Major pairs based on the USD, EUR and GBP have been languishing in trading ranges as outlook for the respective central bank shifts and offset each other. These conditions can provide ample opportunities for swing traders to profit but just as many, if not more, chances to lose. This is because movement within range bound pairs is the hardest to predict and intraday reversals can happen at the drop of a dime. Savvy traders may choose to trade range bound pairs but they all know a trending market is the best market to be in.

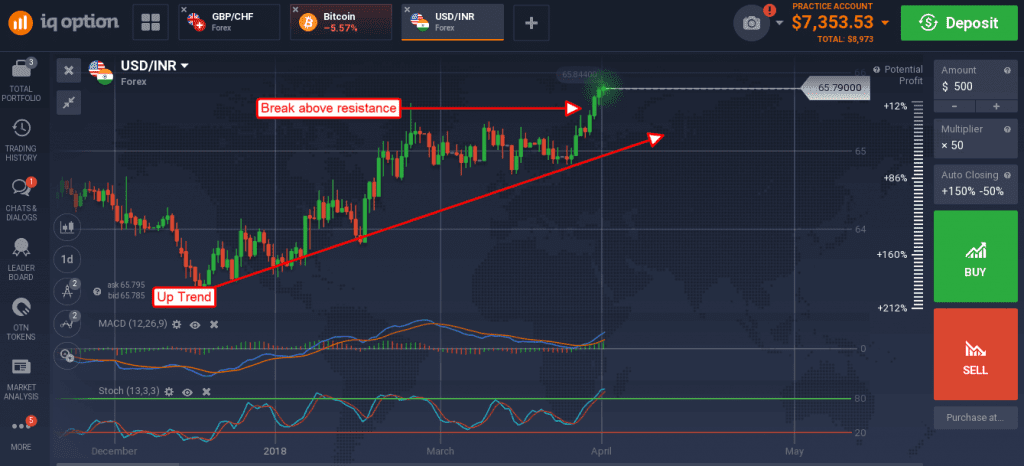

The USD/INR

The US dollar has recently broken out of a consolidation pattern and is on its way higher. This move is driven by FOMC outlook calling for 2 more rate hikes this year which overshadows the Bank of India’s less robust forecast. The pair is now trading at a 7 month high and indicated higher. The indicators are both bullish and pointing higher suggesting higher prices are on the way once resistance is broken near 65.75. Technical projections for this break-out put this pair at 66.00 in the near term and above 66.50 over the next 2 – 3 months.

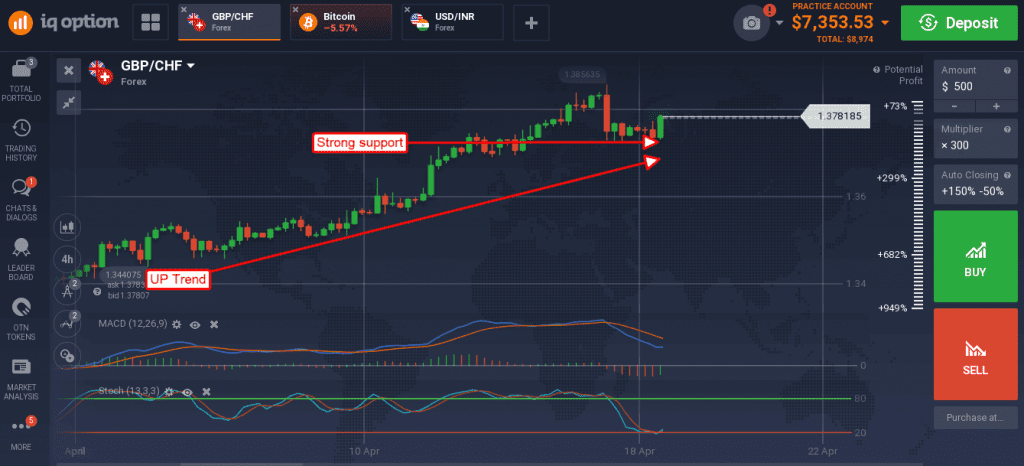

The GBP/CHF

The GBP/CHF has been trending higher over the last 6 week’s and now forming a near-term consolidation pattern with that trend. The uptrend is driven by rising expectation the Bank of England will raise rates next month coupled with a round of weaker than expected inflation data in Switzerland. The combination of rising inflation in the UK and a more risk-on attitude will continue to drive this pair in the near to short term. Resistance is currently at 1.3800 but the indicators suggest this will not hold. A break above 1.3800 would be bullish and likely take the pair up to 1.4200 over the next month.

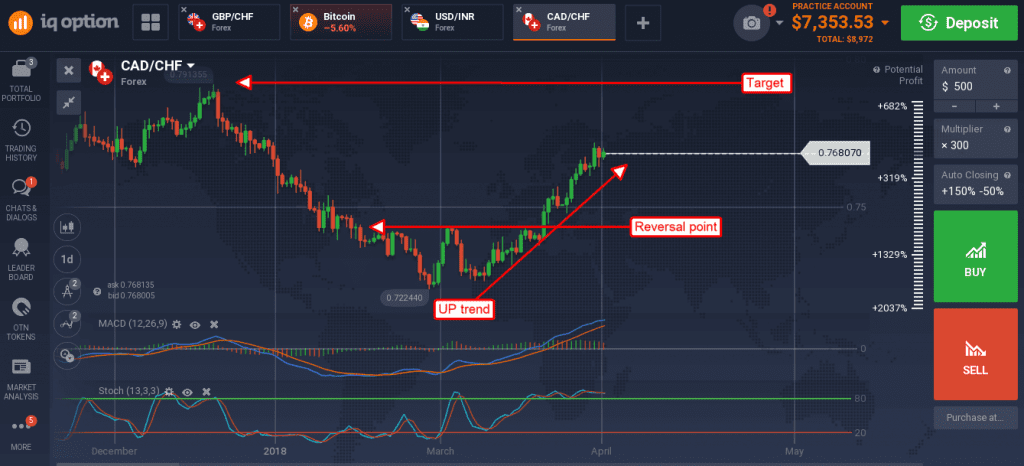

The CAD/CHF

The Canadian dollar is looking very strong against the Swiss Franc. The pair, the CAD/CHF, has been rising over the past month following the confirmation of a head & shoulders reversal. It is now trading just below a potential resistance target near 0.7700 but will likely break it. The indicators are both bullish in support of higher prices although momentum is on the decline. Regardless, momentum remains bullish and will lead the pair higher.

A break above 0.7700 would be bullish with targets near 0.7800 and 0.7900 in the near to short term.