Options are financial contracts that give traders flexibility and leverage. Unlike stocks, they provide the right but not the obligation to buy or sell an asset at a fixed price within a set time. This feature makes them useful both for speculation and for managing risk.

Traders use options to profit from rising or falling markets, limit risk, or protect portfolios during uncertainty. In 2025, they are more popular than ever, driven by the growth of zero-day contracts and advanced trading platforms.

This article explains the fundamentals of options trading. We will cover what options are, how calls and puts work, what influences their price and which strategies traders use most often.

What Are Options?

An option is a type of financial derivative. It is called a derivative because its value comes from another asset, such as a stock, an index or a cryptocurrency. When you buy an option, you are purchasing a contract that gives you certain rights connected to that underlying asset.

The two key elements of every option are the strike price and the expiration date. The strike price is the agreed level at which the asset can be bought or sold. The expiration date is the last day the contract can be used. Options also have a cost known as the premium. This is the price you pay upfront to enter the contract.

What makes options unique is that they give the buyer a choice. A stockholder must live with price movements. An option holder can decide whether to exercise the right or let the contract expire. If the trade does not move in their favor, the most they can lose is the premium. This makes options flexible tools for both speculation and risk control.

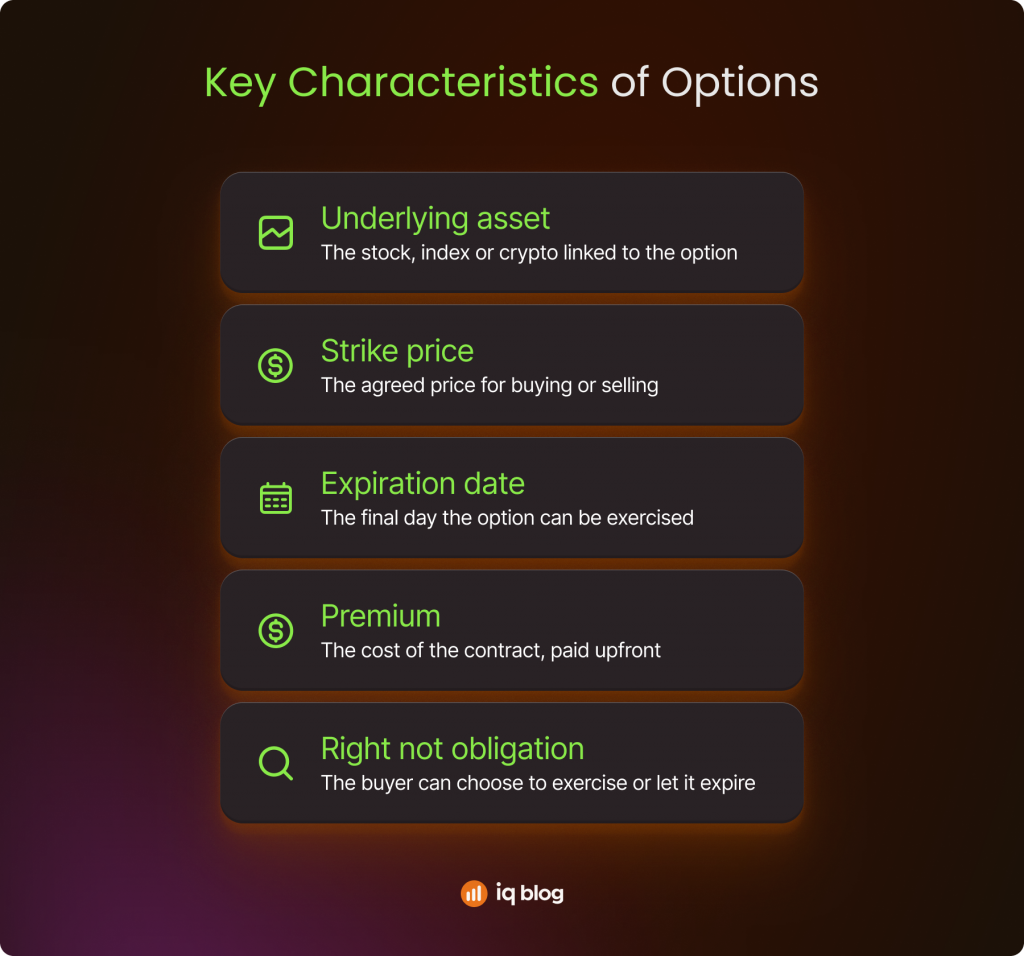

Key Characteristics of Options

- Underlying asset – the stock, index or crypto linked to the option

- Strike price – the agreed price for buying or selling

- Expiration date – the final day the option can be exercised

- Premium – the cost of the contract, paid upfront

- Right not obligation – the buyer can choose to exercise or let it expire

Options are different from futures contracts. A future is an obligation to buy or sell the asset at the expiration date. An option, by contrast, is only a right. This distinction explains why many traders use options to hedge portfolios or to make short-term directional bets without tying up large amounts of capital.

How Options Work

An option is essentially a contract between two parties. The buyer of the option pays a premium to the seller in exchange for certain rights. The buyer has the right to buy or sell the underlying asset at the strike price before or at the expiration date. The seller, also called the writer, takes on the obligation to fulfill the contract if the buyer decides to exercise it.

To understand how options work, think of the four main parts of any contract: the underlying asset, the strike price, the expiration date and the premium. Together, these elements define the value and potential outcome of the trade.

Main Components of an Option

- Underlying asset – the instrument being traded, such as a stock or index

- Strike price – the level at which the option can be exercised

- Expiration date – the final day the option is valid

- Premium – the cost paid by the buyer to enter the contract

Here is a simple example. Suppose a trader buys a call option on Apple stock with a strike price of 180 USD and an expiration one month away. The premium for this contract is 5 USD. If Apple rises to 190 USD, the option is worth at least 10 USD, since the buyer can purchase shares at 180 and immediately sell at 190. Subtracting the 5 USD premium, the net profit is 5 USD per share. If Apple stays below 180, the option expires worthless and the trader only loses the premium.

This structure shows how options give traders flexibility. Buyers risk only the premium, while sellers take on greater risk in exchange for receiving that premium upfront.

Calls Explained

A call option is a contract that gives the buyer the right to purchase an asset at a specific strike price before the expiration date. Traders use calls when they believe the price of the underlying asset will rise. Buying a call is a bullish position.

The payoff from a call comes from the difference between the market price and the strike price, minus the premium paid. If the market price rises above the strike, the option becomes valuable. If the price stays below the strike, the option expires worthless and the buyer loses only the premium.

Example of a Call Trade

Imagine a trader buys a call option on Tesla stock with a strike price of 250 USD, expiring in one month. The premium is 8 USD. If Tesla rises to 270 USD, the call has an intrinsic value of 20 USD. After subtracting the 8 USD premium, the trader earns 12 USD per share. If Tesla stays under 250 USD, the option expires without value and the trader loses 8 USD per share.

Key Points About Call Options

- Bullish tool – Calls profit when prices rise above the strike

- Limited risk – The maximum loss is the premium paid

- Unlimited upside – Theoretically, profit potential grows as the asset price rises

- Leverage effect – Calls control more shares with less capital than buying stock directly

Calls are popular among both speculators and hedgers. Speculators buy them to profit from expected rallies. Investors use them to lock in purchase prices or to gain exposure with limited downside.

Puts Explained

If calls are the tool for bullish traders, puts are the opposite. A put option gives the buyer the right to sell an asset at a fixed strike price before the expiration date. Traders use puts when they expect prices to fall or when they want to protect a portfolio from losses.

How a Put Works

Buying a put sets a floor for the asset’s value. If the market price drops below the strike price, the put gains value. If the price stays above the strike, the option expires worthless and the buyer loses only the premium.

Consider this example. A trader buys a put on Microsoft with a strike price of 300 USD and a premium of 7 USD. If Microsoft falls to 280 USD, the put is worth 20 USD. Subtracting the premium, the net profit is 13 USD per share. If Microsoft stays above 300 USD, the option expires and the trader’s loss is limited to 7 USD per share.

Why Traders Use Puts

- Speculation – Profit from declines without short selling

- Hedging – Protect a stock portfolio from losses during downturns

- Defined risk – Maximum loss is the premium paid

- Flexibility – Useful in both falling and sideways markets

Puts are especially popular in volatile markets, since they allow traders to benefit from downward moves or to safeguard gains made during rallies. In 2025, when markets move sharply around earnings and interest rate announcements, puts remain an essential tool for both defensive and offensive strategies.

Options Premiums and Pricing

The price of an option is called the premium. It represents the cost of buying the right to trade the underlying asset at the strike price. For the buyer, it is the maximum possible loss. For the seller, it is the immediate income received for taking on the contract’s obligation.

Intrinsic vs. Extrinsic Value

Every premium has two components. The intrinsic value is the part that comes from the difference between the market price and the strike price. If a call allows buying at 100 USD while the stock trades at 110 USD, the intrinsic value is 10 USD. The extrinsic value is everything else, the portion based on time left until expiration and expected volatility.

The Role of Time and Volatility

Time decay steadily reduces the extrinsic value as expiration approaches. This is why options lose value even if the market does not move. Volatility, on the other hand, increases premiums. When traders expect large swings, they pay more for the chance to profit from them.

The Greeks in Simple Terms

Options traders use a set of measures known as the Greeks to understand how prices may change.

- Delta – sensitivity of the option to price moves in the underlying asset

- Gamma – how quickly Delta itself changes

- Theta – effect of time decay on the option’s value

- Vega – sensitivity to changes in volatility

Example in 2025

In early 2025, zero-day-to-expiry (0DTE) options on the S&P 500 became extremely popular. Their premiums are almost entirely extrinsic value since they expire within hours. A single spike in volatility during the day can make these contracts double or triple in price, but they also lose all value the moment the market closes.

Why Trade Options? Benefits and Risks

Options are popular because they can amplify opportunities and provide ways to manage risk. At the same time, they carry dangers that traders must understand before using them. Knowing both sides helps in deciding when and how to apply options in a trading plan.

Benefits of Options

Options allow traders to do more with less capital and to design strategies for different market conditions. They are also useful for hedging investments during uncertain times.

- Leverage – Gain exposure to larger positions by paying only the premium

- Flexibility – Combine contracts to profit from rising, falling or sideways markets

- Hedging – Use puts to protect portfolios against declines

- Defined risk for buyers – The maximum loss is limited to the premium paid

- Lower capital requirement – Options require less upfront investment than buying the underlying asset

Risks of Options

The same features that create opportunities can also increase losses. Time decay and volatility shifts work against inexperienced traders. Sellers in particular face far greater risks.

- Time decay – Options lose value as expiration approaches

- Total loss of premium – Buyers can lose the entire upfront cost

- Complexity – Strategies can be difficult to understand without practice

- Unlimited losses for sellers – Writers of uncovered calls face open-ended risk

- Market sensitivity – Sharp moves can wipe out positions quickly

Options are powerful tools, but only when used with caution. Traders must weigh these benefits and risks carefully before adding them to their strategy.

Common Options Strategies

Options are flexible instruments that can be shaped into many strategies. Some are designed for income, others for protection and some for taking advantage of volatility. Below are four of the most common approaches that traders use, explained in simple terms with clear examples.

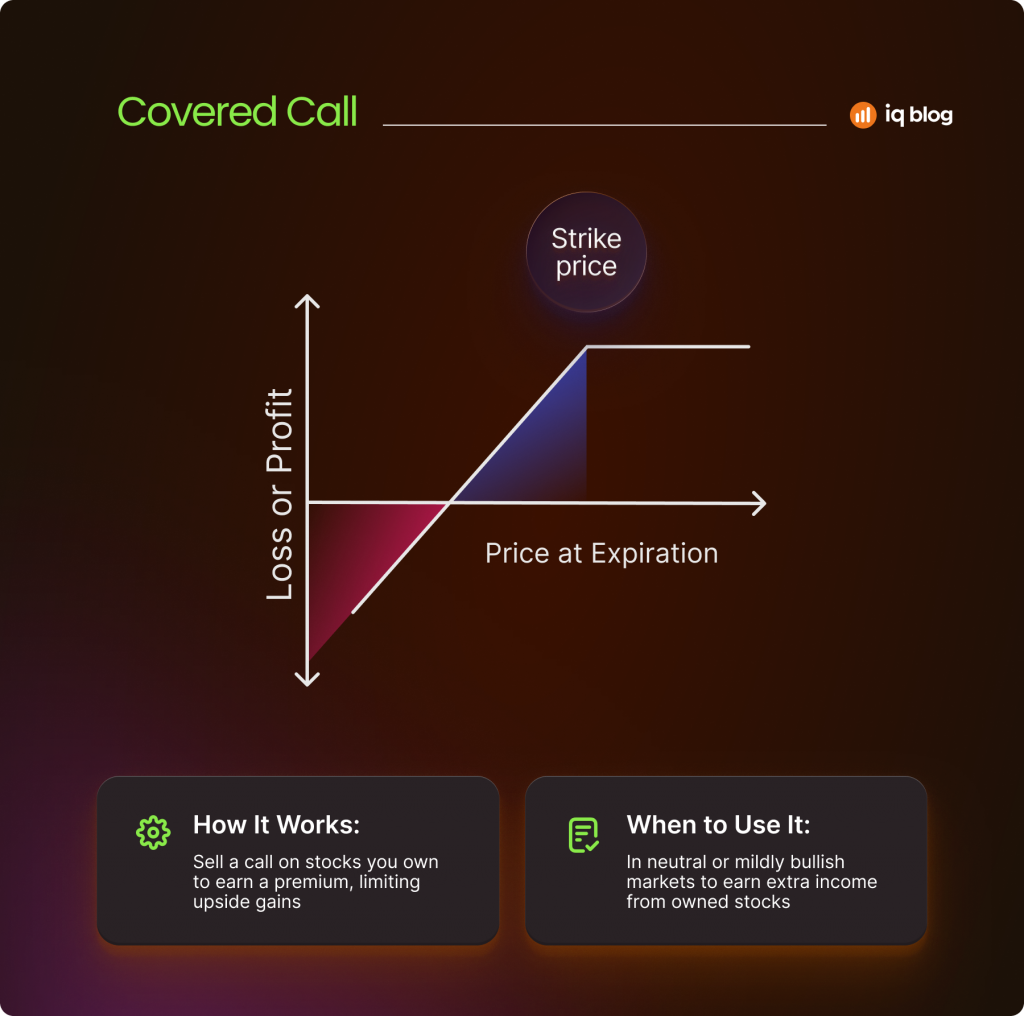

Covered Call

A covered call is one of the most popular strategies among investors who already hold shares. The trader sells a call option on stock they own, collecting a premium in exchange for capping their upside potential. The premium provides extra income and slightly reduces risk if the stock price falls.

This strategy works best in neutral or mildly bullish markets, where the investor does not expect explosive gains. It is often used as a way to generate steady returns from a portfolio. The main risk is that if the stock rises sharply, profits are limited because the shares may be called away.

Example: You own 100 shares of Apple at 180 USD. You sell a call option with a strike price of 190 for 5 USD. If Apple stays below 190, you keep your shares and earn 5 USD per share from the premium. If Apple rises above 190, you sell at that price, keeping the premium but missing any gains beyond 190.

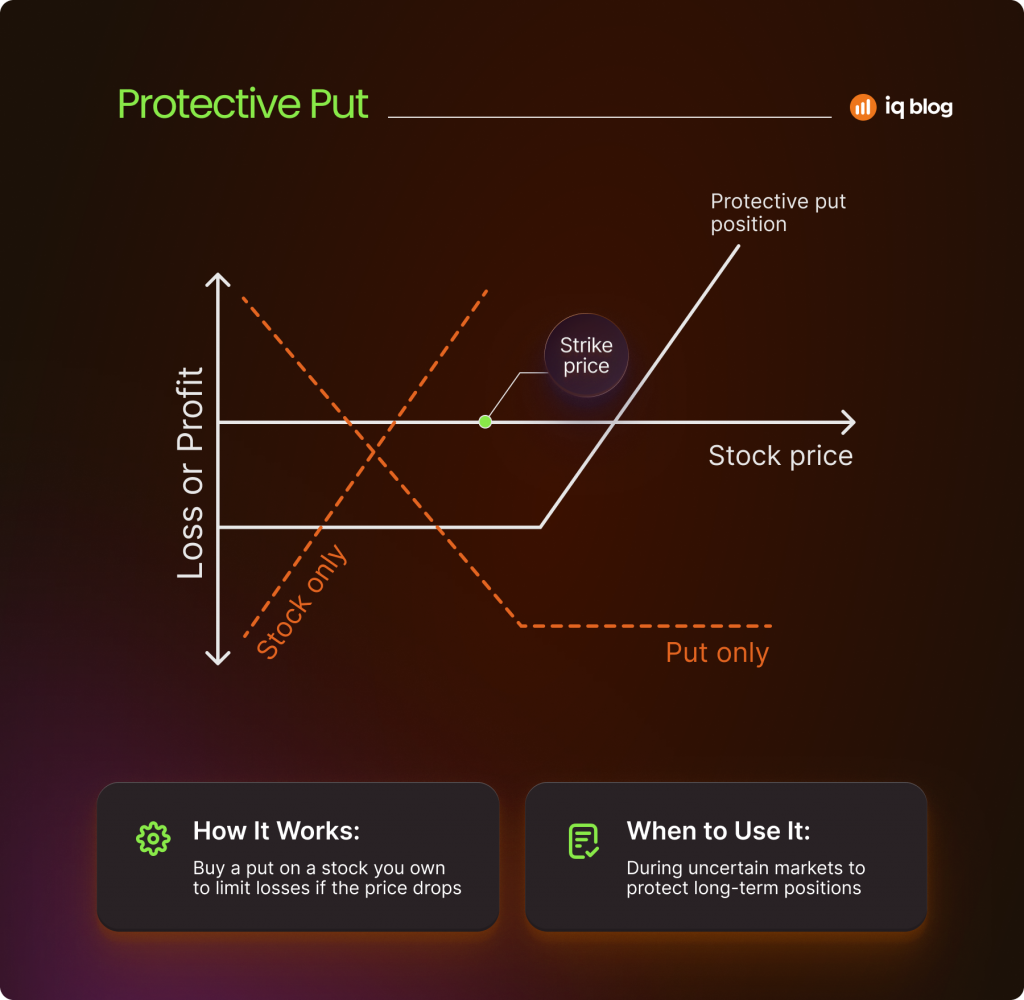

Protective Put

A protective put is often described as portfolio insurance. The trader owns a stock and buys a put option at a lower strike price. If the stock drops, the put increases in value, offsetting losses. If the stock rises, the put expires worthless, but the gain from the shares more than covers the cost of the option.

Protective Put is useful when holding long-term positions during uncertain times. It reduces downside risk while allowing the investor to benefit from potential rallies. The main drawback is the cost of the put premium, which can eat into profits if the stock does not fall.

Example: You hold 100 shares of Microsoft at 300 USD. You buy a 290 USD put option for 6 USD. If Microsoft drops to 270, the put gains 20 USD, covering most of the loss on the shares. If the stock rises, the only cost is the 6 USD premium.

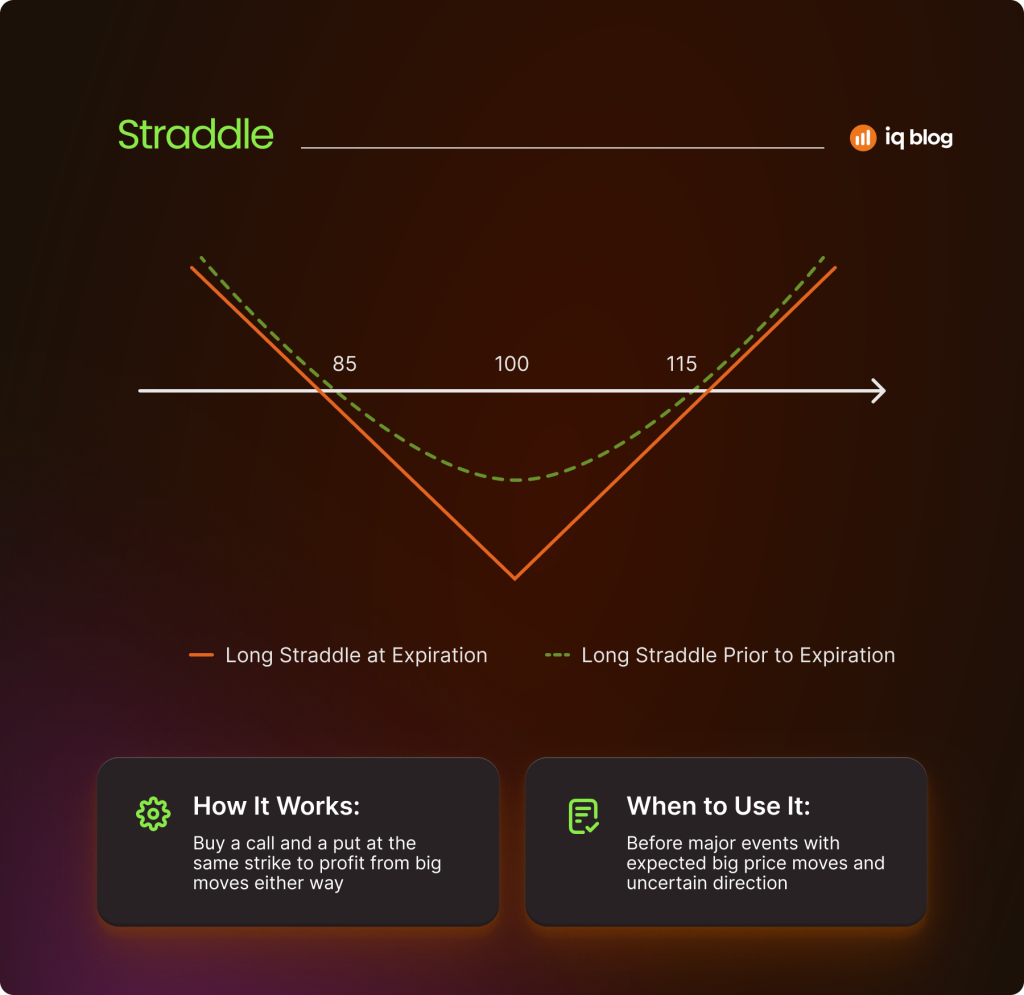

Straddle

A straddle is a strategy for traders who expect big moves but are unsure of the direction. It involves buying both a call and a put at the same strike price and expiration. If the asset jumps higher, the call becomes valuable. If it falls, the put provides the payoff.

This setup is commonly used before events such as earnings announcements or central bank meetings. The challenge is that the combined cost of both options is high, so the asset must move significantly for the trade to be profitable. Small price moves result in a loss.

Example: A stock trades at 100 USD. You buy a 100 USD call for 4 USD and a 100 USD put for 3 USD. Your total cost is 7 USD. If the stock rises to 115, the call is worth 15, giving you an 8 USD profit after costs. If the stock falls to 90, the put is worth 10, leaving a 3 USD profit.

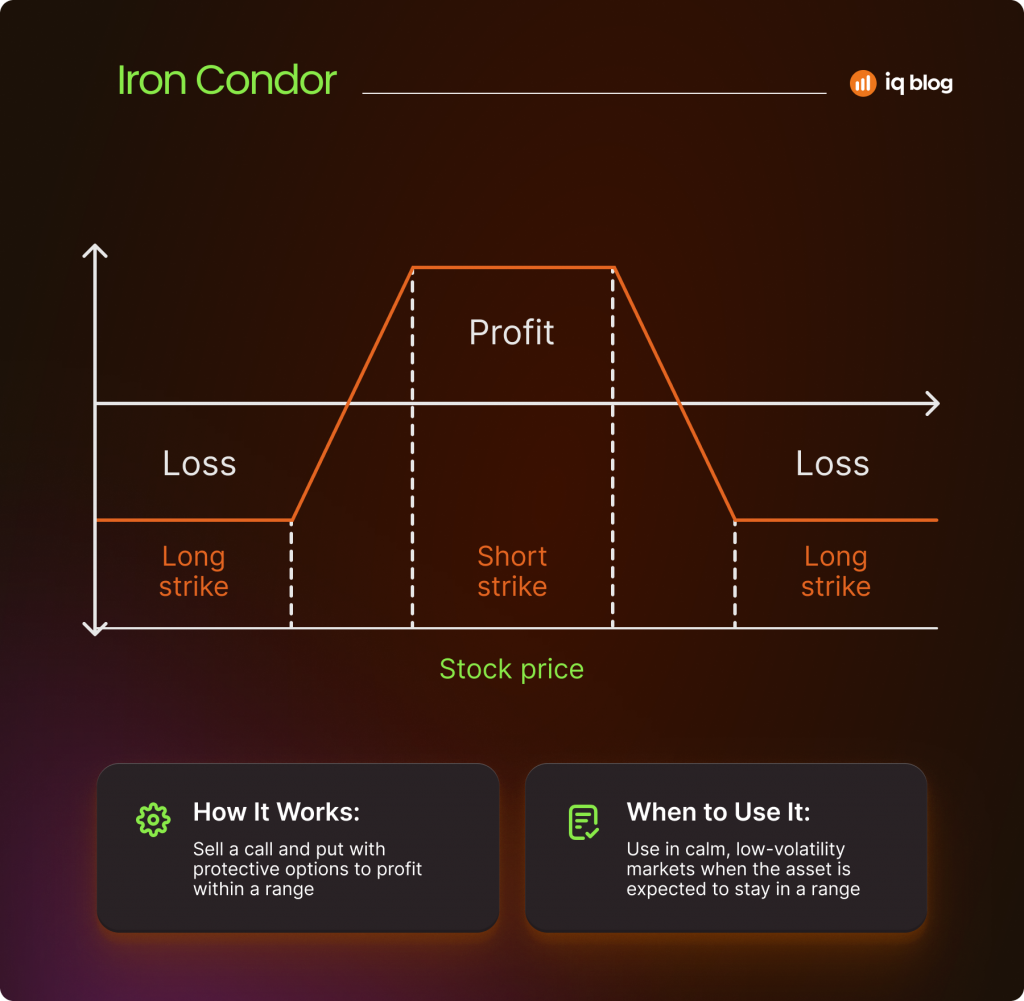

Iron Condor

The iron condor is a range-bound strategy. The trader sells one out-of-the-money call and one out-of-the-money put while also buying further out-of-the-money options for protection. The goal is to collect the net premium if the asset remains within a specific range until expiration.

This approach is popular in calm markets where traders expect low volatility. It provides limited profit and limited risk. The maximum gain is the premium collected, while the maximum loss is the difference between strikes minus that premium.

Example: A stock trades at 100 USD. You sell a 95 put and buy a 90 put. At the same time, you sell a 105 call and buy a 110 call. The total premium collected is 2 USD. If the stock closes between 95 and 105, you keep the 2 USD profit. If it falls below 90 or rises above 110, your maximum loss is 3 USD.

Options Trading in 2025

Options markets have grown rapidly in recent years and 2025 has highlighted some major trends. Retail traders are more active than ever and platforms have adapted by offering faster execution, advanced analytics and even AI-powered tools. One of the biggest stories has been the explosive growth of ultra-short-term options.

The Rise of Zero-Day Options

Zero day to expiry (0DTE) contracts have become a dominant force, especially on the S&P 500. These options expire the same day they are issued, creating fast-moving opportunities but also higher risk. In 2025, 0DTE options account for a significant share of daily trading volume, according to Cboe. Traders use them for quick speculation on intraday moves and for hedging around economic announcements.

Expanding Access for Retail Traders

Brokerage platforms now make multi-leg strategies, risk calculators and real-time data available to all users. What was once considered advanced is now standard. Many platforms also include educational tools and paper trading features, making options more accessible to beginners while still useful for professionals.

AI and Automation

Artificial intelligence plays a larger role in options trading. Algorithms scan for unusual activity, forecast implied volatility changes and even simulate strategies before traders commit capital. These tools help traders act faster and manage risk in ways that were not possible just a few years ago.

Options trading in 2025 is broader, faster and more data-driven than at any point in history. The fundamentals of calls and puts remain the same, but the environment in which traders use them has evolved dramatically.

Final Thoughts

Options are powerful tools that give traders and investors the ability to speculate, hedge and manage risk in ways that stocks alone cannot. Calls allow participation in upward moves, while puts provide protection or profit opportunities when prices fall. Understanding how these contracts work is the first step toward using them effectively.

In 2025, options have become more accessible than ever. Retail traders now use platforms with advanced analytics, multi-leg order tools and AI-driven features. The growth of zero-day to expiry contracts shows how rapidly the market is evolving. Yet the fundamental principles remain the same: buyers risk only the premium and sellers take on larger obligations in exchange for upfront income.

The key to success lies in discipline. Options can amplify gains, but they can also magnify losses if used without care. Traders who respect risk, test strategies and choose the right approach for their goals are best positioned to succeed. With the right knowledge, options can be a valuable part of any trading toolkit.