Day trading is buying and selling within the same day. It targets short moves and quick decisions. It demands clear rules and strict risk control. In 2026, technological advancements, like AI‑powered screeners, real-time bots and zero‑day (0DTE) options have reshaped how traders approach intraday strategies.

In this article, we’ll explore how strategies like momentum and breakout trading still work, but may require new tools like AI sentiment filters or 0DTE derivatives. We’ll also explore the blocking value of strict risk control, especially considering the surge in short‑term options and volatile moves within single trading sessions.

What Makes a Good Day Trading Strategy in 2026?

In 2026, a strong day trading strategy must be fast, simple, adaptive, data‑driven and anchored in sound risk control.

- Speed & Clarity – Signals must be clear and actionable. Traders in fast markets cannot pause to ponder. They need precise setups that trigger immediate responses.

- Adaptability – Markets change quickly. Traders must adjust strategies to new volatility patterns, tech shifts or global events. Flexibility and the ability to act under uncertainty are essential.

- Disciplined Structure – A quality strategy follows strict rules. It defines what to trade, when to trade, how to enter and exit and when to stop trading altogether.

- Quantitative & Systematic – Success comes from measurable, repeatable plays. Being systematic and detail-obsessed helps in avoiding mistakes fueled by emotion.

- Risk Control – Managing risk is central to survival. Traders must limit what they lose per trade and enforce strict stop-loss discipline.

- Psychology Traits – The trader’s mindset matters. Discipline, patience, resilience, adaptability, emotional control, continuous learning and analytical focus are key.

Strategy 1: Momentum Trading

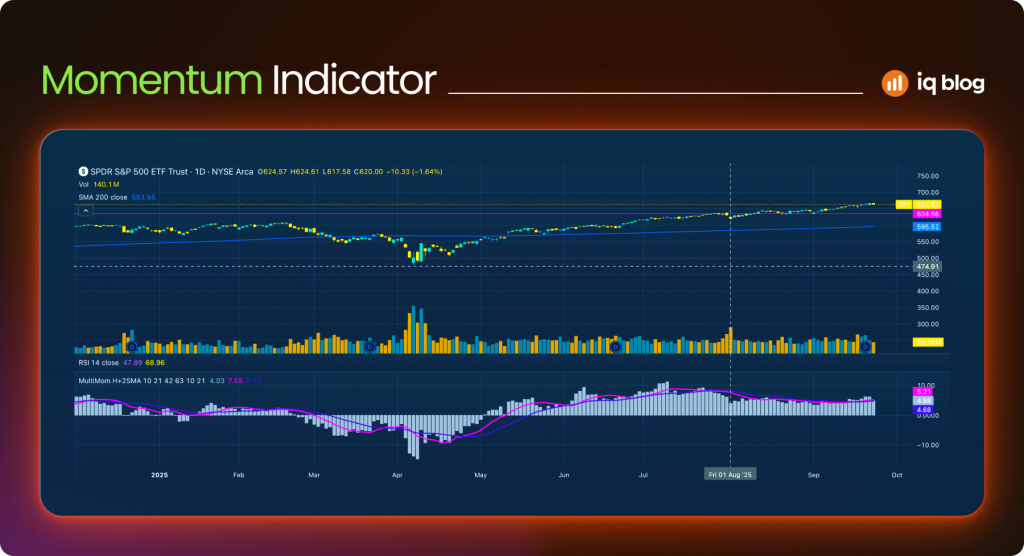

Momentum trading is one of the oldest and most widely used intraday strategies. It is based on the idea that when an asset shows strong movement in one direction, that trend is likely to continue for a short period. Traders enter during this surge and exit once signs of exhaustion appear.

In practical terms, momentum setups are identified using technical indicators and volume analysis. Moving averages confirm the overall trend, while indicators such as RSI, MACD and stochastic oscillators help determine whether momentum has sufficient strength or if it is overextended. Volume is crucial, since strong moves typically occur when trading activity is at least double the daily average.

The benefits of this approach are clear. Momentum trades can deliver quick profits in just minutes or hours. They are also easy to spot visually, as sharp rallies, breakouts or bull flag patterns often signal momentum in action. The risks, however, are equally important. Momentum crashes are sudden reversals where strong gains collapse quickly. High turnover and transaction costs can also eat into profits if the strategy is not executed with discipline.

A good example came in early 2026. The iShares Edge MSCI USA Momentum Factor ETF outperformed the S&P 500 with a gain of nearly 10%, according to MarketWatch. Palantir and Oracle were among the leaders. A trader who identified Palantir breaking out on heavy volume could have entered during the pullback, placed a stop loss below the breakout level and exited once momentum slowed. That single trade reflects the core principle of this strategy.

Key Steps in Momentum Trading

- Scan for assets with volume at least twice the daily average

- Confirm the direction with moving averages and momentum indicators

- Enter on a pullback or breakout confirmation

- Place a stop loss just below the recent low

- Exit when volume fades or indicators show a reversal

When followed with strict discipline, this sequence allows traders to capture fast intraday moves while controlling risk.

Strategy 2: Breakout Trading

Breakout trading is another classic day trading method. The strategy focuses on entering trades when the price breaks through a well-defined level of support or resistance. The logic is simple: when the market pushes past these barriers, it often triggers a wave of new orders and accelerates the move.

Breakouts usually occur after periods of consolidation, when the price has traded in a narrow range for some time. Traders monitor chart patterns such as triangles, rectangles or flags. Once the price pierces the upper or lower boundary with strong volume, it signals that new momentum may be starting. Bollinger Bands and Fibonacci levels are often used to confirm the setup.

The advantage of breakout trading lies in its clarity. Entry points are easy to define: buy when price breaks resistance, sell when it breaks support. The risk is also straightforward to manage, since stop losses can be placed just inside the consolidation range. The main danger is the “false breakout,” where the price briefly moves beyond a level only to snap back into the range. This can lead to small, repeated losses if not handled carefully.

A real-world example came in March 2026, when Bitcoin broke above the 60,000 USD level after weeks of sideways trading, according to Blockain.news. The breakout was accompanied by a surge in trading volume, attracting both institutional and retail traders.

Key Steps in Breakout Trading

- Identify strong support or resistance levels on the chart

- Wait for the price to consolidate and approach these levels

- Enter once the breakout occurs with strong volume

- Place stop losses just inside the prior range

- Take profits gradually as the move extends toward the next resistance or support

Breakout trading rewards patience and discipline. By waiting for the market to show its hand, traders can capture powerful intraday moves while keeping risk contained.

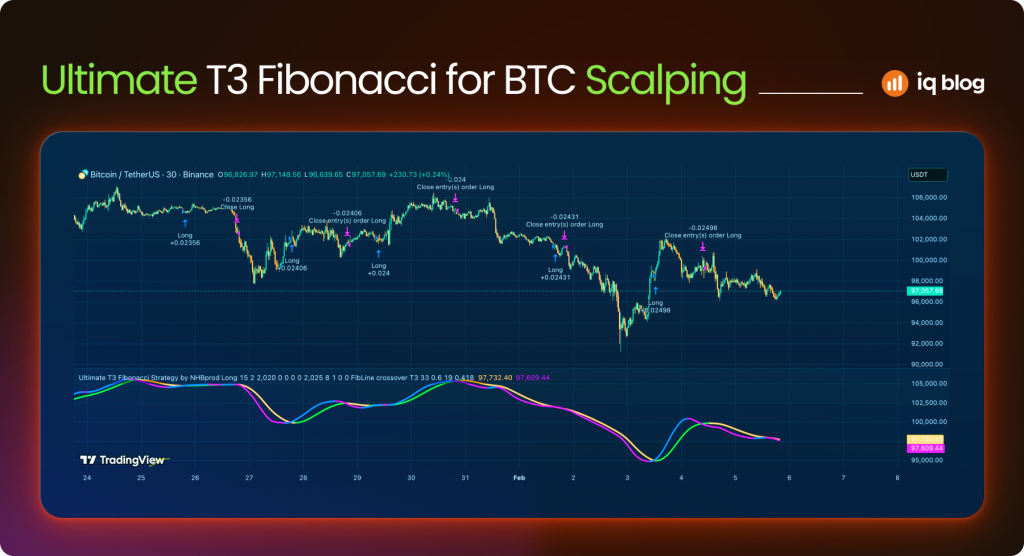

Strategy 3: Scalping

Scalping is the fastest form of day trading. Instead of holding positions for minutes or hours, scalpers execute dozens or even hundreds of trades in a single session. Each trade targets very small price changes, often just a few cents or pips, but the cumulative gains can be significant if the trader maintains consistency.

This style requires high focus, quick reflexes and excellent execution speed. Scalpers depend on ultra-liquid markets where spreads are tight and slippage is minimal. In 2026, assets like EUR/USD in forex and Bitcoin or Ethereum in crypto are among the most popular choices for scalpers, as they offer continuous movement and high daily volume. Level II order book data and direct market access platforms are often used to detect micro-movements.

The benefits of scalping are the constant flow of opportunities and reduced exposure to overnight risk, since all trades are closed within the same day. The downsides are equally clear. Transaction costs can build up quickly and even a small lag in execution may turn winning trades into losses. Scalping also demands intense concentration, making it unsuitable for those who cannot stay glued to their screens for hours.

A practical example can be seen in forex markets in 2026. On a typical trading day, EUR/USD may fluctuate within a 50-pip range. A scalper might enter and exit several times within that window, capturing 3 – 5 pips per trade using high leverage and strict stop losses. With enough trades, these small gains can add up to a meaningful profit.

Key Steps in Scalping

- Focus on the most liquid markets with tight spreads

- Use fast execution platforms and order book data

- Enter and exit positions quickly, targeting small moves

- Apply strict stop losses to cut losing trades instantly

- Monitor transaction costs carefully to protect net profits

Scalping is demanding but effective for traders who thrive under pressure. Success depends on discipline, speed and the ability to manage costs while stacking small, frequent gains.

Strategy 4: Mean Reversion

Mean reversion trading is built on the idea that prices often return to their average after moving too far in one direction. When an asset becomes overbought or oversold, traders anticipate a pullback toward its historical mean. This makes it one of the most popular strategies for disciplined intraday setups.

The approach typically relies on moving averages, Bollinger Bands or oscillators like RSI. For example, if a stock trades far above its 20-day moving average while RSI shows overbought conditions, a mean reversion trader may short the stock, expecting a pullback. Conversely, if a currency pair drops far below its average with oversold readings, a long position could be taken.

The advantage of mean reversion is the high probability of success in range-bound markets. Prices often oscillate within bands, creating frequent trade opportunities. The main risk is when the market is in a strong trend. In such cases, betting on reversals can lead to heavy losses if the price keeps moving away from the average. For this reason, traders often filter signals by checking broader market conditions before acting.

A clear example appeared in February 2026 when some technical analysts identified oversold conditions in the Nasdaq Composite, noting sharp declines in tech stocks and RSI readings dipping toward low levels. The index traded below certain moving averages, and some rebounds followed.

Key Steps in Mean Reversion

- Track moving averages and oscillators to spot overbought or oversold conditions

- Enter trades when the price deviates significantly from its mean

- Use stop losses in case the move develops into a strong trend

- Exit as the price approaches the average again

- Apply this method mainly in sideways or consolidating markets

Mean reversion works best in calm environments where assets move within defined ranges. It rewards patience and discipline but requires caution during periods of strong momentum.

Strategy 5: News-Based Trading

News-based trading focuses on taking advantage of the sharp volatility caused by scheduled or unexpected events. Economic releases, central bank decisions, earnings announcements and geopolitical developments often create large intraday swings. Traders who prepare and react quickly can capture significant profits in these moments.

The method requires staying updated with an economic calendar and having alerts set for key data such as inflation figures, GDP reports or interest rate changes. In 2026, the rise of AI-powered sentiment analysis tools has made it easier for traders to gauge market reactions within seconds of a headline hitting the wires. For example, an algorithm can instantly scan a Federal Reserve statement and highlight whether the tone is hawkish or dovish.

The main benefit of news-based trading is that it delivers large moves in a very short time, sometimes within seconds. The downside is the extreme risk. Spreads often widen during announcements, slippage is common and price whipsaws can hit stop losses before the market direction becomes clear. This makes strict risk management essential.

In January 2026, according to Reuters, after hotter-than-expected US inflation data, the Fed signaled it would likely stay neutral on rate hikes. The announcement pushed bond yields higher and strengthened the U.S. dollar. Some traders who were positioned for rate cuts faced losses, while others who anticipated the shift took gains in equities as expectations adjusted.

Key Steps in News-Based Trading

- Track an economic calendar and prepare for major releases

- Use tools or AI sentiment scanners to react instantly

- Expect wide spreads and adjust position sizes to limit risk

- Place stop losses but allow some buffer for volatility

- Exit quickly once the main reaction has played out

News trading is powerful but unforgiving. Only traders who combine preparation, fast execution and strict discipline can consistently profit from these short-lived opportunities.

How to Choose the Right Strategy for You

Choosing the right day trading strategy is not about copying what works for others. It is about finding a method that fits your own time, risk tolerance and trading style. A trader who thrives under pressure may succeed with news-based setups, while someone who prefers structure and patience may do better with mean reversion. The following steps provide a structured way to narrow down the right approach.

- Define Your Time Commitment – Decide how many hours per day you can trade. Scalping requires full attention, while breakout or momentum trading may work with shorter trading windows.

- Assess Your Risk Tolerance – Be honest about how much volatility you can handle. High-risk traders may lean toward news or momentum strategies. Lower-risk traders often prefer mean reversion or carefully planned breakouts.

- Match Strategy to Personality – Fast and reactive traders may enjoy scalping. Patient and methodical traders might prefer waiting for clean setups like breakouts or reversions.

- Identify Your Tools and Resources – Scalpers need direct market access and Level II data. News traders need fast feeds and sentiment tools. Momentum traders need scanners. Ensure you have the right setup before committing.

- Test in a Demo Environment – Practice your chosen strategy with virtual capital. Track metrics like win rate, profit factor and drawdown. Discard strategies that do not fit your strengths.

- Start Small and Scale Gradually – Once confident, trade live with minimum position sizes. Only increase size after proving consistent results over weeks or months.

Risk Management Principles for Day Traders in 2026

Risk management is the foundation of day trading. Strategies may differ, but without proper controls, even the best setups can lead to rapid losses. In 2026, fast-moving assets such as zero-day options, volatile cryptocurrencies and high-frequency stocks demand even tighter rules. The aim is not just to maximize profits but to preserve capital so that a trader can survive losing streaks and keep trading long term.

Find below a list of the core principles in day trading.

- Set a Maximum Risk per Trade – Limit exposure to 1 – 3% of total account equity on each position. This keeps single losses from destroying the account.

- Use Stop Losses Consistently – Place stop orders before entering trades. They prevent emotional decisions and cap downside when markets reverse suddenly.

- Control Daily Losses – Define a daily stop limit, such as 3 losing trades or a fixed percentage of account equity. Once reached, stop trading for the day.

- Size Positions Correctly – Adjust lot size or contract size based on account balance and volatility. In 2026, tools that auto-calculate position size are widely available and should be used.

- Avoid Overleveraging – Leverage magnifies both gains and losses. Stick to moderate leverage, especially in forex and crypto markets where swings can be violent.

- Plan for Worst-Case Scenarios – Always account for slippage, widened spreads during news events and sudden market gaps. Build these risks into calculations.

- Track and Review Performance – Keep a trading journal with entry points, exits and risk taken. Regular reviews highlight patterns of overexposure and help refine rules.

Tools and Platforms for Day Trading in 2026

Day trading success in 2026 is closely tied to technology. Execution speed, access to data and automation define who has an edge. Platforms now combine charting order placement, AI analysis and risk management in a single environment. Below are the main categories every trader should consider.

Charting and Execution Platforms

Charting remains at the core of intraday trading. Services like TradingView allow traders to track multiple timeframes, apply custom indicators and set alerts. Execution is handled through brokers such as IQ Option or MetaTrader, which offer instant order placement and mobile apps for flexibility.

AI Screeners and Automation

Artificial intelligence has transformed trade selection. Screeners now flag stocks with unusual volume, detect momentum shifts or analyze news sentiment within seconds. Crypto traders also benefit from bots that monitor exchanges for arbitrage and liquidity spikes, feeding signals directly into dashboards.

News and Event Tracking

News-based strategies rely on speed. Economic calendars from sites like Investing.com or ForexFactory help traders prepare for scheduled releases, while integrated news feeds push real-time headlines. Sentiment scanners powered by AI can assess whether a statement from the Federal Reserve is hawkish or dovish in seconds.

Order Book and Market Depth

Scalpers depend on Level II quotes and depth-of-market tools. These reveal pending orders beyond the top of the book and highlight liquidity pockets where short-term reversals or breakouts may occur.

Risk and Analytics Tools

Risk control is now built into most platforms. Features such as automated position sizing, daily loss caps and trade journaling help traders stay disciplined. Post-trade analytics allow them to review win rates, average loss size and consistency over time.

Final Thoughts

Day trading in 2026 is defined by speed, volatility and technology. Strategies like momentum, breakout, scalping, mean reversion and news-based trading remain the pillars of intraday activity, but each requires adaptation to modern conditions. The rise of zero-day options, AI-driven analysis and faster execution platforms has created both new opportunities and new risks for traders worldwide.

While tools and platforms play an important role, success ultimately depends on discipline and consistency. Risk management remains the cornerstone of profitable trading. Without strict rules on position sizing, stop losses and daily loss limits, even the most effective strategy can collapse under pressure. The difference between long-term success and failure is rarely about spotting the right setup, it is about managing the downside when trades do not work out.

There is no universal “best” strategy. The right choice depends on the trader’s personality, available time and appetite for risk. What matters most is selecting one approach, testing it thoroughly and applying it with commitment. In a world where markets move faster than ever, traders who adapt, stay disciplined and respect risk give themselves the best chance of turning opportunity into consistent results.