Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

1) Amazon.com Added 35% This Year. But Why?

Amazon shares (NASDAQ: AMZN) soared 35% in just one year. No single news has contributed to the growth, or to better put it, all of them contributed pretty equally. The company has demonstrated outstanding performance in the past and, according to certain analysts, will continue delivering in 2017 and 2018. An unparalleled set of competitive advantages is behind the Amazon’s recent success. Despite stretched valuation, stock prices are very well possible to go up even further.

Amazon shares (NASDAQ: AMZN) soared 35% in just one year. No single news has contributed to the growth, or to better put it, all of them contributed pretty equally. The company has demonstrated outstanding performance in the past and, according to certain analysts, will continue delivering in 2017 and 2018. An unparalleled set of competitive advantages is behind the Amazon’s recent success. Despite stretched valuation, stock prices are very well possible to go up even further.

2) What to Expect from the Kinder Morgan Report?

Kinder Morgan Inc. (NYSE: KMI) will be reporting tomorrow after the market closes. During the second quarter this year the company was mostly busy organizing an IPO for its Canadian subsidiary. The energy giant also got closer to its leverage target. Investors, however, can find the absence of the dividend policy revision disappointing. Short-term results will probably be damaged by strategic initiatives but the long-term potential will, on the contrary, only increase.

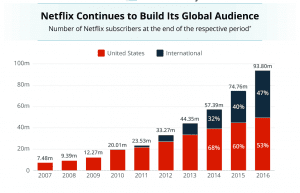

3) Netflix Grows Above Expectations

Netflix (NASDAQ: NFLX) is a unique case. Only a few companies in the world rely on the original content as much in order to achieve international success. It may appear that even the Netflix’s top management was surprised by the above the line performance the company demonstrated during the second quarter of 2017. The company totally dominated the results of the same quarter last year and Q2 2017 guidance. Revenue growth rate is estimated to remain around 30%, which will translate into an EPS increase of $0.32.

Netflix (NASDAQ: NFLX) is a unique case. Only a few companies in the world rely on the original content as much in order to achieve international success. It may appear that even the Netflix’s top management was surprised by the above the line performance the company demonstrated during the second quarter of 2017. The company totally dominated the results of the same quarter last year and Q2 2017 guidance. Revenue growth rate is estimated to remain around 30%, which will translate into an EPS increase of $0.32.

4) Frankfurt — New Trading Hub

With Britain actively trying to cut all ties with the European Union, the investors draw their attention to Frankfurt. Citigroup is only one major banked that has already confirmed the plans to move their facilities from London to the German city and relocate from 150 to 250 employees. Not only the city but also the company are expected to benefit from the initiative.

5) Black Rock Earnings Disappoint

The largest investment entity in the world failed to meet the expectations of shareholders and prospective investors. Assets under the company’s management added 16% but revenue gained only 6 percent. Instead of expected $5.40 Black Rock demonstrated the EPS of $5.24. BLK stock price dropped and has yet to rebound.