Bitcoin is constantly compared to the tulip bubble and dot-com craze of the past, both of which ended badly for most investors. However, this time it looks like there is pursuasive evidence to back this claim. On March 19, Morgan Stanley sent a note to its clients explaining how Bitcoin is unfolding similarly to the way Nasdaq did leading up to its crash in the 2000s.

Bitcoin mimics Nasdaq’s bearish patterns

Morgan Stanley’s research compares the highs and lows of Bitcoin and Nasdaq, demonstrating the striking similarities between them. Bloomberg’s analysis of the note reports that there have been three major bearish waves since Bitcoin reached its peak in December, with prices losing between 45 percent and 50 percent each time before recovering. Morgan Stanley strategist Sheena Shah wrote that “Nasdaq’s bear market from 2000 had five price declines, averaging a surprisingly similar amount of 44 percent.”

In its most recent bearish wave from December to February, Bitcoin experienced a loss of 70 percent, which is “nothing out of the ordinary,” according to Morgan Stanley. Prior to this, Bitcoin bear markets averaged about five months, with rallies lasting anywhere from two to three months.

Perhaps the most interesting conclusion noted in the report was that Bitcoin’s rallies are moving “around 15 times the speed” Nasdaq’s did almost 20 years ago. Thus, many analysists are speculating that Bitcoin might share the same fate.

Trading volume is a red flag

Trading volume is also an indicator worth considering. As Shah pointed out, Bitcoin trade volumes have risen by nearly 300 percent since December, but each Bitcoin rally before a bear market saw that volume fall, just like Nasdaq. From this observation, Shah concluded:

“Rising trade volumes are thus not an indication of more investor activity but instead a rush to get out.”

Markets enter recovery

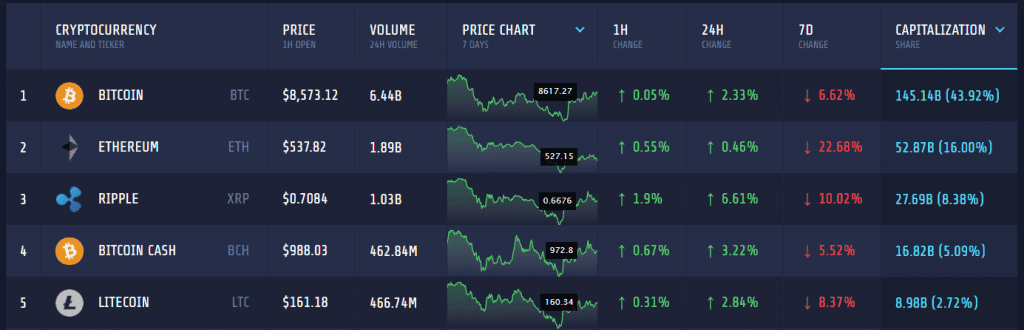

In crypto, there is no way to accurately predict when the next bearish or bullish wave will hit. Nonetheless, crypto has seen an increasing number of Wall Street analysists predicting low prices for the cryptocurrency market as well as claiming the end is drawing near. Today, the market is rebounding following a difficult week, with almost all major cryptocurrencies experiencing gains.

While Nasdaq’s past may show that history is preparing to repeat itself, there is no guarantee that anyone knows what will happen next in the crypto world.