Philip Morris International (PM:NYQ) is one of the world’s leading tobacco companies – owning six of the world’s premier 15 international brands. The company sells products across over 180 markets and manufactures and sells well known cigarette brands – such as Marlboro, the number one global cigarette brand.

In recent years the company has become increasingly involved in developing reduced-risk products – designed to offer less risk of harm to smokers versus continued traditional smoking. On July 20th 2017 the company will announce Q2 2017 financial performance figures followed by a discussion of results – during which, CFO, Jacek Olczak, will offer insights and answer questions regarding the quarterly performance and future outlook expectations.

Let’s take a look at the 8 need- to- know facts about Philip Morris shares into this quarter’s earnings announcement

1) Share Price – Soaring Higher

Shares of cigarette industry titan Philip Morris have performed exceptionally well year to date – gaining over 30% since the start of 2017 and outpacing competitors significantly over this time.

Further to this the shares have risen consistently over the past year – achieving growth of 20.58% over the past twelve months. The share price has benefitted from currency movements as well as increased revenue generation from a widened product range.

2) Beating out the Competition

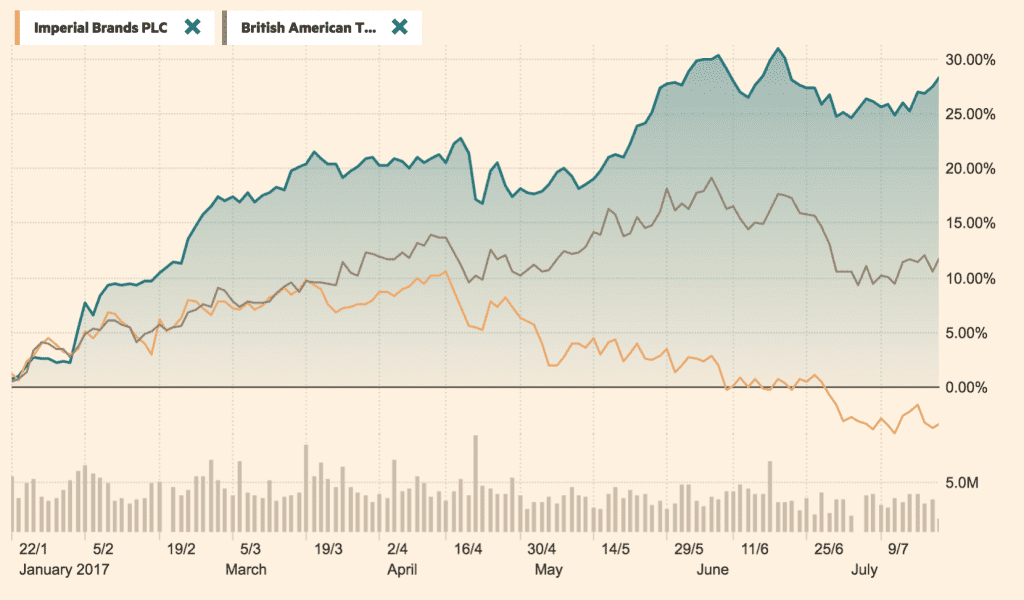

Even more impressive is the pace at which PM shares have outstripped core competitors. Top competitor British American Tobacco was closely tracking the stock through 2016 but has been significantly overtaken since the start of 2017 – both of these companies have benefitted from significant growth in demand in the Asia region. Meanwhile, Imperial Brands Plc has been left far behind in terms of share price performance – suffering more so from contracted demand in Western markets.

Source: https://markets.ft.com/

3) Financial Performance

Wall Street analysts are estimating moderate growth this quarter from Philip Morris – with forecasts of net revenues of 7.08USD billion- which would deliver 6.5% growth year on year. In addition, the forecast is for adjusted earnings per share (EPS) of 1.23USD – representing a year on year improvement of 8 cents from Q2 2016 – an increase of almost 7%.

4) Currency Impact

Philip Morris has experienced reduced bottom line performance over the past two years as the dollar strengthened. However, 2017 has seen the dollar weaken somewhat, alongside some Euro strengthening. This trend is forecasted to generate enhanced growth for the company for 2017. A further consideration is growth within the Asia region – which is taking up an increasingly substantial proportion of profit generation for the tobacco maker. The company is currently hedged on global exposures – however strengthening in the Japanese Yen, Russian Ruble, and Argentinian Peso has the potential to impact profits if trends against the dollar gain momentum.

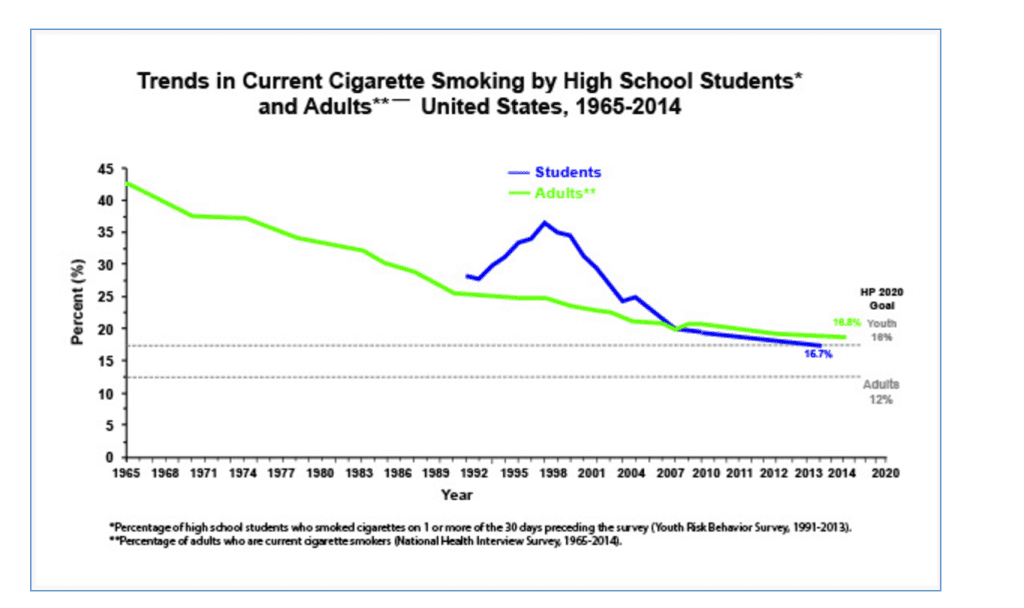

5) Decline in Cigarette Demand

Smoking rates are falling fast in developed regions and as such the competition is heating up in the race to dominate market share in the alternative smoking products segment. Changing preferences in cultures have meant demand for cigarettes has declined substantially and consistently over the past few decades as the general consumer population becomes increasingly health conscious.

6) E-cigarette Development

Philip Morris has taken steps to address evolving, more health conscious, market demands and as such developed a 120USD million research facility, based in Switzerland, to develop less harmful and “harm reducing” products. Philip Morris is aggressively pursuing research in creating smoke-free products such as IQOS Heatsticks (this design heats tobacco rather than burning it). This core strategy has been designed to boost profits and market share whilst meeting changing preferences.

7) Cash Flow

A key figure to keep a close eye on in the earnings announcement is cash flow. Cash flow is a vital component of the strength of the businesses maintaining ongoing activities. Wall Street analysts are forecasting that Philip Morris will generate approximately 7USD billion of free cash flow for the 2017 fiscal year.

Meanwhile total dividend payments for 2017 are forecast at 6.5USD billion. Balancing these factors will be a delicate endeavour whilst attempting to maintain sufficient cash flow required for ongoing operations as well as efforts to expand. This could hamper growth for 2018 if not handled carefully.

8) Regulation

PM has seen profits suffer due to rising tobacco taxes, ongoing anti-tobacco campaigns and increased government restrictions. As an example, the U.S. Food and Drug Administration (FDA) has made it mandatory for tobacco companies to apply precautionary labels on cigarette packets – which are designed to put customers off smoking. This had led to reduced sales volumes and these types of regulatory factors are likely only to increase in their impact on bottom line.

Overall, Philip Morris has a strong positive outlook through 2017 and 2018. The company is pursuing gaps in the market aggressively whilst strategically capturing the traditional smoking market share. The company has a strong balance sheet that can withstand some medium-term turbulence that may stem from regulation, healthier alternatives entering the market place as well as changing preferences. If the company continues to target these weak areas with the tactical focus they have been applying to date the outlook remains positive.

Sources:

- https://markets.ft.com/data/equities/tearsheet/summary?s=PM:NYQ

- https://www.pmi.com/investor-relations/overview

- http://www.businesswire.com/news/home/20170713005638/en/Philip-Morris-International-Host-Webcast-2017-Second-Quarter

- https://seekingalpha.com/article/4086896-philip-morris-watching

- https://www.forbes.com/companies/philip-morris-international/

- https://www.cdc.gov/tobacco/data_statistics/tables/trends/cig_smoking/index.htm

- http://www.cnbc.com/video/2016/03/09/wells-fargo-top-pick-philip-morris.html