A round of central bank policy meetings has just ended with no change and the major forex pairs remain trapped within their ranges. Both the ECB and BOE left policy unchanged and remain on track with their respective plans, neither sparking much move in their respective currencies. What did move the euro and pound was weaker than expected inflation data from the US that pulled the rug out from under dollar bulls.

The US consumer price index came in at 0.2% headline and 0.1% core, both a tenth shy of expectations. This news is the second of the week to show inflation running cooler than expected and points to less need for future FOMC rate hikes.

The BOE decision was released first and came as no surprise. The Monetary Policy Committee voted unanimously to hold rates steady and to continue with QE measures indefinitely. The measures, monthly purchases of corporate and government bonds, will remain in place despite tightening labor markets and above-target inflation. The bank says it will need to raise rates in a gradual and incremental fashion to bring inflation down to the 2% target.

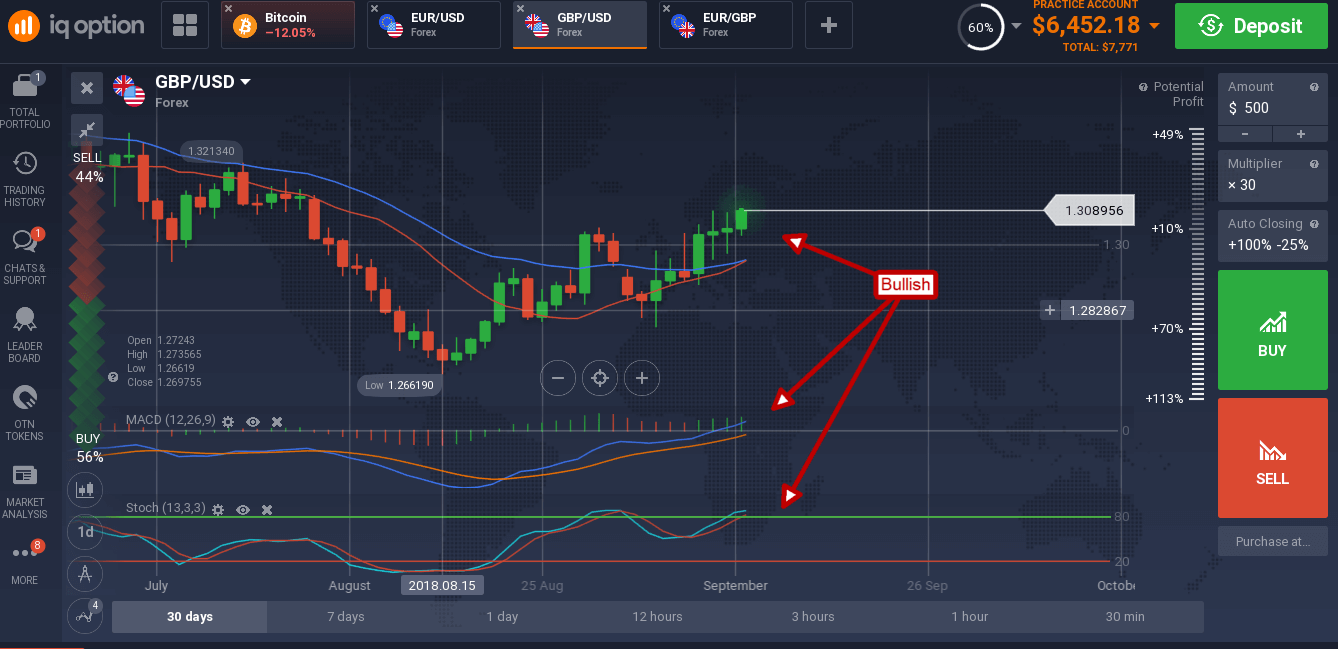

The GBP/USD moved up to extend a rebound from long-term lows. The pair moved up to test resistance at the 1.3090 level and looks like it will move higher. The indicators are both bullish and on the rise, which is consistent with rising prices. A move above 1.3090 will be bullish and could take the pair up to test 1.3300.

The ECB decision was also as expected. The bank maintained its current policy and reaffirmed plans to begin tapering bond purchases next month. The taper will last for three months and should result in an end to QE by the end of December 2018. The ECB also says interest rates will remain at their current low level until at least the end of summer 2019 and possibly longer depending on need.

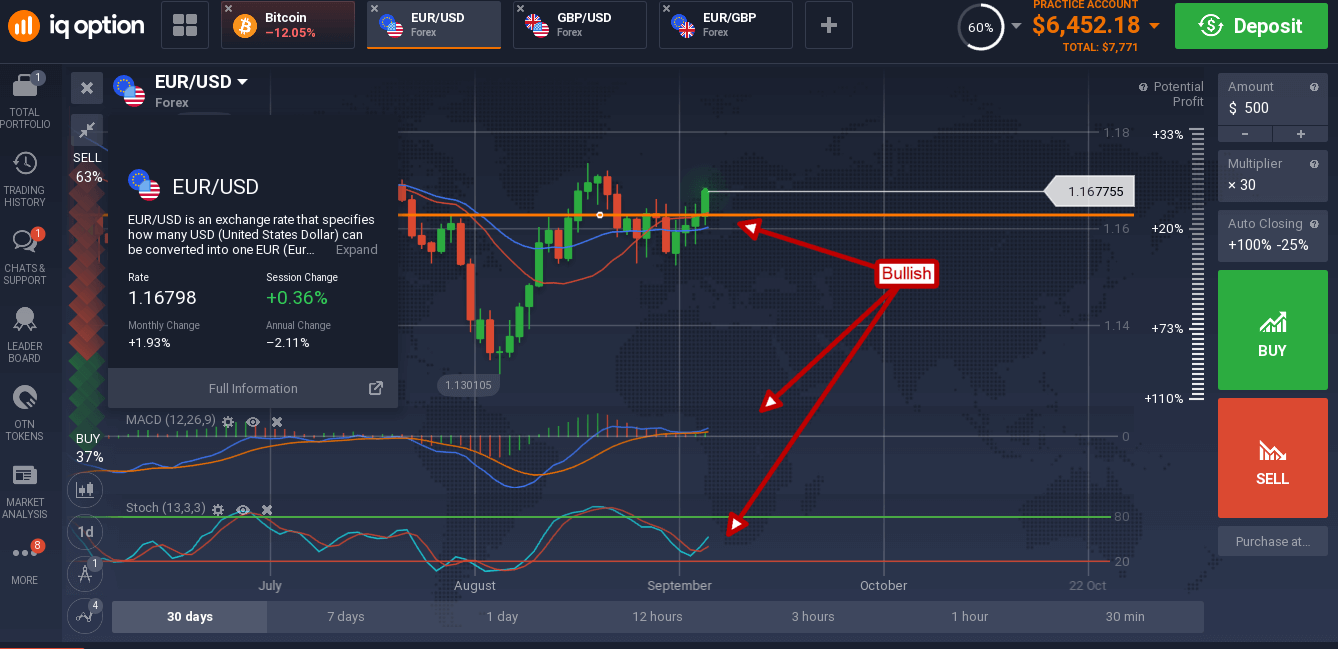

The EUR/USD shot up on the CPI data and is confirming support at the short-term moving average. The candle formed in early Thursday trading is bullish and indicated higher by both MACD and stochastic. Now that that the pair is on the move we can expect to see it continue up to 1.1720, a break above that level could see the pair move up to 1.1800.