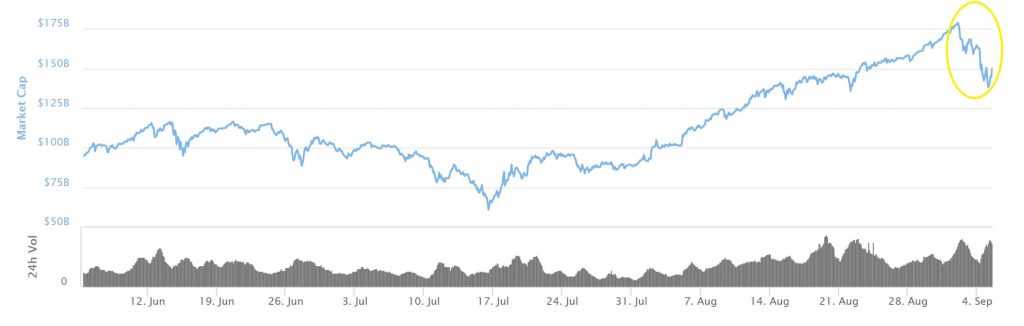

News of China banning all ICO’s ravaged the cryptocurrency market like a storm. BTC was down 8% on Monday and lost additional 4.6% on Tuesday. Ethereum in turn depreciated 20% and 5% on Monday and Tuesday respectively. China’s ICO ban is only the first step in the chain of tougher cryptocurrency-related rules, officials say. Other countries are expected to follow the example of the Asian economic powerhouse. In the near future South Korea is going to ‘punish’ ICOs, as well. The United States, Singapore and Canada have expressed their readiness to regulate initial coin offerings like other securities.

Should tougher regulations be introduced in an ever-increasing number of countries, the exchange rates of Bitcoin, Ethereum and other cryptocurrencies can be expected to go down. The reason for this is simple: many ICOs are funded in digital currencies, BTC and ETH in particular. With this practice going obsolete, the demand for cryptocurrencies will deteriorate, making prices plunge.

On the other hand, certain members of the bitcoin community truly believe that the practice of tougher regulations will benefit the ecosystem and the price action in the long-run. “Regulation of ICOs is the best thing that could have happened to Bitcoin. From now on there won’t be any reckless issuance of virtual currencies,” said one of the QQ.com users.

According to this theory the prices of bitcoin and Ethereum, as well as less popular cryptocurrencies, can be expected to depreciate once tougher regulations are introduced. The decision of the United States, if made, will have tremendous effect on the state of the crypto market. In the long-run, however, the prices can be expected to demonstrate steady growth. Many consider this significant market movement to be an opportunity to invest in Bitcoin and Ethereum where as others believe that tougher restriction will have a negative impact on cryptocurrencies.