The US Justice Department, along with the CFTC, have opened an investigation into alleged price manipulation in the Bitcoin market. The investigation comes at the urging of market participants purporting the said is indeed happening. The focus of the investigation is on schemes such as spoofing and wash-trading. Spoofing is when a trader floods the market with fake orders to bait others into taking the opposite side, wash-trading is a practice in which a trader or exchange could amplify trading volume by trading large volumes with themselves.

The news sent Bitcoin’s price to a new one month low as regulatory concerns hang over the market. Action in South Korea, Japan, Indonesia and the Philippines, among others, have kept the entire cryptocurrency market under pressure in 2018. Gemini Trust, the cryptocurrency exchange set up by Tyler and Cameron Winklevoss, is leading efforts within the US to spot and stop alleged market misuse. The CFTC, while not officially regulating Bitcoin, is able to impose fines on spot trading platforms that facilitate BTC trading.

Singapore is also making news that has helped BTC prices fall. The Asian nation has embraced cryptocurrency regulation and just issued warnings to 8 exchanges for offering cryptocurrency that are deemed securities or futures contracts. The warning only goes so far as to say that an exchange not registered to trade securities is listing said tokens they must cease until registration and licensing can be completed.

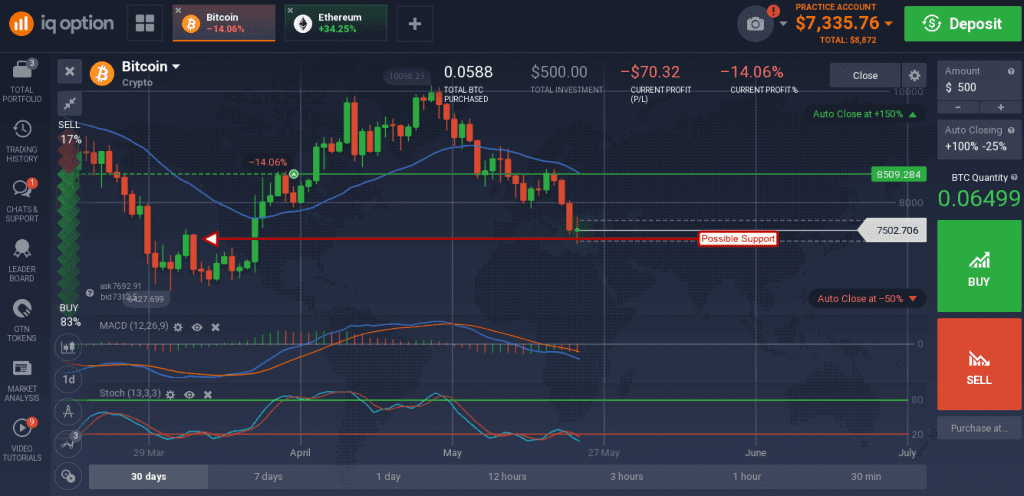

What this means for traders is simple; Bitcoin is heading lower and may retest the bottom of its trading range. The charts don’t look good for the bulls. The coin is moving lower after confirming resistance at the short term moving average and the indicators are in alignment. Both MACD and stochastic are pointing lower after bearish crossovers, indicative of lower prices to come. There is a possible support target at the bottom of Thursday’s candle, a break below there would be bearish. The target is $6675, a level that has provided support several times in the past.

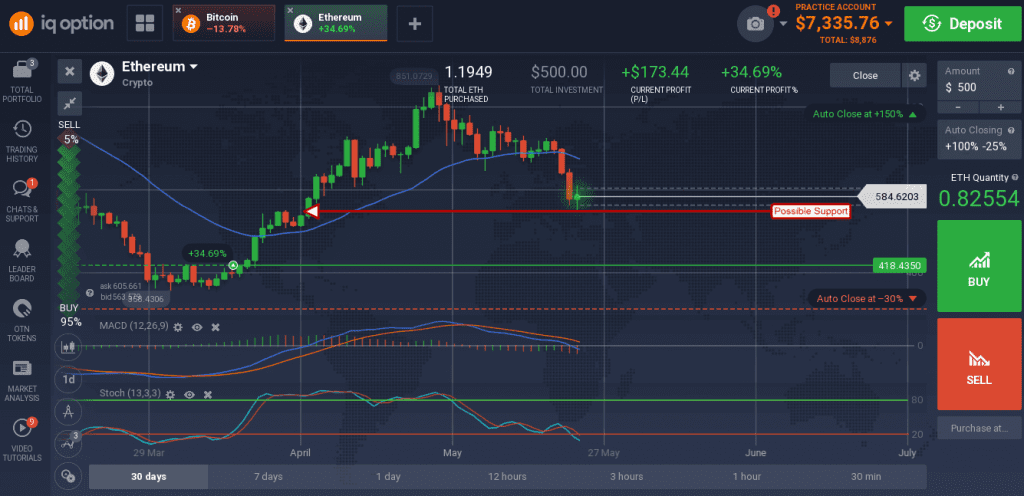

Ethereum, the worlds second largest cryptocurrency by market capitalization, is not immune. Regulatory concerns for one token is a concern for all. As regulators crack-down access to markets will become more restrictive and that will affect liquidity. Ethereum has shed more than 20% in the last week alone and looks like it will move lower in the near term.

The indicators are both converging with the new lows suggesting this move has only just begun. A move to $400 is not out of the question although support targets exist at and above the $500 level as well.