Michael Kors Holdings Limited (KORS: NYQ) Stock is an American luxury fashion company established in 1981 by designer Michael Kors that will report quarterly earnings on May 31st 2017.

The company operates as a designer, distributor, marketer and retailer of branded men’s and women’s apparel. The business as a whole operates across three major segments – retail, wholesale and licensing. As of 2015, the Michael Kors Holdings company operates across over 550 stores and over 1500 in-store boutiques across the globe.

1) Share price struggles to recover

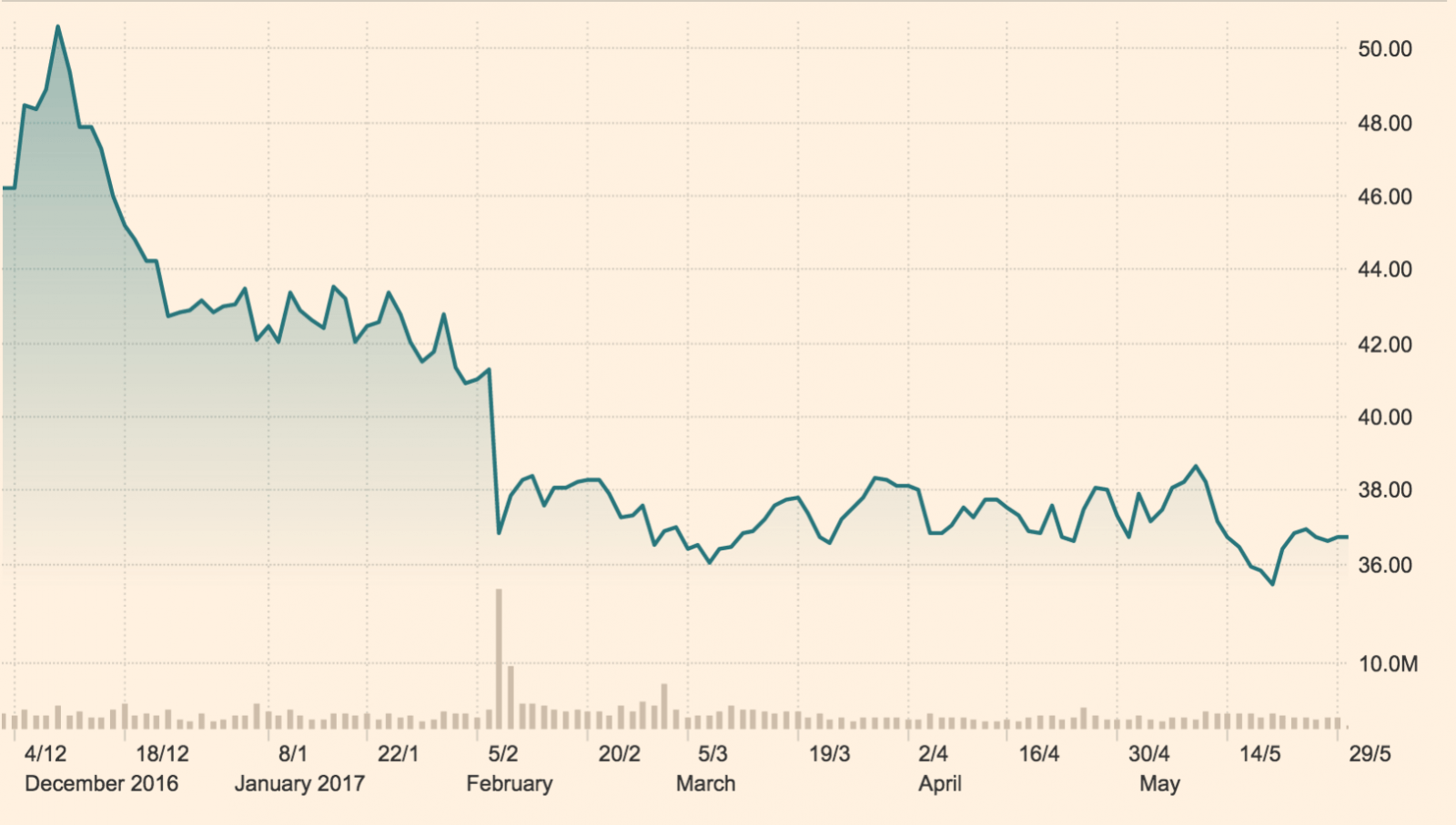

Over the past 12 months the fashion brand’s share price has taken a huge tumble – falling lower by 30% since May of last year. * The shares took a hard hit in December with the Christmas period failing to drive revenues as expected and further to this the New Year brought similar challenges with a contraction in demand and a further sharp fall in share price.* The share price has failed to recover from these rapid downturns since – with the share price down 18% year to date (YTD).*

2) Forecast for Contracted Earnings

Wall Street analysts have a consensus earnings expectation for the company to report a 0.70USD EPS for the current quarter ** – which would represent a contraction in performance year on year when compared to the 0.98 USD EPS reported for the same quarter last year (down a huge 28.6%)*. MK Holdings reported revenue of 1.35USD billion last quarter, falling short of the expected estimate of 1.36USD billion.* Further to this, revenue for the quarter was down 3.2% YoY. *

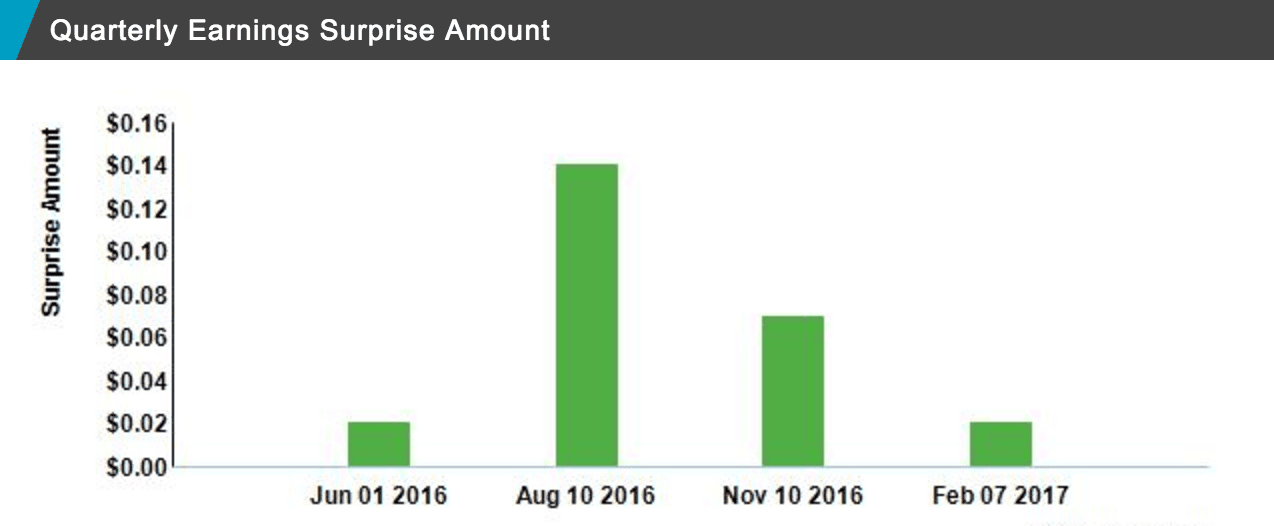

3) A Track Record of Earnings Surprises

Michael Kors Holdings last quarterly earnings were reported as 1.64USD EPS, in February of this year.* This figure was analyst expectation beating and delivered a positive earnings surprise. * In fact, despite tough market conditions, the company has been delivering positive earnings surprises consistently over the past 4 quarters.*

4) Intensifying Competition

Primary competitors of the MK brand include Coach, Kate Spade, and Louis Vuitton. The fashion retail and design industry has become increasingly competitive – with global cost advantages driving barriers to entry lower on the supply side. Further to this, luxury sector competitors – most relevant to the MK demand base, are expanding at a rapid rate to capture increased market share.

A particular focus in this industry currently is towards China and India – with the luxury brands fighting it out through increased investment to capture growing consumption spending in the Asia region. This investment arms race meanwhile is eating into bottom line significantly.*

5) E- Commerce Strategy

A key factor towards the downturn in the share price was poor revenue performance into the tail end of the last financial year.* The driving force of this contraction in revenues has been due to significant declines in mall shopping revenues.* To overcome this challenge the company has identified e-commerce expansion as a core strategic endeavour moving forward. This is forecast to be a significant growth driver into the future and will allow the company to keep pace with intensifying competition.** The company is expected to revamp social media campaigns and online loyalty development initiatives to survive the tightening market dynamics.

Overall the fashion retail segment is fiercely competitive and the market dynamics are fast changing. The company will need to harness competitive advantage in at least one key area of revenue generation in order to beat out the competition and stand out from what is becoming an increasingly crowded marketplace.

Information provided is based on the market research.

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.