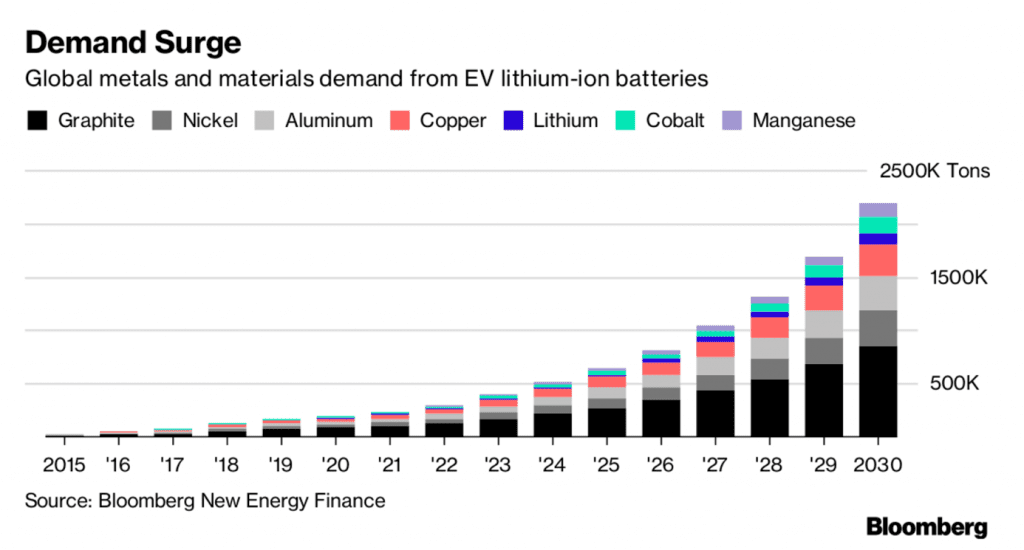

The revolution in e-vehicles set to upturn industries from energy to infrastructure is also creating winners and losers within the world’s biggest metals markets. While some of the largest diversified miners like Glencore argue fossil fuels such as coal and oil still play a crucial role supplying energy needs, they’ll also benefit the most from a move to electric cars, requiring more cobalt, lithium, copper, aluminium and nickel.

The outlook for greener transportation got a boost this year as the U.K. joined France and Norway in saying it would ban fossil-fuel car sales in coming decades. That’s as Volvo announced plans to abandon the combustion engine and Tesla Inc. unveiled its latest, cheaper Model 3. Such vehicles will outsell their petroleum-driven equivalents within two decades, Bloomberg New Energy Finance estimates. “For some of the metals, it’s a complete game changer,” said a commodities economist at in London. “We’ve already seen a big impact on some metals like cobalt and lithium, which have soared over the past couple of years.”

Meanwhile traditional German manufacturers struggle to tackle this trend. Volkswagen, Daimler and BMW largely reiterated pledges to upgrade 5 million cars in Germany with software to reduce harmful emissions, a comparatively easy feat at a low cost, and dodged the more expensive and complicated task of tweaking the vehicles’ hardware. The agreement offers breathing room for an industry that’s relying on diesel to meet the European Union’s toughening emissions standards as it steps up development of electric cars. While the outcome briefly boosted automakers’ shares, it failed to cool criticism ahead of next month’s federal election that Chancellor Angela Merkel’s government has been too soft on the manufacturers.

President Trump may be about to get tougher on trade with China

Trump’s administration is moving closer to launching an investigation into whether Chinese trade practices are unfair, a senior administration official said. That step could ratchet up tensions between the world’s two largest economies. The investigation, which could result in tariffs or other measures, will include the issue of the theft of American intellectual property, the official said. The potential probe, which could be announced as soon as this week. An aggressive move against China on trade would be a sharp change of tack by Trump. Despite repeatedly slamming Beijing over its trade practices on the campaign trail, he has taken a more cautious approach since entering the White House.

Ryanair Paints a Dark Brexit Scenario

Flights to and from the U.K. could be grounded and Britons limited to ferry journeys to Ireland and road trips to Scotland, Ryanair said in its starkest comments yet about the possible fallout of Brexit for aviation if a wide-ranging deal isn’t secured in time.

Europe’s biggest discount airline extended its warning to the future of rival carriers, with CEO Michael O’Leary suggesting that a failure to negotiate terms guaranteeing existing air services and accords could force British Airways owner IAG SA to sell its Spanish Iberia unit and render redundant EasyJet’s Plc’s new European operating license. “It’s becoming more and more likely that there will be disruption to flights in April 2019,” O’Leary said Wednesday in London, citing lead times of six months or more in drawing up future timetables. “The airlines will be screaming blue murder through September-October of 2018 if there isn’t an agreement. At that point in time all hell is going to be breaking loose over here.”

Apple hopes China will ease VPN restrictions

Apple’s CEO says he hopes China’s intensified crackdown on internet access is only temporary. Tim Cook on Tuesday addressed the controversy over his company’s recent removal of some virtual private network (VPN) apps from its China App Store, reiterating that the U.S. company was simply complying with Chinese regulations. “We’re hopeful that over time the restrictions we’re seeing are lessened, because innovation really requires freedom to collaborate and communicate,” Cook said during Apple’s latest earnings call. “We believe in engaging with governments even when we disagree,” he said.

German to Take on Tesla Gigafactory Riva

German executives are preparing to announce a new home for a lithium-ion battery plant designed to rival the output at Tesla Gigafactory. Terra E Holding GmbH will choose one of five candidate sites in Germany or a neighbouring country next month to build its 34 gigawatt-hour battery factory, the Chief Executive Officer said in an interview. The former ThyssenKrupp manager has helped to assemble a consortium of 17 German companies and won government support for the project, which will break ground in the fourth quarter of 2019 and reach full capacity in 2028, he said. The battery factory is the latest sign that German industry, the motor behind the world’s fourth-biggest economy, is gearing up for a new stage in the energy revolution. Lithium-ion batteries can help stabilize intermittent flows of wind and solar power on electricity networks. They’re also projected to power millions of plug-in cars expected to roll off German production lines beginning early next decade.

Economic events today:

9.30am – UK services PMI (July): The most important of all the UK PMI surveys, a weak or strong reading can have a material impact upon the GDP expectations for the quarter. Estimated to fall marginally from 53.4 to 53.2. Markets to watch: GBP crosses, UK indices

12 pm – Bank of England interest rate decision: Will they, won’t they? Lots of mixed signals coming from rate setters after the 5-3 split to stay unchanged last time round. Markets to watch: UK indices, GBP crosses

3 pm – US ISM non-manufacturing PMI (July): This ISM number is forecast to remain steady at around 57.4. Market to watch: dollar crosses