US economic data shows sustained, robust growth in June. The data, Retail Sales and the Empire State Manufacturing Survey, both came in as expected but the expectations were good. While otherwise a catalyst for dollar bulls data within the data show price gains are slowing and that sapped strength from the dollar.

Retail sales grew at a 0.5% rate in June, in line with economist’s projections, and come with the bonus of upward revision to the previous month’s data. May was revised higher by 0.5% to 1.3% which, along with the June gains, brings the annualized total +6.6%.

The Empire State Manufacturing Survey fell a little more than -2 points to 22.6. This shows slowing of expansion within the sector but is still positive, consistent with robust gains in the manufacturing sector. New Orders and Shipments both fell but remain positive while Delivery Times and Employment both showed expansion.

The surprising bit of news, and the information that kept the dollar from advancing, was the Prices Paid Index. Prices paid fell a full ten points showing moderation of price advance but remains high and over 42.0. This data supports the Fed’s rate hiking program but not the need for additional hikes, or hikes at a faster pace than what is already expected by the market.

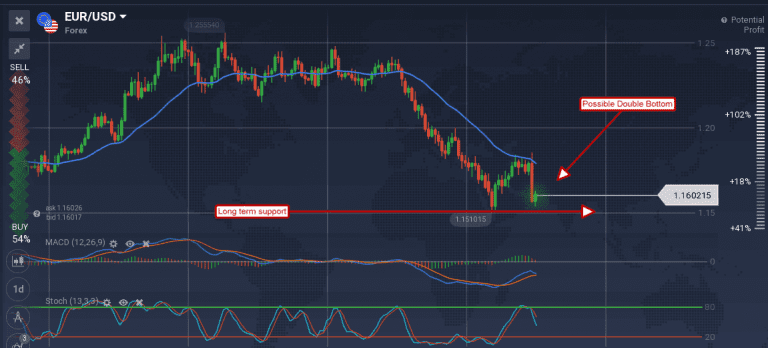

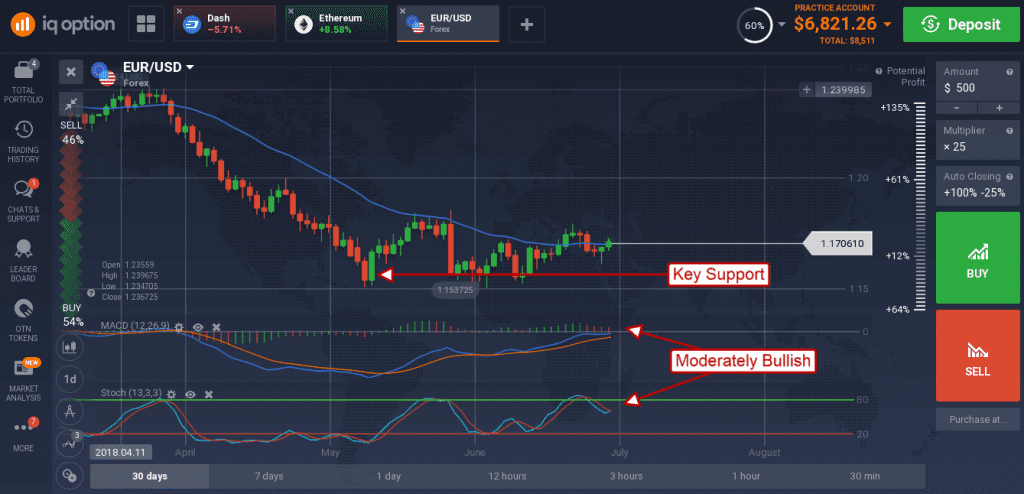

The EUR/USD moved higher in early trading but was halted shortly before the news. The pair hit resistance at the 1.17200 level where it may reverse course. The caveat is that the pair is trending within a consolidation zone and above key support so any downward fall from Monday’s early high is likely to be minimal.

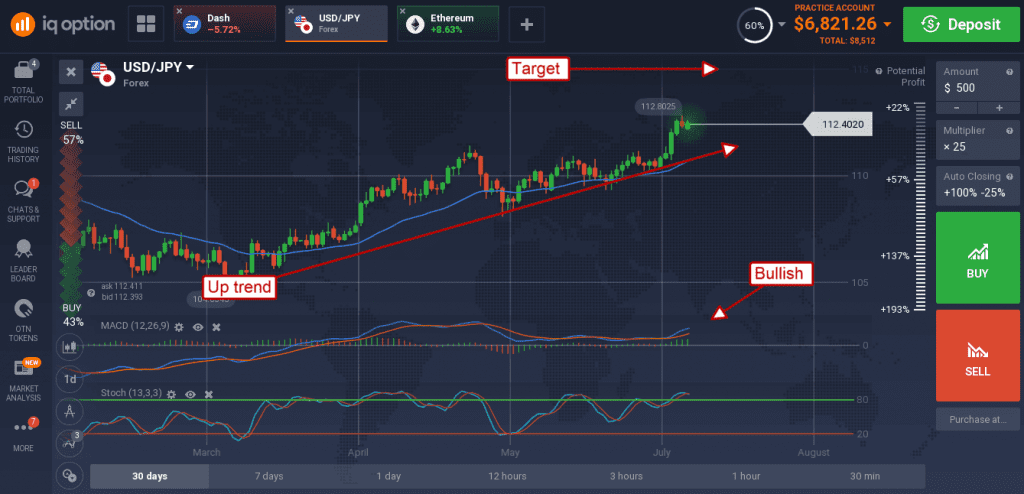

The USD/JPY faltered in early Monday trading but remains in uptrend for the short term. The pair formed a small green candle near the close of Friday’s session and within a forming consolidation pattern. The indicators are bullish and convergent with last week’s high suggesting growing strength within this market. The pair may trend sideways this week as data is very light although upward bias should be expected. A move to new highs would be bullish and likely take the USD/JPY up to 113.50.

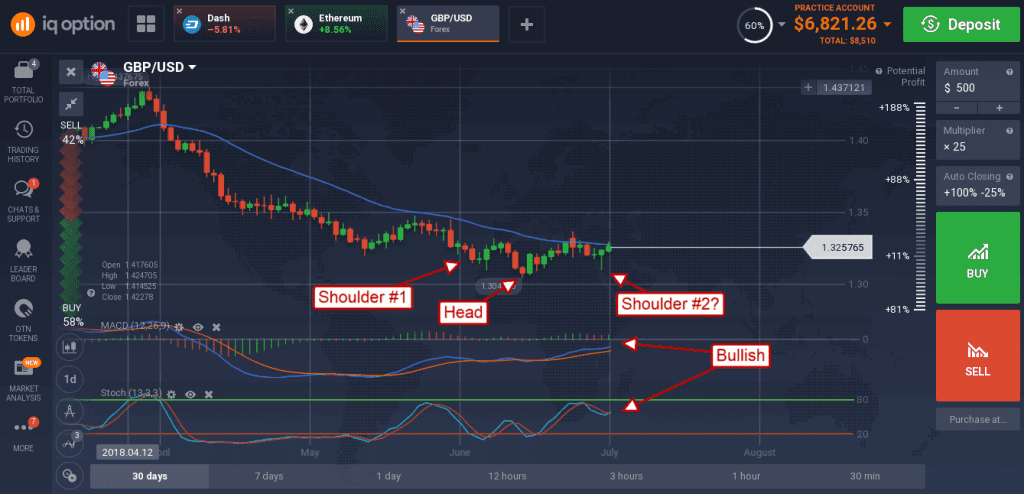

The GBP/USD moved sideways in a mixed session early Monday. The pair moved up off last week’s retest of support to retest resistance at the short term moving average. The resistance was confirmed but not strongly and leaves the pair set up to complete a budding Head & Shoulders reversal.

A move up and above the moving average would be bullish and confirm the reversal. A move lower is likely to find support near 1.3100.