A key policy maker with the Bank of England has come out and said it plain; the market is miss-pricing the pace of BOE interest rate hikes over the next 12 months. For the most part, the market has priced in a single rate hike and that, according to Michael Saunders (a member of the policy committee), is far too cautious. “If the economy plays out as I expect, it may be that rates need to go up a little faster than that.”

Saunders is one of the more hawkish members of the committee, having actively voted for rate hikes at the last 3 meetings, and sees business investment driving growth despite the overhanging shadow of Brexit. He qualifies his statements with the idea Brexit would unfold smoothly and at a gradual pace that would allow for continued growth in the UK economy, declining unemployment and rising wages.

Saunders stance highlights results from the last BOE meeting. The bank decided to hold rates steady, as expected, but a surprising number of members had voted in favor of hiking now (three members versus the expected two, the surprise vote coming from the BOE’s chief economist) in evidence of a growing need to control inflation. The vote has even led some to speculate a rate hike could come as soon as the next meeting to be held the 2nd of August.

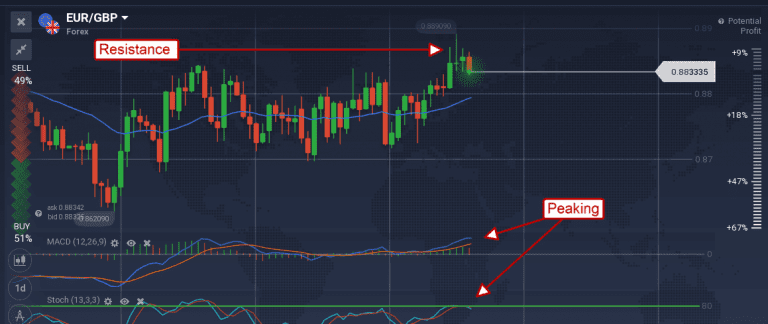

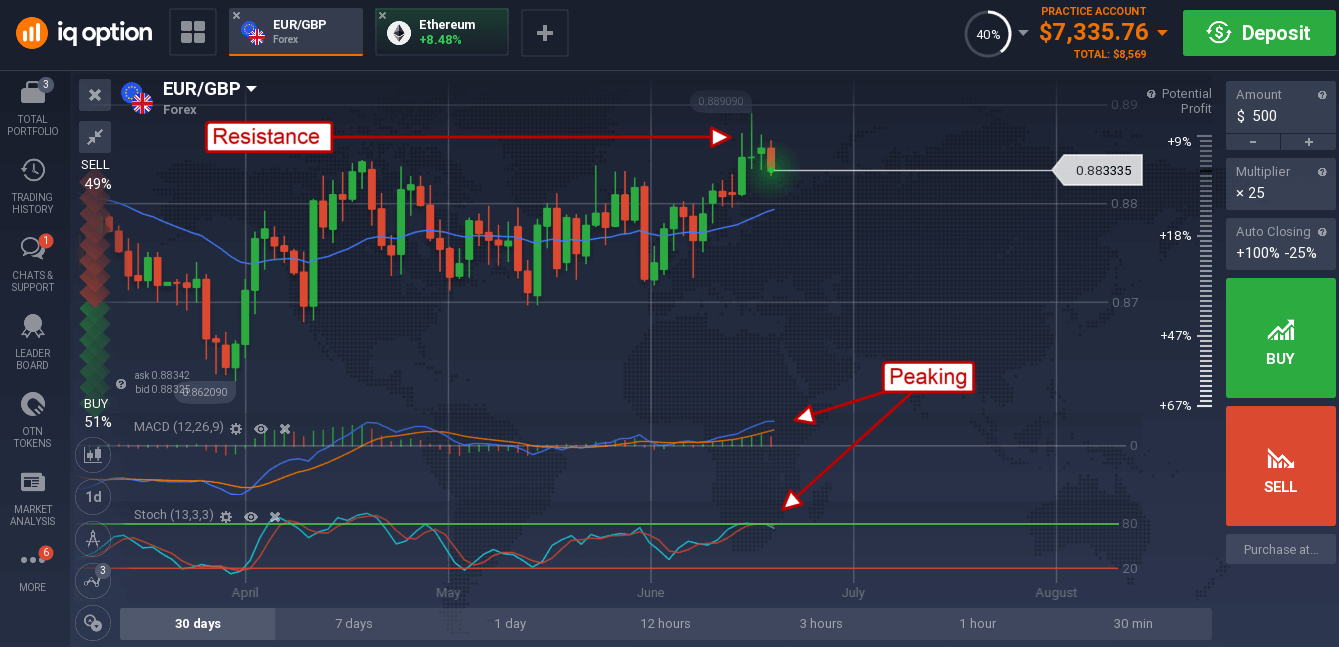

The pound firmed on the news although the reaction was muted. The news does reinforce a hawkish/bullish outlook for the pound but does little to affect fundamentals without an official statement from the bank itself. The EUR/GBP shed a quarter percent in response to the news and is confirming the presence of resistance at the 0.8850 level. This level is consistent with the upper end of a long-term trading range and may provide a pivot point for reversal. Stochastic has already confirmed resistance with a bearish crossover below the upper signal line, MACD remains bullish but has peaked and is in decline.

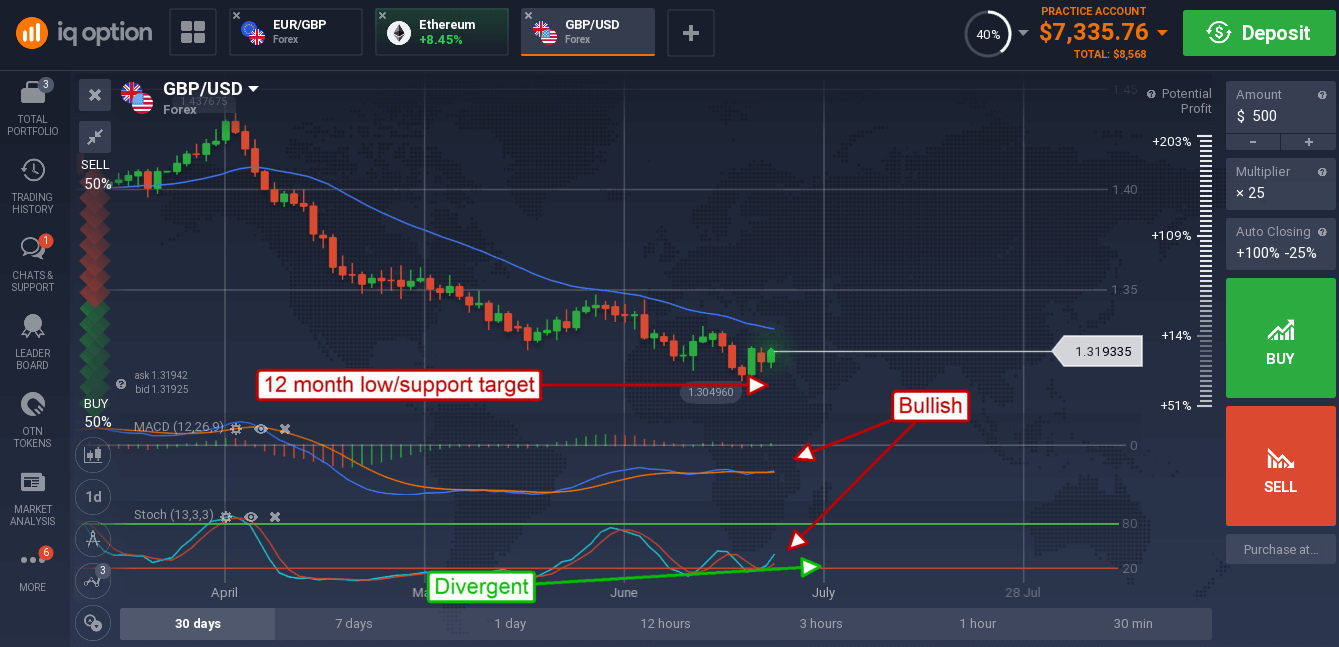

The GBP/USD has been in a downtrend for many weeks and is showing signs of potential reversal. The pair moved up on Tuesday’s news, accompanied by bullish indications in both stochastic and MACD, in evidence of support. Support is near 1.30725 and a one year low, a move from this level would be bullish.

The caveat is resistance at 1.3025, the short term EMA, which would need to be broken to confirm reversal. Positive data and hawkish comments from the UK and BOE will spur this move. The risk is US data, some due out this week (NFP, unemployment, hourly earnings), that could firm FOMC outlook.