J&J is going to release its earnings report on Tuesday, 18th of April. Johnson & Johnson (NYSE: JNJ) Stock is an American international company with interests in the spheres of pharmaceuticals, medical devices, and consumer products. The company was founded in 1886 and is currently listed among the Fortune 500. J&J stock is a component of the Dow Jones Industrial Average.

Performance indicators

| 52 Week High-Low | $129.00 – $108.65 |

| Dividend / Div Yld | $3.20 / 2.55% |

| EV/EBITDA Annual | 13.20 |

| Consensus EPS forecast Q1/17 | $1.77 |

| Reported EPS Q1/16 | $1.68 |

| Forward PE | 17.84 |

Company’s shares grew $10 or 8.7% in the last six month. The consensus EPS forecast for the quarter is $1.77. The reported EPS for the same quarter last year was $1.68. How the stock will behave after the earnings report is released remains to be seen. It will depend on a variety of factors, among which are earnings surprise, key financial metrics, and the ability of the company’s management to address arising issues.

The company will publish its earnings report for the first quarter of the current year on 18 April 2017 before market open. According to Zacks, Johnson & Johnson has all the chances to show good and stable growth in 2017. Let’s take a closer look at the company profile and estimate future stock price fluctuations.

Harbingers of growth

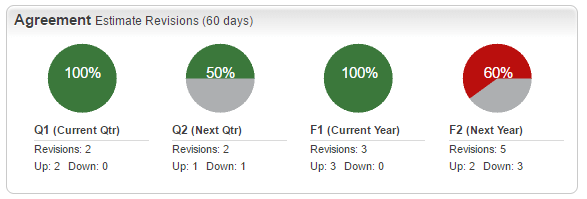

Positive earnings revisions. The company got mostly positive revisions for its estimated financial results for the current and next quarters and the current year. The ability to generate revenue is one of the key metrics that the market will evaluate when the earnings report for the fiscal quarter is finally out. Positive revisions mean that the experts are becoming more confident about JNJ financial performance.

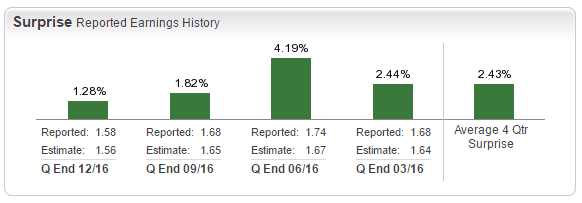

Positive earnings surprise. Johnson & Johnson has a history of delivering positive earnings surprises. According to the analysts, the company that has already demonstrated positive earnings surprises in the past is more likely to do so in the future.

Steady growth stock. During the last one year company’s stocks grew 14.8%, which looks especially favorable when compared to the industry’s average 2.1% growth for the same period of time.

Profitable acquisitions. The company managed to close a number of successful deals in the previous year. J&J acquired such companies as Cougar Biotechnology, Aragon and Abbott Medical Optics, strengthening its cancer medical portfolio. The company also has a deal with Achillion, aimed at the collaborative development of hepatitis C virus candidates.

Introduction of new products. Johnson & Johnson continues to introduce blockbuster products to the pharmaceutical market, launching 12 new drugs since 2011. Ten more products are expected to reach the market by 2019. The introduction of new products is essential for pharmaceutical companies as it helps to avoid genericization of the portfolio.

Positive feedback. New products do not only enter the market, they also meet consumers’ expectations. New products do not always make it to the market successfully, but this is not the case for JNJ. Imbruvica, Xarelto, and Darzalex are performing well. The products launched in the last five years accounted for 22% of total 2016 sales.

Geographic diversification. Corporate plans of geographic expansion of emerging market are not kept in secret. J&J opened R&D facilities in China, India, and Brazil, three out of four BRIC countries and continues to develop its operations in developing countries.

Possible headwinds

Generics competition. As it happens with any innovative pharmaceutical company, once the term of a patent is over, other companies are free to introduce their own versions of the same product. Generics are cheaper and therefore easily increase their market share by appealing to the price-sensitive public. In case of Johnson & Johnson, quite a few products face generic competition, including Invega and Ortho Tri-Cyclen Lo. The pharmaceutical segment of the company is expected to witness lower gross rates in 2017 due to rising competition from generics.

FDA regulations hit sales. In 2010, the FDA introduced the so-called risk management program — RiskMAP. In accordance with it, all unusual side effects should not only be mentioned on the product’s label but also aggressively draw consumers’ attention. Food and Drug Administration sees cancer warnings on Remicade and Simponi labels as a reason to restrict sales of these products. Mandatory warning signs on drug labels apparently lead to lower sales.

FDA consent decree. In 2011, the FDA imposed a consent decree on a J&J subsidiary, which limits the activities of the Consumer Healthcare division of McNeil-PPC, Inc. Though the supply of all major products has been reestablished, should the aforementioned event take place once again, the company may encounter financial and reputational risks.

Broken deadlines. A number of pipeline setbacks have recently delayed the introduction of new products due to regulatory and internal reasons. Not a big deal in the short-term the recurring of this event can seriously hamper long-term profitability.

What to expect from stock prices?

Johnson & Johnson is one of those big old companies that provide their investors with stable returns in the long-run. The overall valuation for 2017 is moderate to positive with double-digit growth being quite possible. Short-term price fluctuations can be expected after the earnings report is released. Should the results of the Q1 be satisfactory, the market will react with purchasing activity, pushing the prices up.