Acuity Brands Inc (AYI: NYQ) is one of the leading providers of innovative lighting systems globally – with a product range that includes LED lighting, lighting controls as well as related add-on products. The company now provides lighting solutions for a wide range of customers across North America as well as globally – including government organisations and large corporate institutions. The lighting company is due to report Q3 earnings on the 29th June 2017 prior to the opening bell.

1) Share Price – Taking a Tumble

Acuity Brands shares have experienced a series of significant and sharp drops over the past calendar year – now trading at 175.33USD per share and down over 23% over the past twelve months. The levels of volatility are high and dominated by downside movement.

The company has been hurt especially by economic factors of the US environment – rising interest rates combined with fluctuations in the dollar have driven margins lower across the entire lighting industry. Further to this, negative earnings reports over the past year have contributed to the series of sharp falls in share price. It is worth noting that the lighting industry on average has experienced a decline in share price of 22.9% over the past twelve months.

2) Earnings Expectations

Acuity Brands reported Q2 2017 earnings of 1.77 per share in April of this year – a figure which met analyst consensus expectations and provided a 9.94% improvement on the Q2 2016 reported earnings figures.

The analyst consensus expectation for the Q3 2017 earnings per share (EPS) is 1.92 USD per share – indicating an expectation of 1.9% growth compared to Q3 2016. The average quarterly earnings growth rate over the past five quarters for Acuity Brands in 3.56%. Revenues are also expected to grow by 3.5% year on year for the most recent quarter.

3) Profit Contraction

Acuity Brands and its industry peers have been experiencing severe margin contractions over the past 6 months. Reduced shipment volumes have accompanied slowing demand and driven margins lower. This is forecast to continue through the remainder of 2017.

In particular, economic conditions in North America and Europe have led to reduced demand. Further to this, when it comes to wider global sales, the company has suffered labour supply issues – causing bottlenecks in distribution chains and stalling large projects and their accompanying revenue streams.

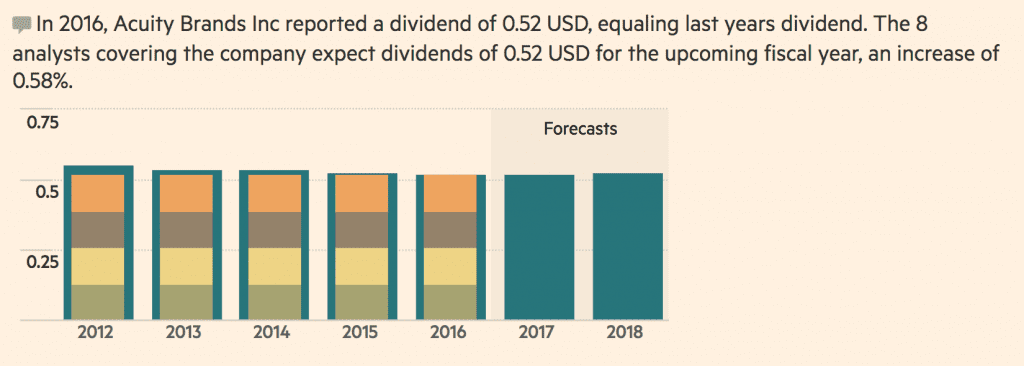

4) Dividends – Showing Stability

Acuity Brands reported a dividend of 0.521 USD for 2016 – which was exactly equal to the previous year’s dividend. This indicates some stability in dividend return. Further to this Wall Street analysts are forecasting a 0.58% increase in dividends this year – with a forecast figure of 0.525 USD per share for the 2017 financial year.

5) Fundamentals – Potential to Drive Future Growth

Despite its troubles over the past year, Acuity Brands has a number of fundamental factors in place that indicate it can deliver strong rates of growth over the medium to long term. As the number one lighting fixture provider in the Northern US region the company has a solid customer base on which to leverage upon.

The company has indicated a positive outlook particularly in this region and forecasts an increase of over 30% in sales in North America over the next five years that will be driven by a strategy to expand the energy efficient lighting segment.

6) Outlook into Potential

Given the significantly low share price at this time there is a cheap entry point. The success of a potential long-term investment will depend on how effectively company management are able to leverage upon core company strengths and execute on planned strategic initiatives.

Will you be watching the Acuity Brands data? Tell us in the comments.

Sources:

- https://www.acuitybrands.com/

- https://markets.ft.com/

- http://www.nasdaq.com/symbol/ayi