The US-Senate rejected a repeal of Obamacare. Republican leaders are holding votes on a slew of different health proposals this week to see how close they can get to passing something.

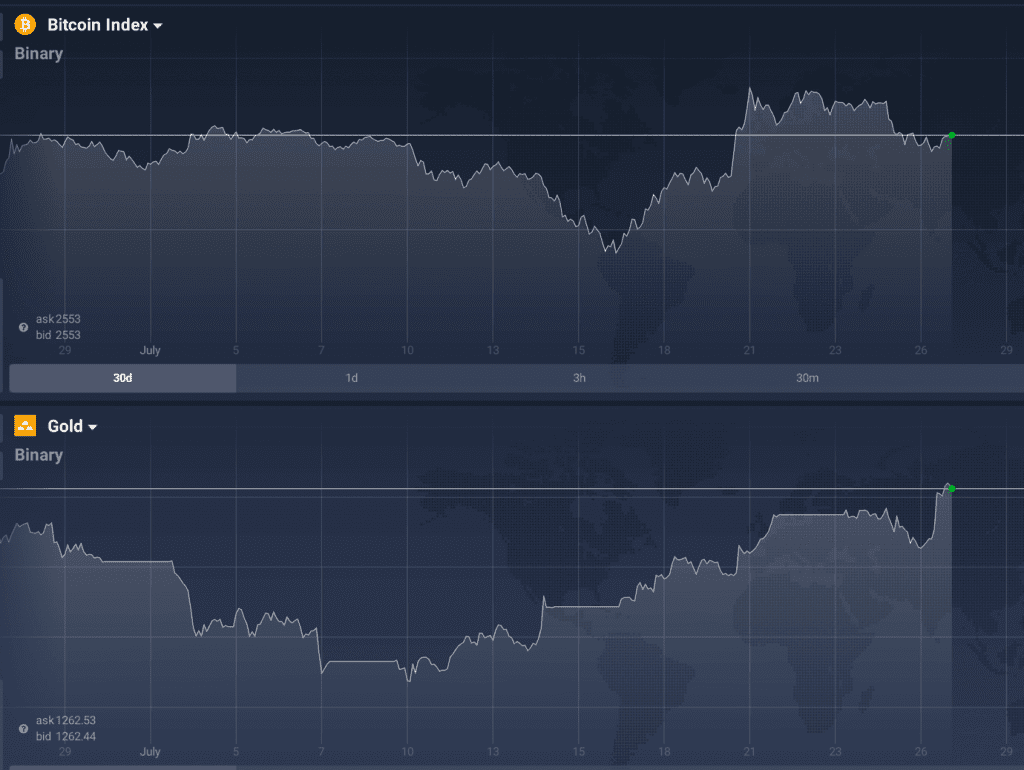

The amendment defeated 45-55 Wednesday was similar to the Affordable Care Act repeal that passed Congress in 2015 and was vetoed by then-President Barack Obama. As always when political uncertainty hits anywhere in the world gold as well as „digital gold“ – Bitcoin – profits.

US-Regulators Weigh in Cryptocurrencies

The cryptocurrency world is breathing a sigh of relief after U.S. regulators finally weighed in on initial coin offerings (ICO), saying that companies which raise money through the sale of digital assets must adhere to federal securities laws. Prices of many of the more than $1 billion in digital coins already sold this year were little changed as issuers, analysts and attorneys said the Securities and Exchange Commission guidance late yesterday provides some long-sought clarity.

Dollar weakens after FED statement

The Bloomberg Dollar Spot Index (pictured) traded at the lowest in more than a year, while the 10-year Treasury yield extended losses after the Fed held rates steady. The FED yesterday voted to keep interest rates unchanged following the conclusion of its latest Federal Open Market Committee meeting. Prior to that get together, some polls had given the central bank just about a 3% chance of raising borrowing costs at the meeting.

Any decision other that the one just made, therefore, might have produced some quick and sharp selling. Fortunately for the bulls, that did not occur. In addition to the unanimous vote to keep the federal funds target unchanged, the FED also suggested that it would start to shortly wind down the massive stimulus program it embarked on nearly a decade ago in order to rescue the economy from a severe recession and financial crisis.

Although the bank did not specify a date for this start, many speculate that such a move will come as early as September, when the next FOMC meeting takes place. The Fed did use the phrase relatively soon to imply when it would begin to pare its balance sheet, therefore the suggestion that this likely means September.

As to increasing borrowing costs, the bank did not tip its hand, although we sense that one additional rate increase, at most, is likely upcoming this year–perhaps in September. Finally, the Fed stated that inflation was running below its 2% target–a subtle change from the somewhat below 2% area used heretofore.

Oil near 8-week highs on lower U.S stocks

Oil prices were just below 8-week highs, buoyed by hopes that a steeper-than-expected decline in U.S. crude oil inventories will reduce global oversupply. Brent crude futures were down 9 cents, or 0.1 percent, at $50.88 a barrel, after rising about 1.5 percent in the previous session. U.S. West Texas Intermediate futures were down 8 cents, or 0.2 percent, at $48.67 a barrel. U.S. crude stocks fell sharply last week as refineries increased output and imports declined, while gasoline stocks decreased and distillate inventories dropped.

The 7.2 million-barrel decline in crude inventories in the week ended July 21 was well above the 2.6 million barrels forecast. “This marks the fourth consecutive week that total hydrocarbon inventories have fallen during a time of year when they normally increase,” said an oil analyst. U.S. shale producers this week announced plans to cut spending this year as a result of low oil prices.

Optimism that the long-oversupplied market is moving towards balance was also supported by news earlier in the week that Saudi Arabia plans to limit its crude exports to 6.6 million barrels per day in August, about 1 million bpd below its export levels a year earlier. Kuwait and United Arab Emirates, fellow members of the OPEC, have also promised export cuts. “The narrowing of the global glut is still on track,” a bank said. But analysts say oil prices may have little room to head higher as recent gains could encourage more output, particularly from U.S. shale producers with low costs.

“The market will likely be paying even more attention to drilling activity in the U.S. in the coming weeks, particularly after suggestions from certain industry players that the rig count in the U.S. is slowing,” an expert said in a research note on Wednesday. U.S. fuel exports are on track to hit another record in 2017, making foreign fuel markets increasingly important for the future growth prospects and profit margins of U.S. refiners. Meanwhile, Norway’s Statoil said on Thursday it expected a 5 percent increase in output this year amid higher oil prices, but the company reduced its planned exploration spending.

Important economic events today

7am – German GfK consumer confidence (August): expected to hold at 10.6. Markets to watch: eurozone indices, EUR crosses

1.30pm – US durable goods orders, Chicago Fed index (June), initial jobless claims (w/e 22 July): durable goods orders expected to rise 0.4% MoM from a 1.1% fall, while excluding transport forecast to fall 0.1% from a 0.1% increase.

Chicago Fed index forecast to rise to 0.13 from -0.26, and jobless claims forecast to be 246K from 233K a week earlier.

Markets to watch: US indices, USD crosses