Recent central bank activity has brought volatility to euro-based forex pairs over the past month. Despite this the single currency has managed to hold firm at key support levels versus most major currencies. Thursday’s data suggests economic conditions in the EU are better than feared setting the euro up for a big move against the US dollar and British Pound.

To start, EU business sentiment fell less than expected as the effects of global trade disputes and tariffs are shrugged off. The EU Consumer & Business Survey came in at 112.3, down from the previous month’s112.5, on strength in services and manufacturing. The Services and Industrial Sentiment Indicators both held steady from the previous month versus expected declines as investors look past near-term fear to longer term fundamentals.

In the US the second revision to 1st quarter GDP came in weaker than expected but the data was mixed. The 1st quarter PCE price index and the GDP price index both came in hotter than expected and helped to halt an early advance posted by the euro. The mitigating factor is that the data is rear looking, it’s nearly 3 months old, has been addressed by two FOMC rate hikes and overshadowed by a current read on PCE prices due out on Friday.

Friday’s data will be especially important as it contains important reads on both EU and US consumer level inflation, either of which could move the EUR/USD. EU level CPI is expected to edge higher while US PCE prices are not, a combination that could send the EUR/USD shooting higher.

The pair is currently sitting on a key, long term support level that will dictate future movement. A move up will confirm support and the possibility of reversal with the caveat resistance is just above at the short term moving average. A touch to this level may spark another round of selling so caution is due. A break above this level, near 1.1700 would be bullish.

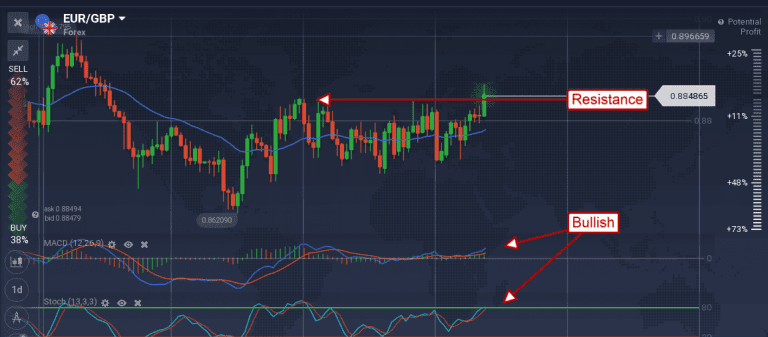

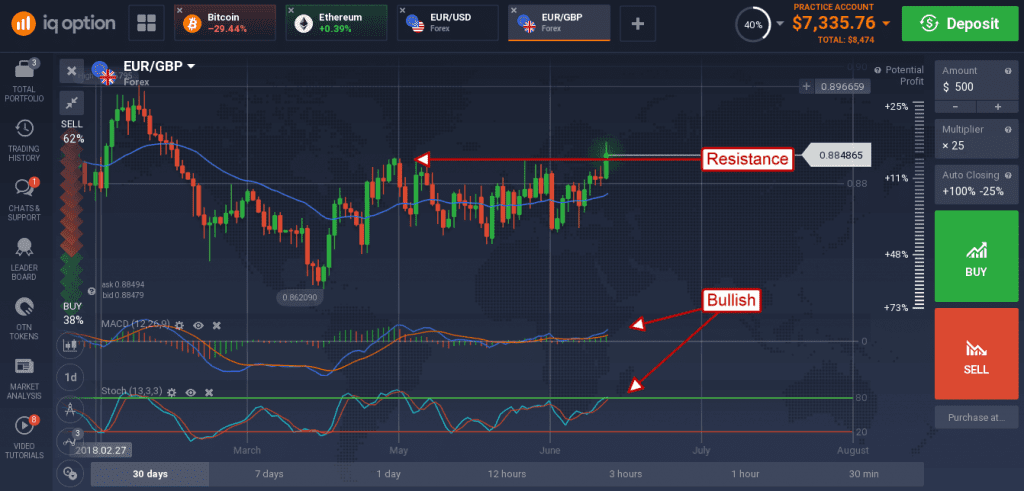

The euro is also posed to rally versus the pound and that rally has already started. The Thursday data sent the EUR/GBP shooting up to break out of its near trading range to set a new 3.5 month high. The indicators are bullish in support of the move and suggest higher prices are on the way. The caveat is UK data in the form of GDP revision, also due on Friday, that may curb gains.