The ever-shifting balance of power between the EU’s single currency and the US dollar has the tide turning in favor of the euro. The pair has been pushed to a long-term low on fears, misplaced expectations and global angst leaving it ripe for reversal. Now, new data shows unexpected strength in the EU that will help lift the EUR/USD off its low and possibly drive it higher in the short term.

The data includes consumer level inflation data from both the EU and the US. In the EU CPI data came in hotter than expected at both the headline and core level. At the headline EU CPI rose by 1.9% versus an expected 1.6% and well above the previous months 1.2%. The number is not only hot, it is expansionary and brings the question of EU tightening back into the forefront.

On the US side of the equation Personal Income and Spending both rose more than expected helping to cement expectation the FOMC will raise rates at the June meeting in two weeks. Income rose by 0.3%, as expected but up from the previous month, while spending accelerated at a rate of 0.6%, much better than the previous 0.4% and the previous months upwardly revised 0.5%. Regarding inflation, PCE prices rose at a pace of 2.0% in April, unchanged from the previous month and as expected, while core held steady at 1.8%.

The key for traders is that the acceleration of inflation has stalled suggesting the FOMC will not need to raise rates much more, and most likely not more than 1 more time this year. The CME’s Fed Watch Tool was showing a 58.3% chance for a third hike by December, that figure edged down to 56.3% after the Income and Spending data was released. The next hurdle for dollar traders will be the NFP data on Friday, particularly the Average Hourly Earnings data. Earnings are a key factor in core inflation, if wages rise more than expected it could lead the dollar higher.

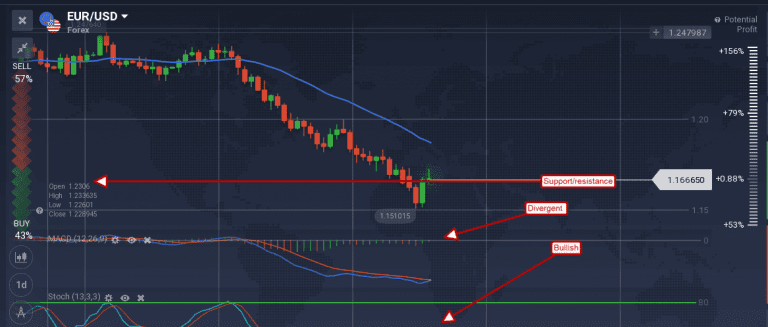

The EUR/USD was up in early trading as strong EU CPI supported the single currency. The move was countered by US data although the longer-term outlook has shifted in favor of the euro (expectations for ECB tightening are up while those for the FOMC are down). The pair formed a shooting star doji candle in early Thursday trading, but this is not confirmed. The indicators are mixed but look bullish with stochastic firing a bullish crossover and MACD poised to do the same. A move up from yesterday’s support/resistance level at 1.6600 would confirm reversal in the dollar while a move lower would not.

The USD/GBP tried to move higher as well, aided by positive housing and lending data, but the move was countered by US inflation. The pair appears to have halted its bounce from support but that is not confirmed.

The indicators are mixed so a move in either direction is possible although there is a decided bullish bias, stochastic is firing a bullish crossover while MACD diverges from a long-term low. Tomorrow’s NFP will likely tip the balance one way or the other.