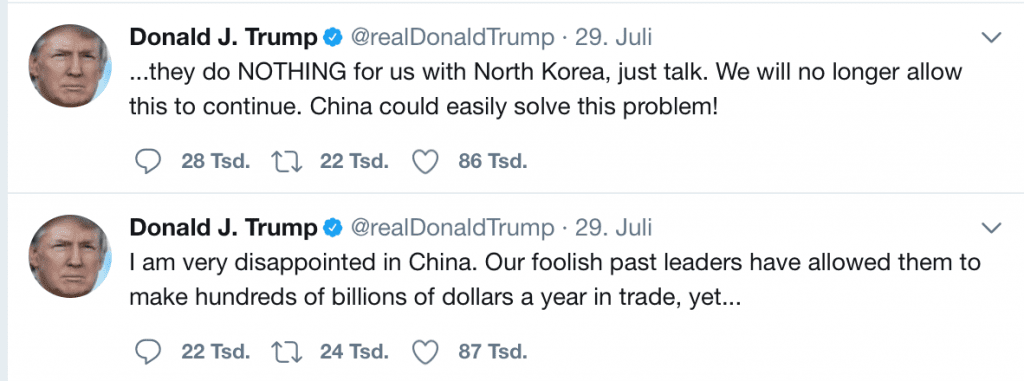

North Korea’s test of a long-range missile that could hit major US cities has drawn condemnation from the US, China, Japan and South Korea, and calls for a rethink in tactics toward Pyongyang, given the dramatic escalation in its capabilities.

US ambassador to the United Nations Nikki Haley late Sunday dismissed claims Washington was seeking UN Security Council action, as it has done following previous tests, pointing out North Korea “is already subject to numerous Security Council resolutions that they violate with impunity.” “The time for talk is over,” Haley said, and instead pointed to China, saying Beijing “must decide if it is finally willing to take this vital step” of challenging Pyongyang, a point that echoed US President Donald Trump Saturday, who said he was “very disappointed in China.” Gold profited from this development, and is likely to profit further.

Maduro Waits for Trump’s Response After Violent Vote

It was political theatre at its best when a smiling Nicolas Maduro arrived at a polling place just after dawn Sunday to be among the first to vote for members of a National Constituent Assembly that will rewrite Venezuela’s constitution, and likely aim to upend six decades of democracy.

For the president, the hand-picked successor to Hugo Chavez, the creation was another step in a stubborn rise to autocratic power in the face of international condemnation, U.S. sanctions, a cratering economy and months of civil unrest that has claimed more than 110 lives. The slate of 545 chosen to staff the new assembly are mostly all Maduro supporters, his wife among the more than 6,000 on the ballot.

While the opposition has vowed to keep up the pace of near-daily protests, the bigger threat is a stepping up of sanctions by the U.S. – the largest buyer of the crude oil whose international sales make up around 95 percent of Venezuela’s foreign currency earnings. “I am confident that President Trump will respond swiftly and decisively,” U.S. Senator Marco Rubio of Florida said in a statement Sunday. “I urge him to impose economic sanctions on the Maduro regime that will not harm the people of Venezuela but will deprive the Maduro regime of the resources they need to remain in power.”

Pokémon Go sued

Niantic’s inability to make Pokémon Go work properly is becoming legend. Basically, if something can go wrong, it will go wrong. And there was a lot of wrong at the high-profile Pokémon Go Fest in Chicago last weekend. It was such a mess that a few dozen players have filed a class action lawsuit against Niantic, alleging false advertising. The plaintiffs are demanding Niantic compensate them for travel to the festival, which was an unmitigated disaster.

A user traveled from California to attend Pokémon Go Fest with the understanding he’d be able to play the game and catch rare Pokémon, and he was far from the only out-of-towner to show up. However, he and several thousand others found they were unable to play the game at all during the event. Niantic has apologized for the situation, but now 20-30 people have joined the lawsuit in search of a more tangible monetary apology. Attendees were offered a refund on the $20 tickets and $100 of in-game currency. The promised legendary Pokémon was also provided. However, the event was a bust, and many players spent a significant amount of money to get there. Niantic has refused to comment on the pending litigation.

Apple removes VPN as Beijing doubles down on censorship

Beijing appeared to have doubled down on its crackdown of the internet in China, with news emerging that over the weekend, Apple pulled several virtual private network (VPN) services from the local version of the App store. Multiple VPN service providers, affected by the decision, slammed the move online, calling it a “dangerous precedent” set by Apple, which governments in other countries may follow.

Beijing appeared to have doubled down on its crackdown of the internet in China, with news emerging that over the weekend, Apple pulled several virtual private network (VPN) services from the local version of the App store. Multiple VPN service providers, affected by the decision, slammed the move online, calling it a “dangerous precedent” set by Apple, which governments in other countries may follow.

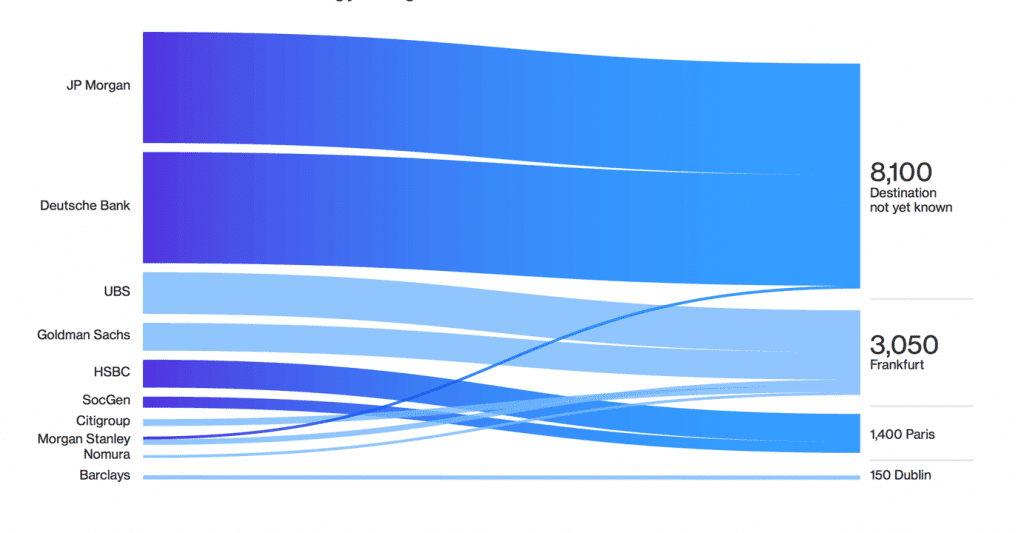

Frankfurt Is the Big Winner in Battle for Brexit Bankers

Frankfurt has emerged as the biggest winner in the fight for thousands of London-based jobs that will have to be relocated to new hubs inside the European Union after Brexit. Morgan Stanley, Citigroup Inc., Standard Chartered Plc and Nomura Holdings Inc have picked the German city for their EU headquarters to ensure continued access to the single market.

Goldman Sachs Group Inc. and UBS Group AG are weighing a similar decision, said people familiar with the matter, asking not to be named because the plans aren’t public. HSBC Holdings Plc is the biggest non-French bank so far to opt for Paris, while Bank of America Corp. has plumped for Dublin. London could lose 10,000 banking jobs and 20,000 roles in financial services as clients move 1.8 trillion euros ($2.1 trillion) of assets out of the U.K. on Brexit, according to think-tank Bruegel.

Goldman Sachs Group Inc. and UBS Group AG are weighing a similar decision, said people familiar with the matter, asking not to be named because the plans aren’t public. HSBC Holdings Plc is the biggest non-French bank so far to opt for Paris, while Bank of America Corp. has plumped for Dublin. London could lose 10,000 banking jobs and 20,000 roles in financial services as clients move 1.8 trillion euros ($2.1 trillion) of assets out of the U.K. on Brexit, according to think-tank Bruegel.

The implications for the U.K. are substantial: finance and related professional services bring in some £190 billion ($248 billion) a year, representing 12 percent of the British economy.

Economic events on Monday, July 31st

10 am – Euro area inflation (flash, July): core inflation is expected to remain steady at 1.1%. Markets to watch: Eurozone indices, EUR crosses10 am euro area inflation (flash, July): core inflation is expected to remain steady at 1.1%. Markets to watch: Eurozone indices, EUR crosses.