excellent portfolio diversifiers but require disciplined position sizing.

Agricultural Commodities

Food inflation has drawn attention to farm investments. The Invesco DB Agriculture Fund (DBA) tracks farm-related commodities through futures contracts. Weather risks, seasonality, and governments’ policy changes face agricultural commodities. They’re better suited for mature traders with a basic understanding of fundamental analysis.

Market Factors Affecting Commodities:

- Central bank monetary policies and interest rates

- Currency fluctuations, especially the strengthening of the USD

- Disturbances in global supply chains

- Weather patterns and natural disasters

International and Emerging Markets ETFs

Diversification in foreign markets can boost returns while reducing risk. Certain foreign ETFs outperformed their domestic counterparts in 2025.

Developed Markets Outside the US

European and Asian markets offer different economic cycles and growth opportunities. The Vanguard FTSE Developed Markets ETF (VEA) provides global international exposure.

Currency fluctuations add another layer of complexity. A weakening dollar can enhance international returns for US investors.

Emerging Markets Opportunities

Emerging markets are fairly valued despite recent underperformance. Exposure to India, China, and other emerging economies is provided through the iShares MSCI Emerging Markets ETF (EEM). These markets are less stable but offer more growth opportunities. They can be employed as satellite holdings in balanced portfolios.

Regional Performance Analysis:

- European markets are supported by economic recovery

- Asian markets reflect strong technology sector growth

- Latin American markets are commodity price-dependent

- Emerging markets are vulnerable to currency and political risks

How to Analyze the Performance of ETFs

Profitable trading in ETFs entails more than looking at simplistic price charts. You need to understand the underlying performance reasons and how long they will last.

Technical Analysis of ETF Trading

ETFs technically act similarly to single stocks. Support and resistance levels, moving averages, and momentum indicators all function. Volume analysis is crucial with ETFs. High volume confirms price action, and low volume shows unconvincing conviction.

Fundamental Analysis

Examine underlying holdings and the underlying health of those holdings. The overvalued tech ETF will underperform regardless of sector performance. Also, take into account sector concentration. Some ETFs become overly concentrated in a few large holdings and undercut diversification benefits.

Our post on “Fundamental Analysis vs Technical Analysis” will help you better understand which of these analysis methods helps to evaluate the performance of ETFs.

Risk Assessment Tools

Beta measures how much an ETF will move in relation to the market. High-beta ETFs amplify market movement, and low-beta funds provide stability. Correlation analysis allows you to view how different ETFs will move together. Avoid purchasing many ETFs that move together.

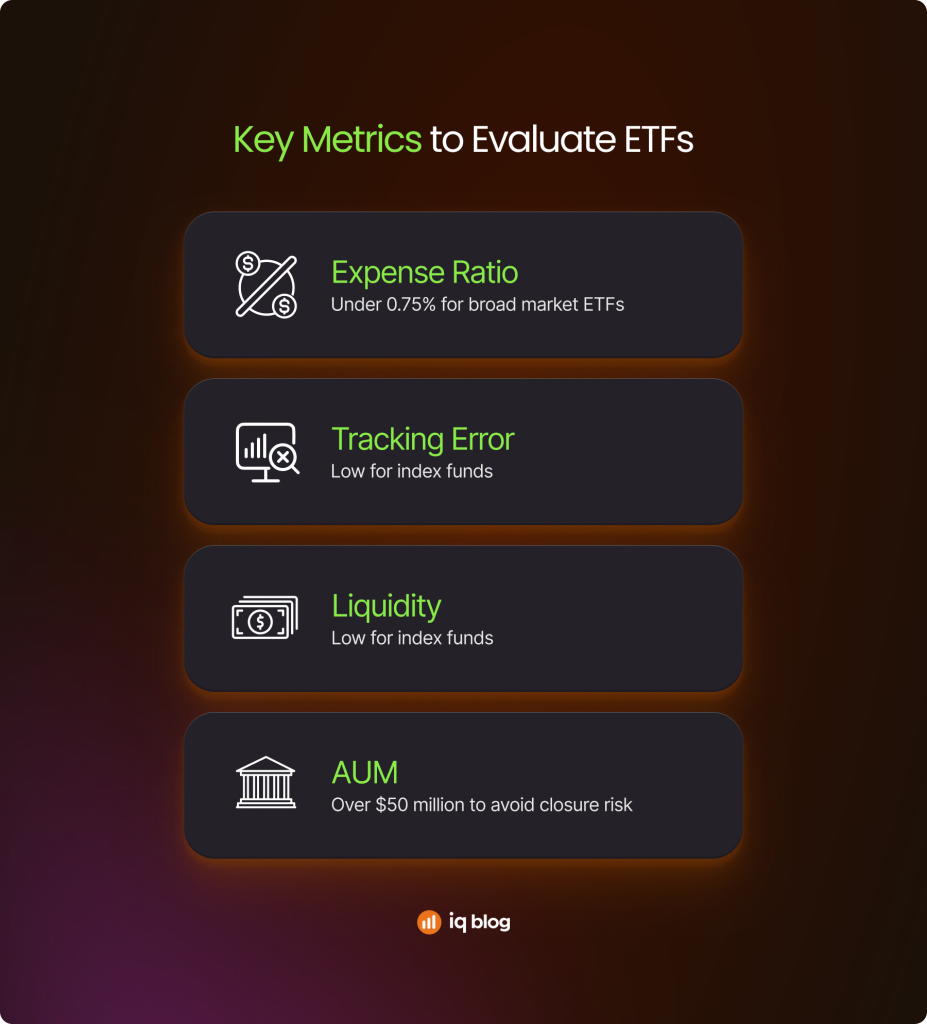

Key Metrics to Evaluate ETFs:

- Expense Ratio: Under 0.75% for broad market ETFs

- Tracking Error: Low for index funds

- Liquidity: Over 100,000 shares per day

- AUM: Over $50 million to avoid closure risk

Trading Strategies for High-Performance ETF

Different ETFs require different approaches. Your method must accommodate the type of fund and what you are trying to achieve in trading.

Momentum Trading Strategies

Momentum is excellent with sector ETFs showing strong trends. Time entries through moving average crossovers and relative strength indicators. Set strong profit targets and stop losses. Momentum can turn quickly, especially in volatile sectors like technology.

Check out our post on “How to Use Stop Loss and Take Profit” for more information on how to manage the risk that comes with momentum.

Swing Trading Strategies

ETFs honor technical levels more often than individual stocks. That’s why they can be applied to swing trading strategies. Look for ETFs recovering from support levels or crossing resistance levels. These are high-quality risk-reward opportunities.

Position Sizing Strategies

Risk no more than 2% of capital on any single ETF trade. Diversify across sectors and geographies to contain concentration risk. Employ correlations when sizing positions. Different technology ETFs look diversified but correlate with one another in times of stress.

Practical Tips for Trading ETFs

- Start with liquid, broad-market ETFs and then move to sector funds

- Employ limit orders to avoid paying wide spreads

- Monitor expense ratios because they have a direct impact on returns

- Keep thorough records for tax reporting

Common Mistakes to Avoid When Trading Performing ETFs

Even experienced traders make costly ETF mistakes. Knowing these mistakes can improve your success rate.

- Chasing Performance Without Research: Last year’s winners often become this year’s losers. Before investing, find out why an ETF was successful.

- Overlooking Expense Ratios: High fees tend to compound over time. For a 1% expense ratio, you need 1% extra return just to break even.

- Overweighting Individual Sectors: Sector ETFs are volatile. Limit cap exposure in any sector to 20% of your portfolio.

- Timing the Market Wrongly: Nobody times market tops and bottoms all the time. Invest in long-term trends, not short-term predictions.

- Overlooking Tax Implications: ETF trades create taxable occurrences. Utilize tax-deferred accounts for active trading.

Conclusion

Effectively trading ETFs in 2025 demands a well-rounded approach that includes careful investigation, rigorous risk management, and exposure in several parts of the economy at the same time. While technology, defense, and commodities have emerged as standout performers, the key to sustainable success lies not in chasing yesterday’s winners but in comprehending the foundational principles of each sector’s growth potential.

Risk Disclosure: Past performance is not indicative of future results. ETFs carry market risk, and leveraged or sector-specific ETFs may amplify volatility. Always trade with a risk management strategy.

FAQs

Q. How much should I invest in trading ETFs?

A majority of brokers allow for fractional share buying, thus $1 is acceptable. However, $1,000 minimum is better to have improved diversification options.

Q. How frequently would I rebalance an ETF portfolio?

Quarterly rebalancing is ideal for most traders. More frequent rebalancing incurs additional transaction charges without improving returns.

Q. Are leveraged ETFs for novices?

Leveraged ETFs are complicated vehicles that will cost you money even if the underlying asset appreciates. Don’t get your hands dirty until you understand how they work.

Q. How are ETFs different from mutual funds?

ETFs are sold and bought during the day, similar to stocks, while mutual funds are priced just once per day. ETFs tend to cost less and are more tax-efficient.

Q. How do I view ETF holdings?

Check the provider’s website under the fact sheet for the fund. This will show top holdings, sector distribution, and performance figures.