UK labor data was a little mixed in today’s release but generally supports expectations for expansion and rising inflation within the British economy. Today’s data includes average earnings, jobless claims and unemployment figures which combine to reveal steady but not overly strong improvement within the labor market.

Headline average earnings with bonus grew by 2.5% on a YOY basis in November. The more important but less covered average earnings ex-bonus grew by 2.4% YOY, better than the expected 2.3% and up a tenth from the previous month. It is important to note that this is lagging data and could spur the BOE to act if they believe gains will continue into the new year.

Jobless claims fell as expected but not as much as expected. The headline claims figure came in at 8,600 versus the expected 5,400 but did not have an adverse effect on unemployment. Unemployment held steady at 4.3% as expected.

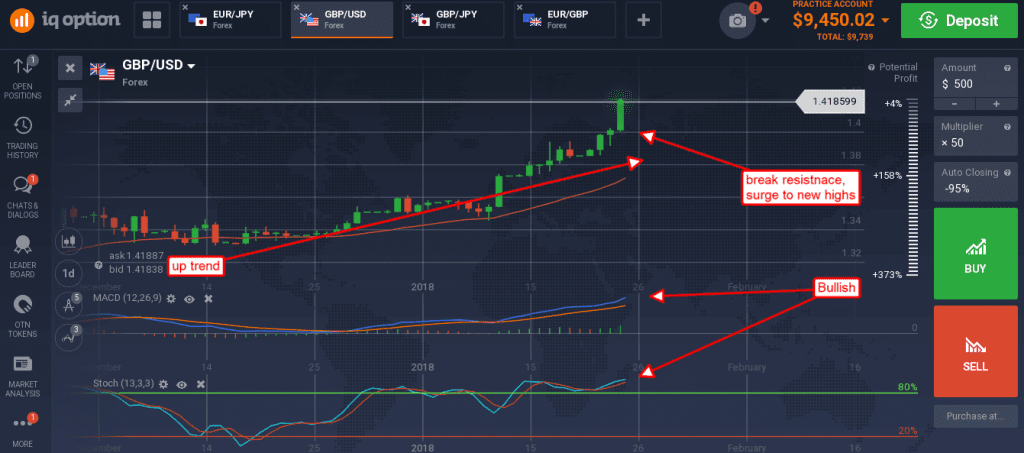

The data, however tepid, was enough to send the pound surging versus most major world currencies. The news may not be great, but it is good and keeps the UK on a path to expansion and the BOE on a path to tightening. In terms of market conditions, it means risk-on inflows to the pounds should accelerate.

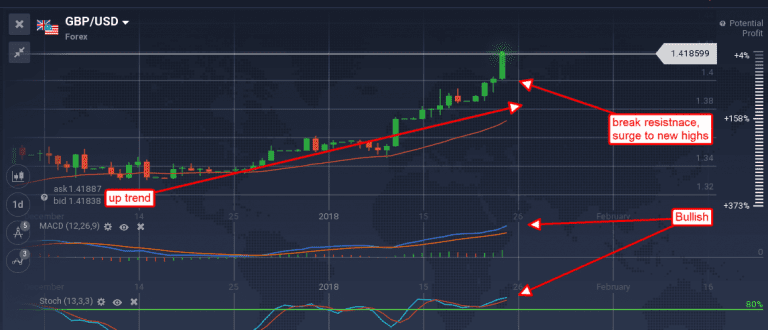

The GBP/USD moved up creating a strong, long green candle closing near the high of the early morning session. The indicators are bullish and strong, consistent with a trending market, and suggest higher prices to come. My target of 1.4000 has been exceeded, next target is near 1.4500.

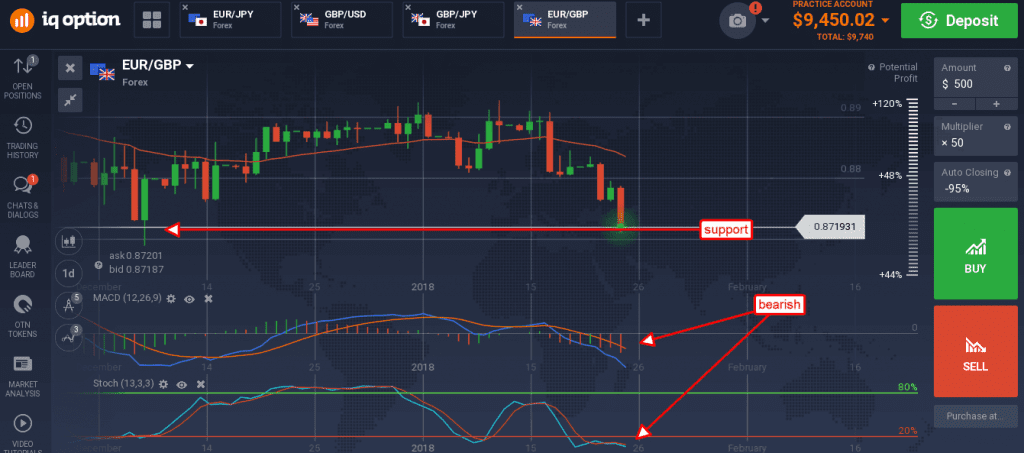

The pound also surged versus the euro as mixed PMI data from the EU did little to firm support for the single currency. EU composite PMI came in at 58.6 and above expectations but the gains were driven by services. Services PMI came in at 57.6 and more than a full point better than expected while manufacturing growth slowed from 60.6 to 59.6.

The EUR/GBP created a long red candle moving down to test support at the bottom of a trading range.

The indicators are bearish but not strong, suggesting there may be further downside but not convincingly. Tomorrow’s ECB meeting may have something to do with it. A break below 0.8700 would be bearish, a bounce from this level would confirm the range. The ECB is not expected to tighten but is expected to indicate a shift in policy stance that will lead to tightening.

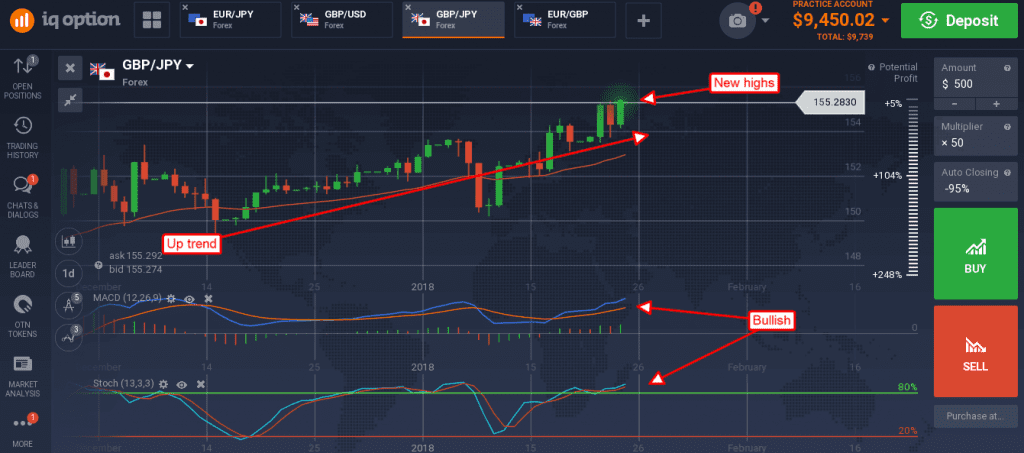

The pound also gained strength versus the yen, but gains were small and capped by near term resistance. The pair has been trending higher and is supported by the indicators so further upside should be expected. Resistance is currently near 155.20, a break above which would be bullish. Target for this move is as high as 160.00 in the near term.

Look to UK data and the BOE meeting in two weeks to dominate this market.