Trade war and geopolitical tension dominate the news but not the fundamentals, don’t let it distract your trading. These are the events you need to watch this week.

Geopolitical Tension: Don’t let it distract your trading

Trade war, tariffs and geopolitical tension dominate the news daily, but they have not altered the fundamentals. Along with this weeks expected trade war rhetoric there are several key events that could easily move forex markets. This is what they are.

Number 1

The US Dollar has been gaining strength on bullish comments from the FOMC and an expectation they will continue to raise rates. The issues that outlook for rate hiking is mixed, will there or won’t there be two more hikes in 2018, and that question is driving dollar denominated pairs. This week US data includes a revision to 1st quarter GDP estimates, the lesser of two market moving events, and the monthly Personal Income and Spending data. GDP is expected to hold steady or rise slightly from the previously released 2.2%, great for the economy, but it will be the PCE price index that truly affects trader sentiment. Traders are looking for clues to when and how many more rate hikes may be needed, hotter or weaker than expected PCE prices will sway sentiment.

Number 2

The EU is facing a raft of general, and generally unimportant, data this week. It is also facing three events that will drive market sentiment for the euro over the long term. The first is the quarterly ECB economic bulletin, in its expect to find indications of strengthening within the EU economy, the second is the EU leaders summit scheduled to occur Thursday and Friday. While not a policy meeting, it is a chance for one and all of the EU’s leaders to make market moving comments. The important data, however, will come on Friday with the all-EU CPI. CPI is expected to advance at the headline level but fall at the core, an event that could weaken the single currency against its key rivals.

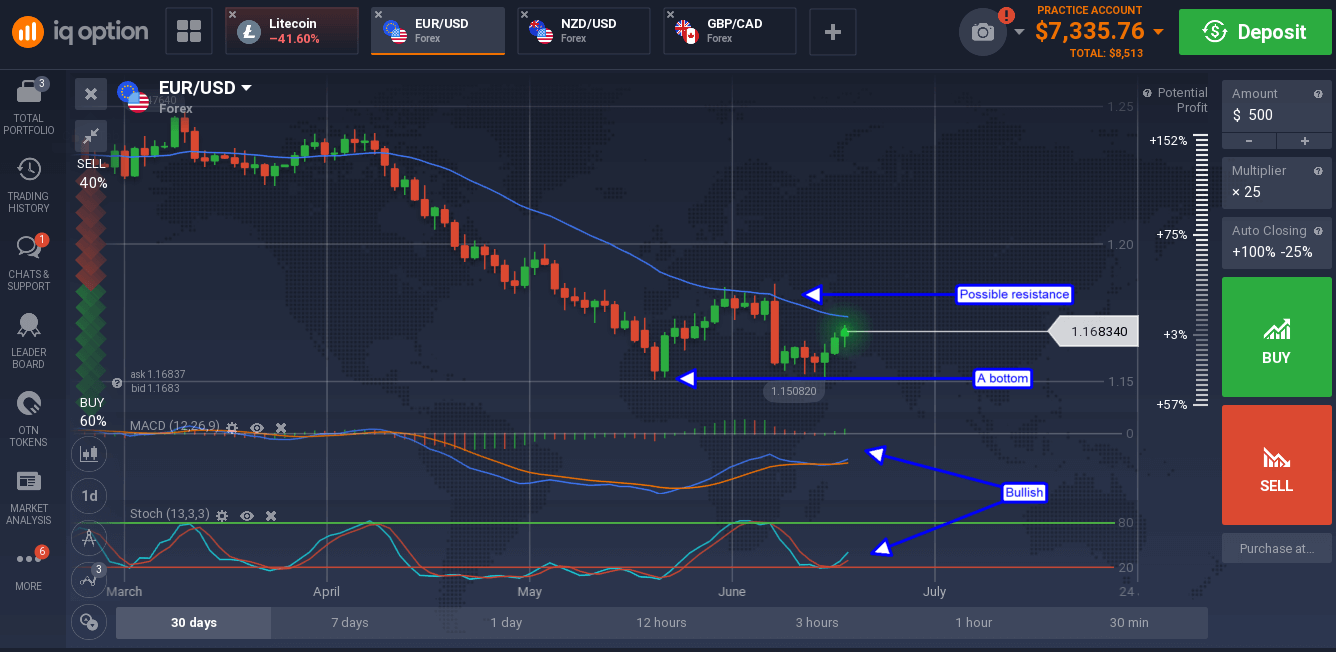

The EUR/USD was moving higher in early Monday trading. The support level at 1.1555 has held and looks like it will continue to hold at least until later this week. The indicators are consistent with support at this level on the weekly and daily charts, both showing significant divergent from the recent lows and strong bullish signals on the daily, so a move higher can be expected. A double bottom is a still a possibility with this pair but will not confirm until price has risen above 1.18000 and closed there. Until then traders should watch out for resistance at the short term moving average, a break above that would be bullish.

Number 3

The Reserve Bank of New Zealand is holding its policy meeting this week and expected to release its statement late Wednesday. The bank is not expected to raise its rates but may make hawkish comments about the economy, inflation or both. The New Zealand Dollar is poised to reverse, and such an event could make it happen with the caveat US data is also expected out this week. The NZD/USD was weakening in early Monday trading but still above key support.

The indicators are consistent with that support, near 0.6860, and indicate a shift in momentum at least. A move up may find resistance at the short term moving average, a move above that would be bullish.

Number 4 and 5

UK GDP revisions are due out on Friday. The revision is expected to hold steady from the previous release and have little to no effect on the Pound (a miss or beat would affect the pound). Canadian GDP is due out a little later in the morning, expected to decline on weakness with US trade, and could easily tank the Canadian Dollar.

The GBP/CAD is during a Vee bottom reversal that will move higher provided the UK and CAD data comes out as expected.