The FOMC released the March policy statement and largely met expectations. I say largely met because they are a bit more hawkish in the near term while maintaining the stance interest rates would remain low over the long term. The statement came with quite a few changes detailing their stance and inducing volatility in the forex markets.

Jerome Powell, in his first meeting as Fed Chairman, decided to raise the overnight rate by 25 basis points to a range of 150 to 175 bps on signs of firming economic activity. They see a need for continued gradual hikes although with a recent upgrade to outlook, the pace of hikes may be quicker than expected.

The committee did not indicate the need for more than 3 hikes in 2018 but does see the need for additional tightening in 2019 and 2020. Economic expansion is projected to continue accelerating this year, reaching +3% levels, with ongoing recovery in labor markets expected as well. Despite the improvement to forward outlook the FOMC did not step-up their inflation targets and that will keep interest rates low in the long term regardless the pace of hikes now.

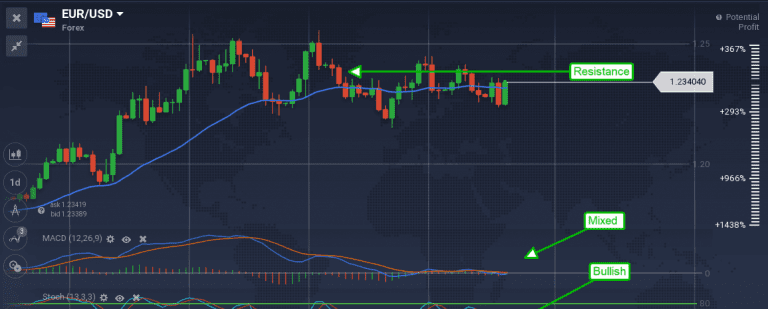

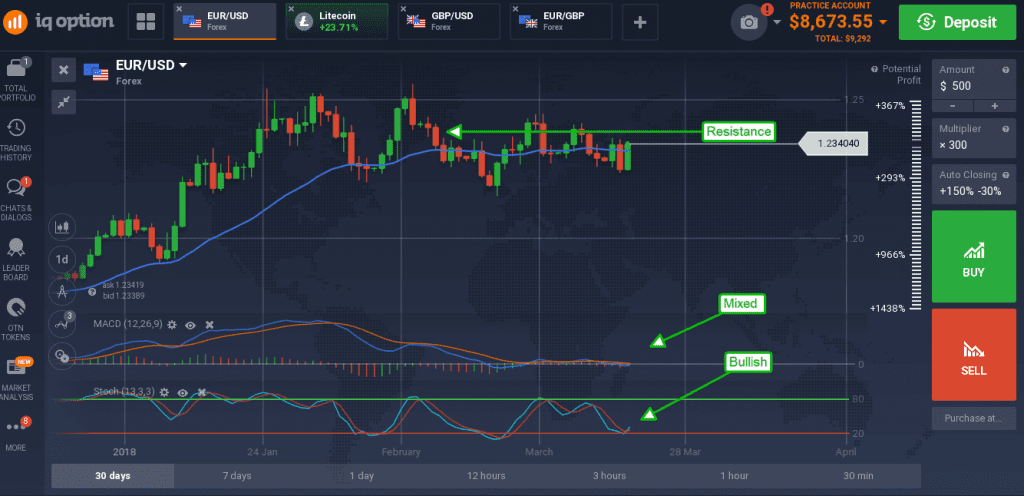

The EUR/USD jumped on the news as US interest rates are not expected to rise above market estimates in the long run. Volatility set in as traders digested the details, but euro bulls won out in the end. The pair moved up from support near the bottom of its trading range but remains trapped within that range. Wednesday’s action is bullish but does little to alter longer term outlook. Price action was halted at the midpoint of the range, just above the short term moving average, and does not look strong. The indicators remain weak, consistent with range bound trading, and may remain that way if no catalyst emerges. A move above the midpoint may take the pair up to the top of the range, near 1.2500, with possible targets for resistance at 1.2360.

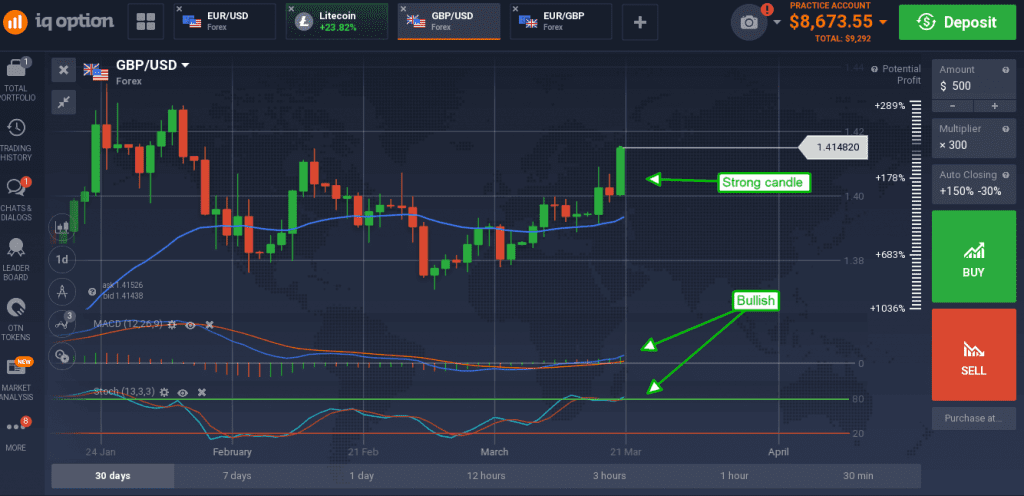

The dollar weakened versus the pound on expectation the BoE would indicate a rate hike in their policy statement due out in the early hours of Thursday morning. The bank has stated they would be raising rates sooner and faster than the market expected leading many to believe a hike could come in the April meeting.

The GBP/USD made a strong move up from support at the 1.4000 level and looks likely to move up to test resistance. Resistance is at 1.4300 where price advance has been rejected before. The indicators are bullish and leading the market higher to retest resistance. The risk is the BoE, if they fail to meet expectations the pound could see a big fall.

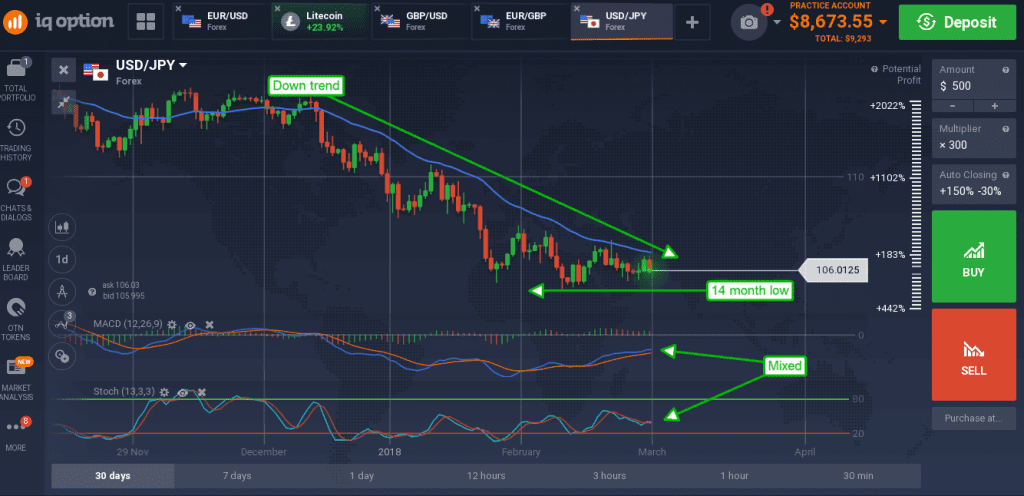

The dollar weakened versus the yen as well, falling from Tuesday’s high to approach the long-term low near 105.50. This low date back more than a year and is a likely point of support and possible reversal. The indicators are both bearish and weak, suggesting a further decline in prices that may take the pair down to the low and below.

A break below the 105.50 support target would be bearish and confirm the three months down trend with a target near 100.00.