Emerging data shows a downward trend in Japanese CPI that will keep the yen falling in the long term. The data, core CPI, the read is 0.5% and below the expected 0.6%. The number shows increase in overall inflation, but the amount of increase is slowing and trending lower over the long term despite best efforts of President Shinzo Abe and Bank of Japan Governor Haruhiko Kuroda.

A look at the charts provided by the BOJ show that over the past three years inflation has retreat from a high, bounced and is now peaking at a much lower rate. This is in tandem with other signs of economic weakness which have emerged over the past quarter which have diminished expectation the BOJ would begin to tighten policy anytime soon. With inflation running cool, well below the 2% target, and receding it is far more likely we’ll see the BOJ act to support the economy than move to curb growth. That’s reason #1.

Japan is expected to release a lot of data this week, data that will shed further light on the economy. On the inflation front there is manufacturing PMI that, when coupled with the All Industries Activity Index and leading indicators, could further undermine the BOJ’s efforts. Considering Japanese data has been weak and below expectation of late I do not expect to see much strength in the data that is released this week. That’s reason #2.

Reason #3 is this; the US economy is showing signs of expansion; the EU economy is showing signs of expansion and the UK economy is showing signs of expansion that are leading to steady increase in underlying inflation. . . and this week we’ll get data from all three regions in support of that. In the US there are reads on both services and manufacturing PMI, along with the minutes for the last FOMC meeting, to support the dollar. The USD/JPY fell in Tuesday trading as the dollar took a breather, but the pair is poised to move higher. Resistance is near 111.45, a level that may keep prices in consolidation for a few days, but once that level breaks a move to 112.00 and 113.00 is highly likely.

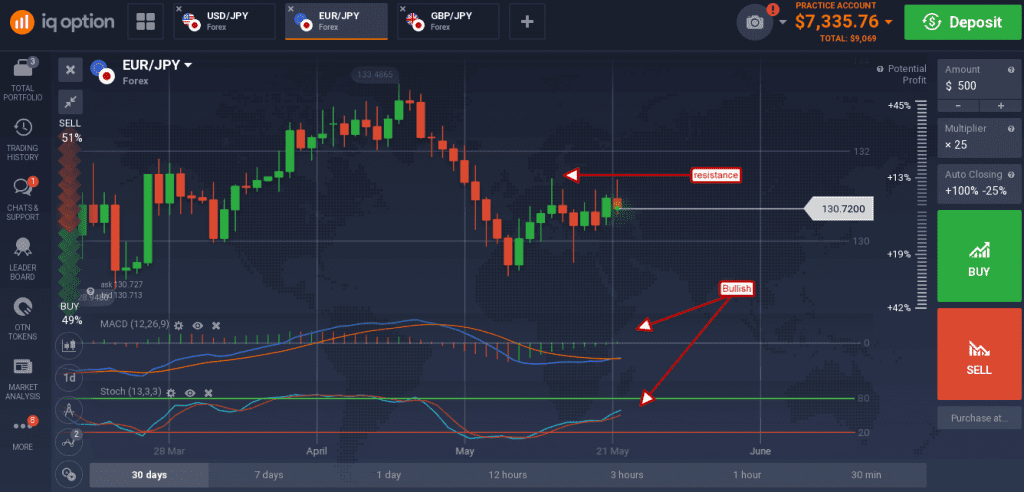

The EUR/JPY is trending sideways within a range and showing signs of reversal within that range. The pair has been wallowing within this range for some time as EU and Japanese data conflict, the difference now is that Japanese data is weakening while there is an expectation for EU economic expansion to begin accelerating.

The pair has formed a double bottom at the lower end of the range that is supported by the indicators. Stochastic has been trending steadily higher over the past two weeks, consistent with rising prices, and has some way to go before it is overbought. Momentum confirmed this with a bullish crossover in Tuesday trading. A close above the moving average will be bullish and likely take the pair up to 132.00 and 133.00 in the near term.

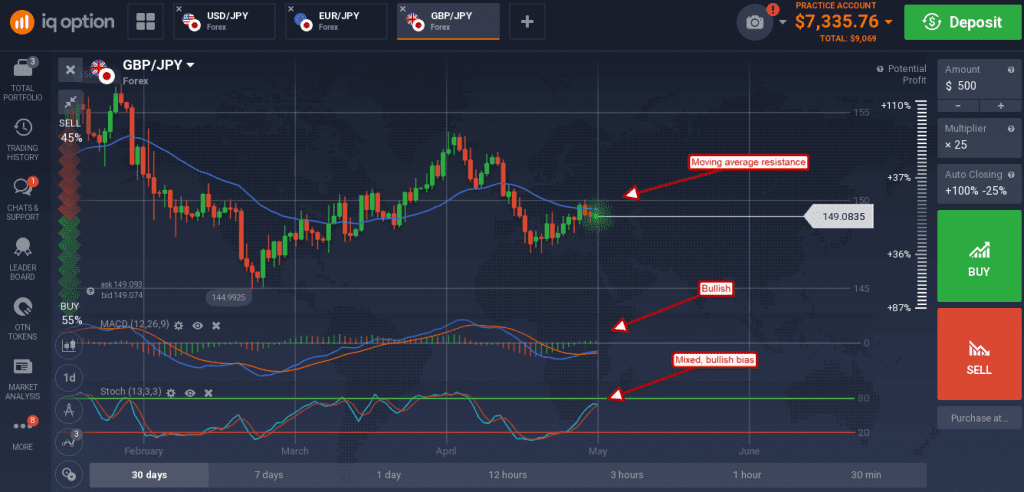

The GBP/JPY is trending with a similar range and likewise poised to move higher on this week’s data. In the UK there is a raft of inflation data due out over the next 48 hours traders should be on the alert for.

Should this pair move up to close above the moving average or, better yet, the 150 level, a move up to 152.00 and 154.00 is likely to follow.