Other than the advised short EUR/NOK trade that played out well, the tide has changed. Markets are experiencing full risk-on mode and my last week’s forecasts failed miserably.

Major last week’s events:

- Tariffs’ front: The third wave of tariffs on $200bn worth of Chinese products is a fact and China retaliated. A 10% tariff will be imposed starting from Monday 24th and will jump to 24% by the end of the year. In case the USA imposes new tariffs, China will only be able to increase the already imposed tariff rates or devalue the CNY, as there are no more imported US goods to be taxed. Mr. Ma (CEO of Alibaba) argued that the trade war could last 20 years. At the same time, China is set to cut import tariffs for products from the rest of the world and canceled trade talks with USA.

- NAFTA: A deal was not reached at Thursday’s meeting.

- US Transformation: Another way of describing a one man’s rule is his comments as the third wave of tariffs was announced “Hopefully, this trade situation will be resolved, in the end, by myself and President Xi of China, for whom I have great respect and affection.” You impose rules for all and you keep the power to provide exceptions from the rule.

- Turkey-Russia: The two countries agreed on a ceize-fire zone in Syria until October 10th

- North Korea-South Korea: A 3rd summit between Kim and Moon took place. Kim will allow experts to witness weapon dismantling, as has happened again this year.

- Cryptos: Total market cap at $225bn, +10% w/w, -73% from January’s $821bn peak, +21% from the $186bn low two weeks ago. Both Ethereum and Ripple were impressive.

- Cannabis Equities: Tilray, a Canadian company in the field of medical cannabis research, cultivation, processing and distribution, that filed its IPO in June at 17$, reached 154.98$ on Tuesday, peaked at 295$ on Wednesday and closed the week at 123$. Aurora, Aphria, Canopy and Cronos are a list of cannabis stocks to watch.

Major next week’s events:

- Wednesday’s Monetary Meeting of the FED. A rate hike is almost certain

- Friday’s announcement of the Italian Budget.

- Weekend’s conference of UK’s conservative party

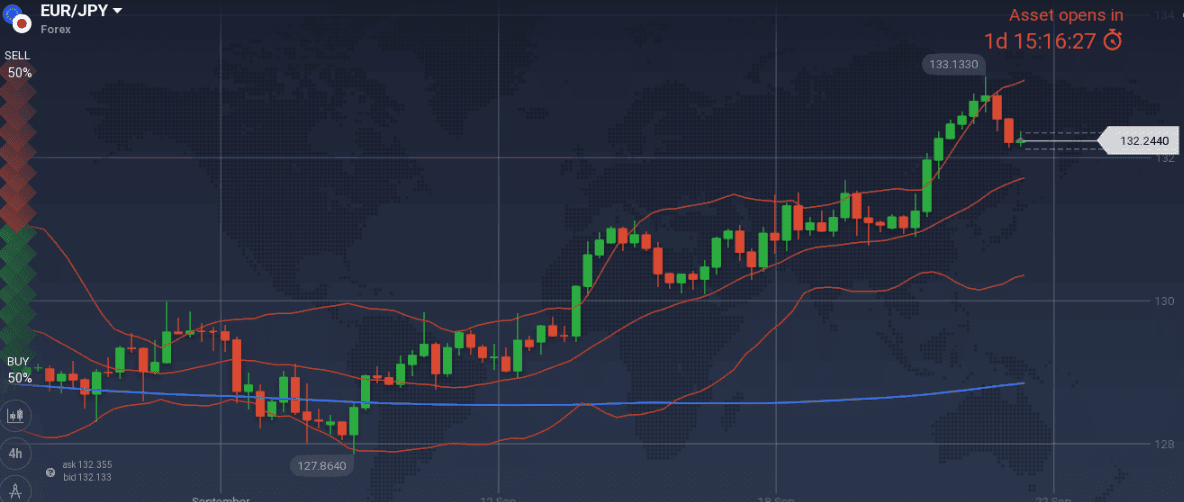

JPY

Last week’s Monetary meeting and LPD leadership election confirmed expectations. Monetary policy is unchanged, and Abe won easily the vote. Yet none of these helped JPY, as we have experienced a week with risk-on sentiment, all around the globe.

My last short trades are on the red. I would short EUR/JPY at 134.37

Snapshot improved:

- Core CPI (=BOJ’s compass) increased to 0.9% (vs 2.0% target and BOJ’s members’ expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.00% annual, 0.7% q/q, 10Y Government bonds yield at 13% (+1bps w/w) vs BOJ’s target of 0.00±0.20% level

- Unemployment at 2.5%

Strengths of JPY:

- Abe’s win at the Liberal Party elections provide stability. An expected cabinet’s reshuffle could further boost Japanese equities.

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike in Oct’19, rules out any possible monetary policy change, before 2020.

- increase of GDP reading, increasing bank lending, retail sales, Manufacturing PMI capital spending and sentiment readings

Weaknesses of JPY:

- risk-on mode all around the globe. Two reports by JP Morgan and Goldman Sachs argue that the selloff in Emerging Markets has been overblown

- decreased Services PMI, further decrease of trade balance and current account

- increased unemployment reading (new reading is expected this week)

Watch:

- Monday is a Holiday

- Wednesday’s inflation reading, Friday’s Tokyo core CPI and Unemployment reading. I am expecting unchanged readings that would favor JPY

- Next Monetary Meeting on 31 October

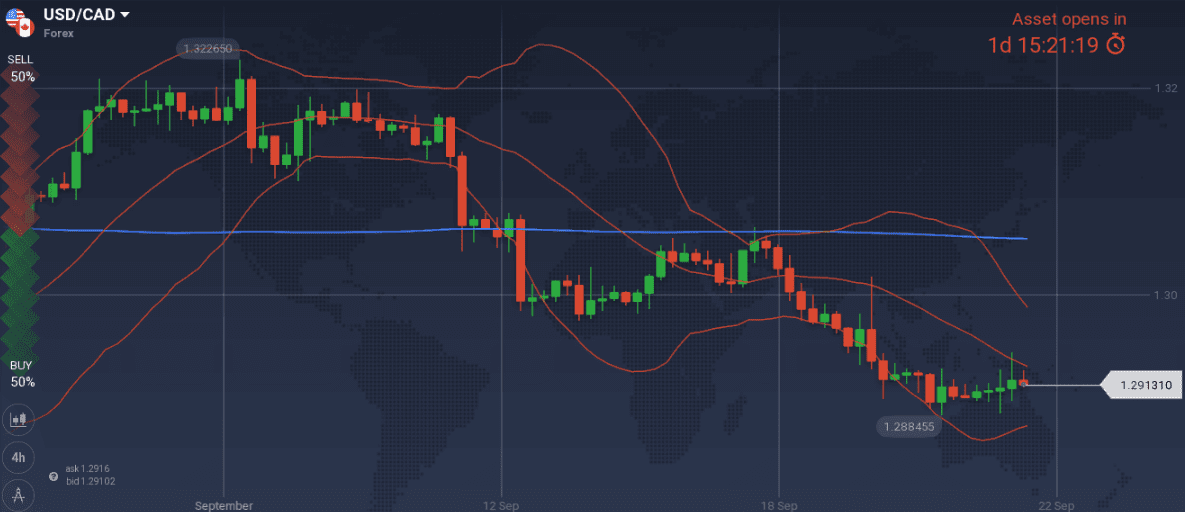

CAD

I am entering short USD/CAD at 1.2968 targeting 1.2690

Snapshot improved.

- Inflation decreased to 2.8% (vs 2.5% target, BOC expects 2.0% within 1Q19), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 1.9% (vs. BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 43% (+8bps w/w).

- Unemployment at 6.0%

Strengths of USD/CAD, weakness of CAD:

- decreased GDP m/m (new reading expected) and increased unemployment reading

- housing market, wholesale sales, and retail sales readings

- CAD has strengthened reaching the 200Day Moving Average level. In order for the level to be crossed south, more news (like a NAFTA agreement) need to come.

Weaknesses of USD/CAD, strengths of CAD:

- I am expecting a CAD rally once a deal is reached. Remember that there is some pressure from USA and Mexico, to close a deal within this week.

- next monetary meeting on the 24th of October may include a rate hike

- increasing Canadian securities purchases from abroad.

- Against OPEC’s downward revision of world’s oil demand and ECB’s lower energy price expectations, oil moved higher. The running theme in oil market is the scheduled US sanctions against Iran that will take effect on 4th of November, Venezuela’s production problems and Russia reaching all time high production. Attention should be paid to the Joint OPEC/Non-OPEC ministerial monitoring committee scheduled on 23 September, there is some talking to increase production by 0.5MBarrels per day.

Watch:

- Any news on NAFTA negotiations

- Friday’s GDP reading

- Next Monetary Meeting on 24 October

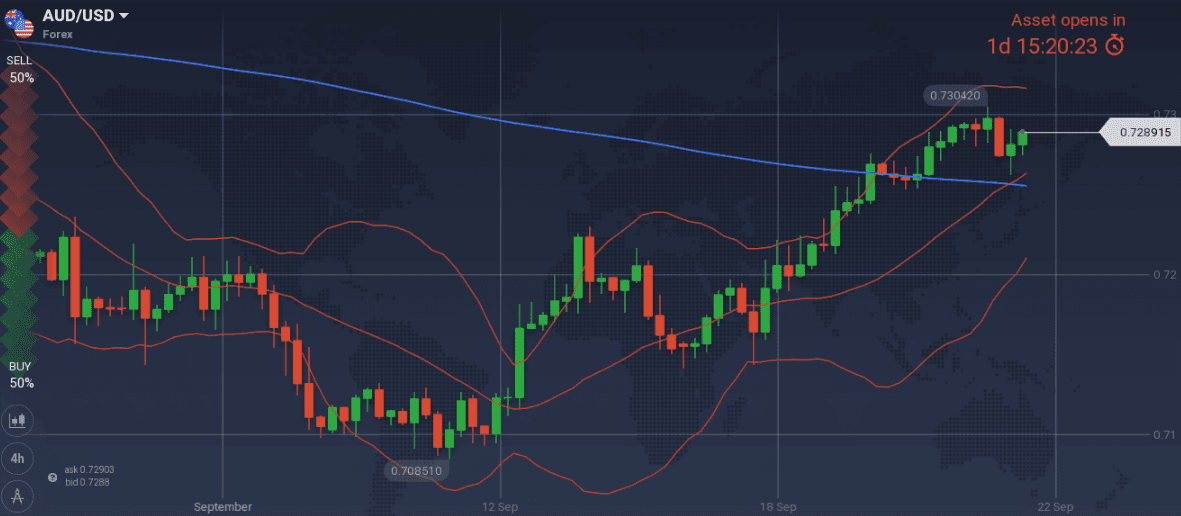

AUD

Last week I had not offered an entry point. On the one hand I was arguing in favor of higher AUD/USD, but on the other hand I was pointing to it’s correlation with CNY and I was expecting an extended devaluation of the later.

I would enter long AUD/USD with a stop limit order at 0.7310, as risk-on sentiment seems to prevail

Snapshot unchanged:

- Inflation at 2.1% (expected at 1.75% later in 2018 and then higher in 2019), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.4% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.70% (+10 bps w/w)

- Unemployment at 5.3% (expected to reach 5.0% by 2020)

Strengths:

- The Australian political drama is over. The 20th of October snap election for the seat of the former PM, is not expected to result into a new government.

- GDP is increasing, and upward revisions are expected, latest employment change number was 3 times bigger than expected

- household consumption recovered in 3Q18, according to the latest minutes of meeting of RBA.

Weaknesses:

- market participants expect the RBA’s rate to remain unchanged and not follow the rate hike schedule of other Central Banks

- decreased trade balance, current account and company operating profits

- decreasing capital expenditure, building approvals, home sales, confidence and consumer sentiment

- a significant 50 Day Moving Average level (0.7300) needs to be crossed

Watch:

- No market moving readings are expected this week

- Next Monetary Meeting on 2 October

USD

I was at the wrong side of the USD move for 2 consecutive weeks, and it is not wise to offer a forecast for next week

The US economy is demonstrating impressive macro readings, pushing US equities higher and at the same time decreasing the value of the dollar.

Snapshot almost unchanged:

- Core PCE (=FED’s inflation compass) at 2.0%, CPI at 2.7%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.9%y/y, 4.2% q/q, 10y Bond yields at 3.07% (+8 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Points to be considered

- inflation is not worrying (the latest release showed a lower number; labor cost data decreased & Trump canceled a 2.1% wage raise for federal employees). At the same time the Fed is set to rise rates on Wednesday’s meeting and the 10y Government Bond yield is finally above the 3.0% threshold. This combination should have driven USD higher, but it is not happening.

- business inventories rising and retail sales falling are signaling a downtrend. Yet these are the only readings that are pointing to equities falling and USD rising as a haven

- two new narratives capable of boosting US markets for another semester are in the making (a) indexing inflation so that long term capital gains are taxed lower (b) publishing earnings every 6 months instead of every 3 months can bring creative accounting.

- GDP, Manufacturing PMI, Non-manufacturing PMI are all recording big numbers.

- risk-on news like a NAFTA deal, EU-UK negotiations concluding, consensus with China, may simultaneously hit the headlines sending USD lower. None of this news materialized. NAFTA negotiations are reaching yet another deadline on Friday. The Brexit deal is more than a month away and there is always the possibility of never happening. Consensus with China is off the table as a third wave of tariffs will be implemented. Yet, markets are in a risk-on mode and USD is falling

Watch:

- Wednesday’s Monetary Decision. A third-rate hike is certain.

Had the USD was strengthened over the last couple of weeks, I would advise to short the FOMC announcement. My reasoning would have been that the event of rates reaching the 2.00~2.25% range has already been priced in and it would be time to sell the event. Now that USD is weakening for two straight weeks, I cannot offer a way to trade this event.

My focus is on the remarks on inflation. All readings since the last meeting are pointing to lower inflation giving no reason for a 4th hike within 2018.

- Thursday’s GDP reading

- Friday’s core PCE reading (=FED’s inflation compass), Inflation expectations and Consumer Sentiment.

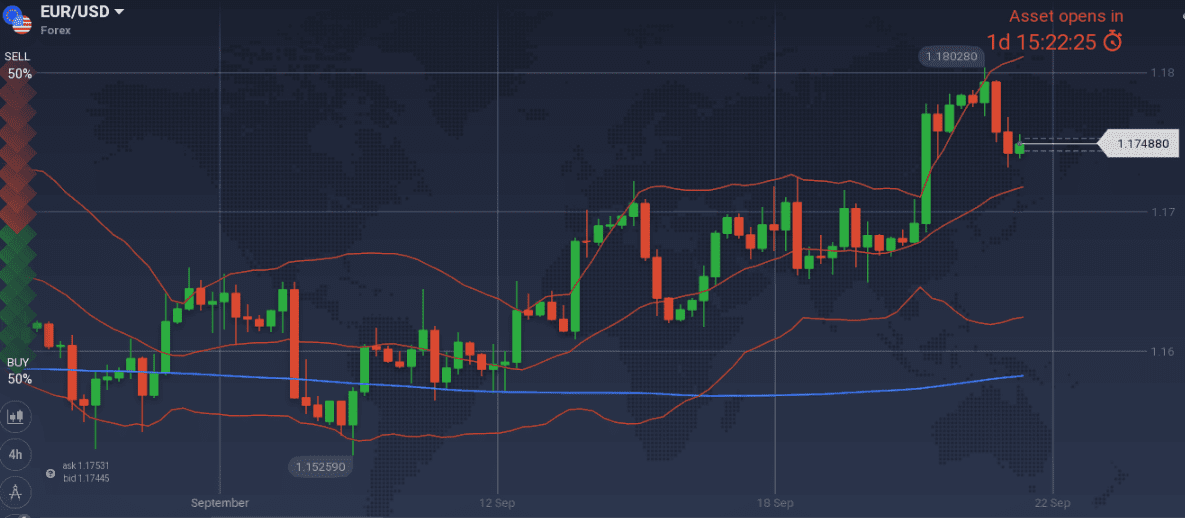

EUR

I am keeping my short EUR/USD bias.

Snapshot unchanged:

- Annual CPI at 2.0%, core CPI (=ECB’s compass) at 1.0%, ECB ‘s rate at 0.00%

- GDP at 2.1% growth (OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.36% (+5bps w/w), 10y German Bond yields at 0.46% (+1bps w/w), 10y Italian Bond yield at 2.84% (+3bps w/w), 10y Greek Bonds yields at 4.07 (-2bps w/w, at the fifth week following bailout protection)

- Unemployment at 8.2%

Strengths of EUR/USD:

- excluding Italy, fiscal policies will not be as neutral as previously expected

- risk-on sentiment and rising US equities is favoring EUR

- improvement of labor market and wage growth

- decreasing bond yields of European periphery, decreasing unemployment

Weaknesses of EUR/USD:

- we are less than a month away from the Bavarian elections and a week before the announcement of Italian government’s budget.

- the different stages of monetary policy between EU and US, can only be simulated with two expected dips of EUR/USD, in late September and mid-December

- latest current account reading was bellow €22bn and sent the pair lower for only 5 hours.

- decreased M3, retail sales, trade balance, manufacturing PMI, investor confidence

Watch:

- Monday’s Business Climate. Decreasing number favors short EUR/USD positions

- Wednesday’s FED meeting

- Thursday’s M3 and private loans growth. Decreasing M3 favors short EUR/USD positions

- Friday’s inflation readings. Economists expect a rising number that does not favor short EUR/USD positions

- Next Monetary Meeting on 25 October.

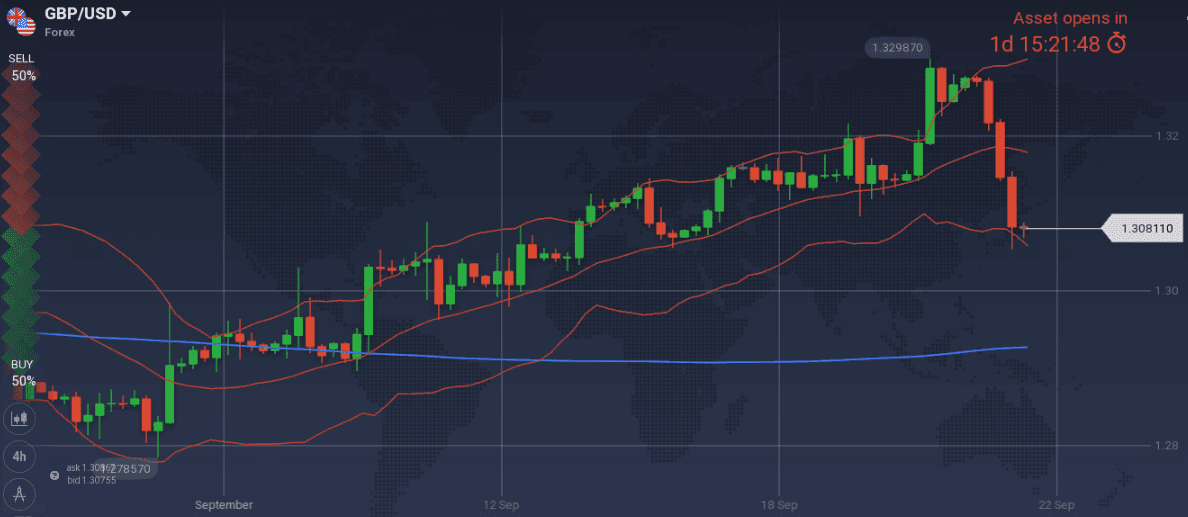

GBP

It is hard to offer a forecast in such a volatile environment while any politician’s comment can move the market.

The last week was even harder, as the same headlines “Brexit deal is very far away, by Junker”, “Current UK’s proposals will not work, by Tusk”, “UK’s proposal is the only one on the table, by May” had opposing results on Thursday and Friday.

Snapshot deteriorated:

- Inflation increased to 2.7% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP at 1.3% growth (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.55% (+2bps w/w)

- Unemployment unchanged at 4.0%

Strengths:

- the bad weather narrative for the abnormally low GDP number of 1Q18 is valid. GDP m/m growth increased to 0.3% and 3Q18 GDP q/q expected at 0.6%. (A final release of GDP is expected next week)

- positive macro releases: Services PMI, Consumer Confidence, M4, consumer’s inflation expectations increased

Weaknesses:

- inflation is peaking up again while BOE has only signaled 3 hikes for the next 3 years. It will be a very hard task to fight inflation and GBP weakening at the same time

- a no deal with EU is possible. In this case UK would be able to be competitive to EU regulatory wise but would lose tax revenues from the decrease of financial activity in the City.

- the no deal scenario has already been characterized as bad outcome by Mark Corney (Governor of BOE) and has been quantified to be equal to a £80bn in public finance by Philip Hammond (Head of Treasury)

- Negative macro releases: decreased average earnings, industrial order expectations, manufacturing and construction production and PMI

Watch:

- UK politics and negotiation process.

- Friday’s consumer’s confidence, current account, GDP q/q reading

- Next Monetary Meeting on 1st of November.