The ECB’s fall Economic Bulletin reaffirmed the banks latest policy statement. The EU’s central bank says economic expansion is broad-based and ongoing although it has slowed a bit from the previous year. The bank says despite the expected slowdown in activity the trajectory of inflation remains on course. The bank is still expecting to end QE purchases at the end of December although it says stimulus is still required to maintain activity and upward pressure in inflation.

Upward pressure in inflation is present. Today’s round of data also brought the monthly CPI from German which shows consumer level inflation rising much faster than expected. The monthly gain of 0.4% was 0.3% above expectation and resulted in a YOY gain of 2.3%, also 0.3% above expectations. The news should have sent the EUR/USD higher as it supports the idea of ECB policy tightening but it didn’t. An issue with the Italian budgetary process popped up and sent a ripple of fear through the EU market and that is an opportunity for us today.

Friday the US PCE Price Index is due out and all signs point to a decline in US core inflation. The consensus is 0.1% from 0.2% and could exceed that target based on other data. The US CPI and PPI both fell in the last month and could easily result in no change or even a decline in the monthly core PCE inflation. Regardless, the expected slowdown of acceleration in core inflation is likely enough to weaken the dollar as it suggests the FOMC will not have to scale up plans for policy tightening. With the ECB on track to tighten, and maybe sooner than expected, and the FOMC on track to reach the end of their tightening cycle, I see no place for this pair to go but up over the short to long-term.

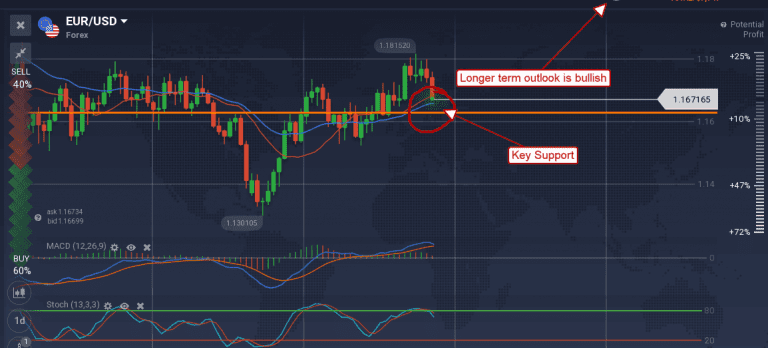

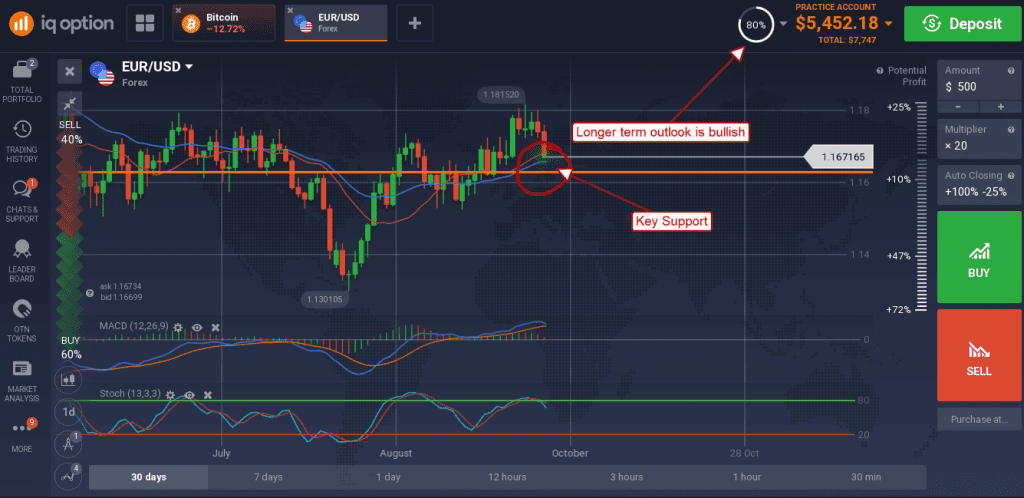

Moving averages are great technical tools for predicting opportune entry levels for successful trades. The moving average provides a gauge by which a trader can judge the fair value of an asset at any given time, and then use that gauge to predict levels where the asset is over or undervalued. The trick with the moving average as a technical entry point is waiting for the right time to enter the trade and in this case, I say the time is now.

The EUR/USD has pulled back to find support above the 30-day EMA on a knee-jerk reaction to news, and with a strong catalyst waiting in the wings. A test of support at the EMA, or a move up from current levels, would confirm support for this theory.

Resistance is currently at the 1.1800 levels and may contain prices in the near-term. A move above the 1.1800 level would be bullish and could take the pair up to the 1.2200 level by the end of the year.